EBC Markets Briefing | Swiss franc up ahead of Fed meeting; gold loses its shine

The Swiss franc strengthened on Tuesday ahead of a slate of central bank meetings that will likely see a Fed rate cut. Meanwhile, all eyes are on Trump's Asia tour, hoping for a trade deal with China.

Swiss President Karin Keller-Sutter declined to say whether her country could this year strike a deal on tariffs with Washington, following trade tensions that have strained relations between the two nations.

Trump imposed 39% tariffs on Switzerland in August. The country's key export is also subject to the 100% tariff on imported medicines he threatened.

Switzerland's exports to the US rebounded in September due to strong gold demand, but economists expect a contraction of Swiss output — adjusted for large sports events — in Q3.

Local farmers' lobby has outright rejected most ideas to permit more American imports of rival goods. That means Bern has basically no bargain chip to reach a better deal later.

A yearly increase of 12% in the franc is adding to deflation risks. Swiss inflation stayed unexpectedly low last month, posing a challenge to the central bank at a time when the economy chugs along.

The currency traded above 50 SMA, but the positive momentum appears to be fading. We expect that a drop to 0.8 per dollar could be on the horizon.

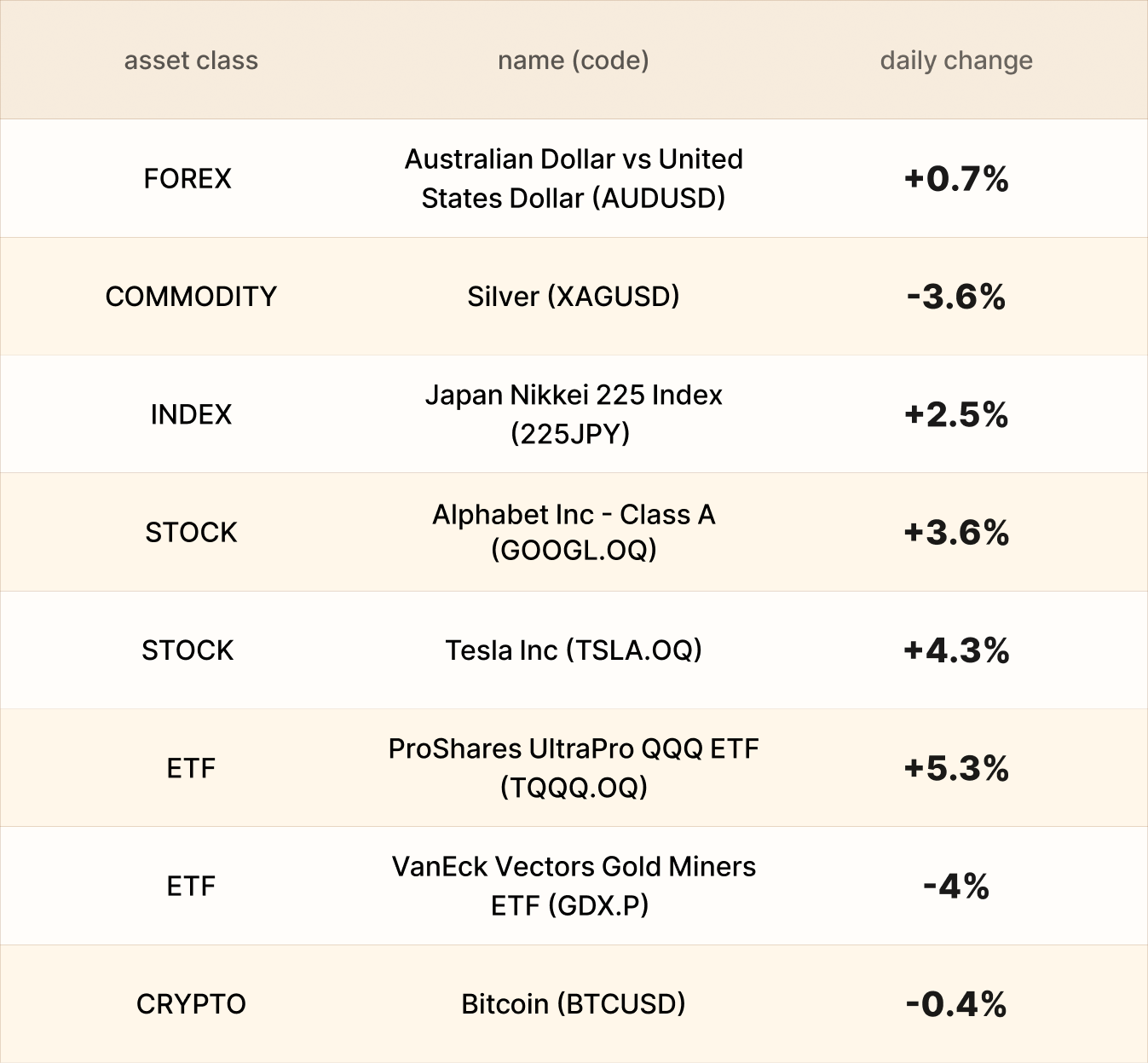

Asset recap

As of market close on 25 October, among EBC products, ProShares UltraPro QQQ ETF shares led gains. The Nasdaq 100 posted record closing highs for the second day in a row.

Analysts at Morgan Stanley suggested that, based on comments from Musk about the company's robotaxi programme, Tesla has effectively succeeded in its efforts to develop full self-driving technology.

The price of gold fell below $4,000, as some of the "froth" was taken out of what industry executives said had become an unsustainable rally. But they are still confident in its long-term prospects.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.