Dollar pressured as markets are betting on a dovish Fed

Dollar pressured as markets are betting on a dovish Fed

Over the past week, the probability of a key Fed rate cut in May jumped from 11% to 47% and reached nearly 60% on Tuesday.

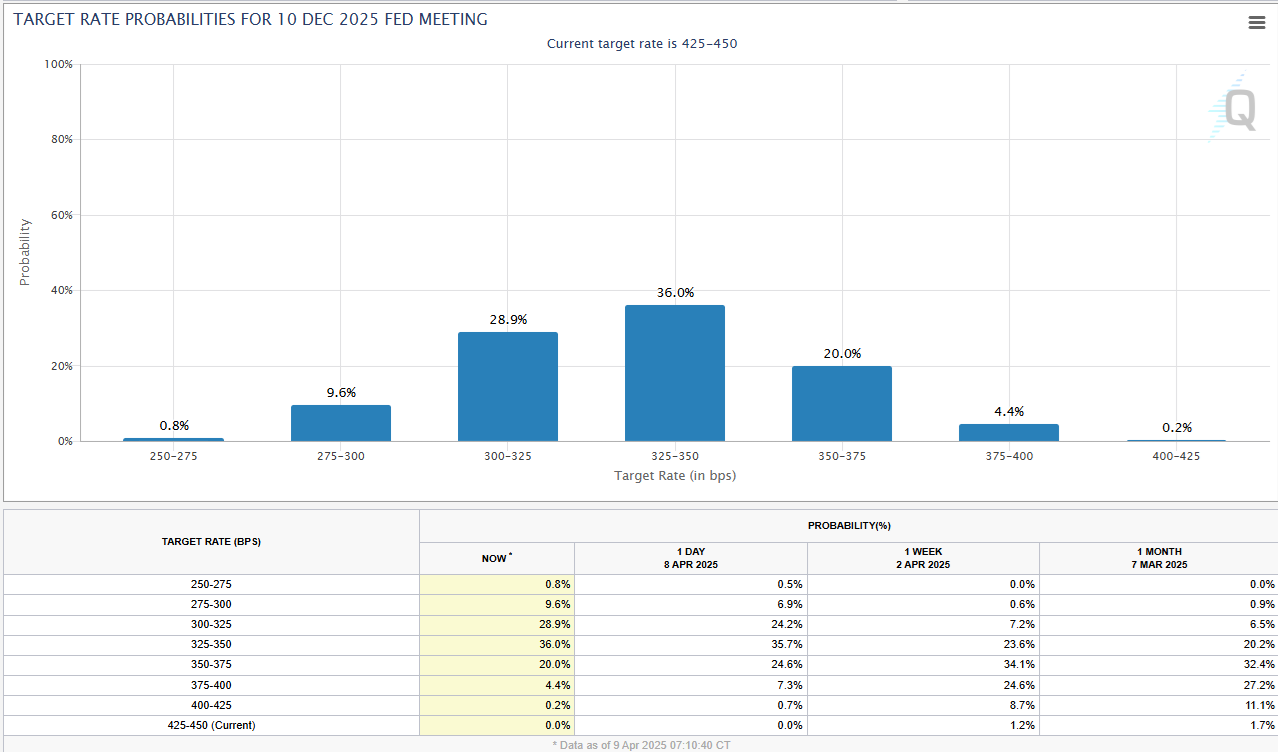

For year-end, the market now sees the prevailing scenario as a 100-point rate cut to 3.25%-3.50% or lower with a 75% probability, although a month ago, those odds were barely above a quarter.

This could be a technical move reflecting a flight to defensive short-term government bonds. This hypothesis is supported by the jump in 10- and 30-year long-term government bond yields, which typically fall along with declining short-term yields.

Such erratic movements increase pessimism about the outlook for equities, where liquidation of margin positions may continue or intensify.

While this is usually favourable for the dollar, we are now seeing increased pressure on the US currency due to the sell-off in equities and long-term bonds.

Technically, the dollar index has already been in an active decline phase since early April, having broken sharply below the March support area. The rebound at the start of the week only closed the gap without changing the pattern, which suggests a fall to the 99 area - almost 3% from current levels.

Although other major economies are also expected to accelerate rate cuts, markets tend to play down the changes in the US first. This has caused the dollar to rise before the rate hike cycle begins in 2022 and fall before the first cuts in 2024 and 2020. In terms of stress and uncertainty, the current situation resembles March 2020.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)