Americans' incomes continue to rise sharply without fuelling inflation

Americans' incomes continue to rise sharply without fuelling inflation

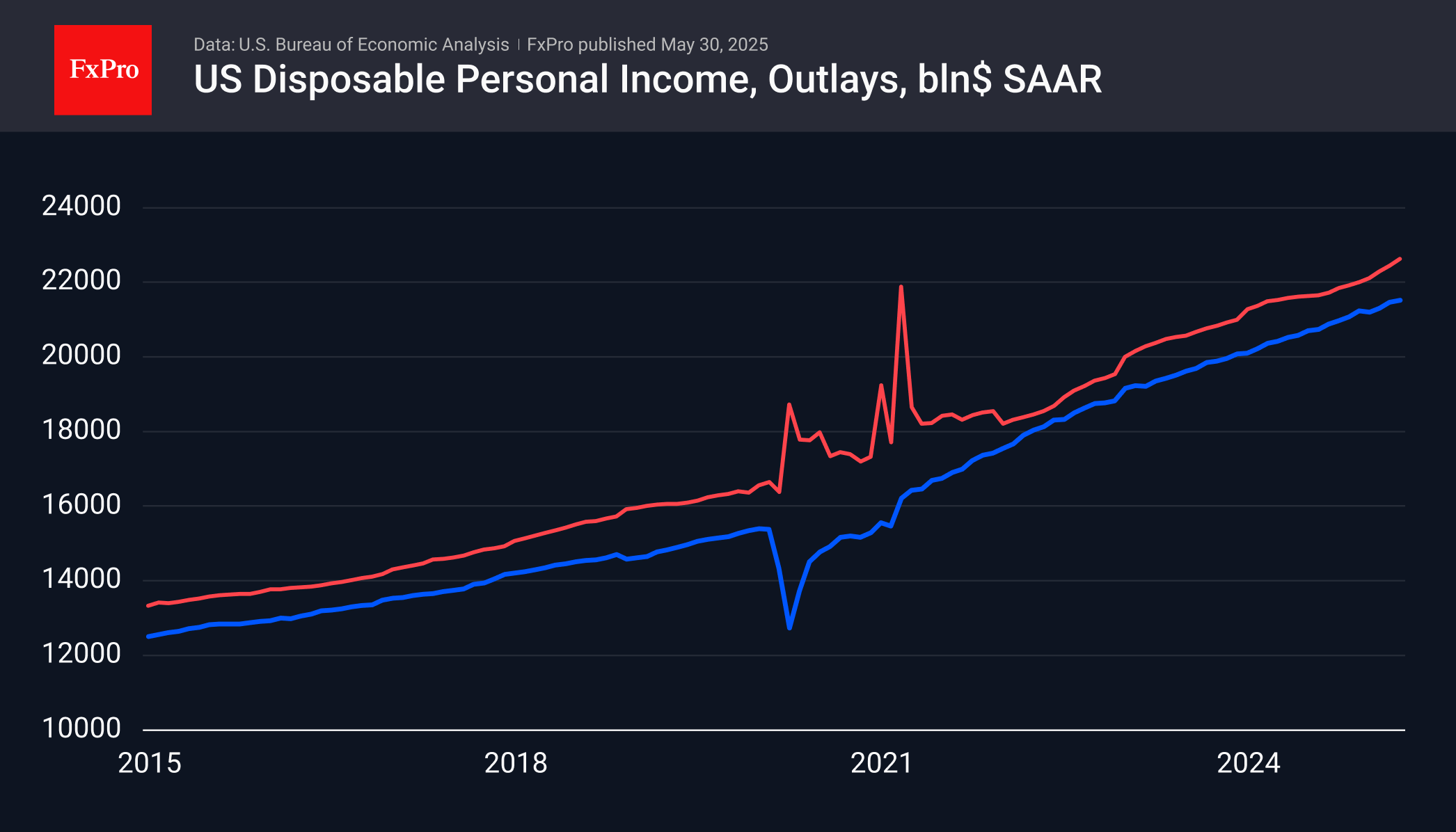

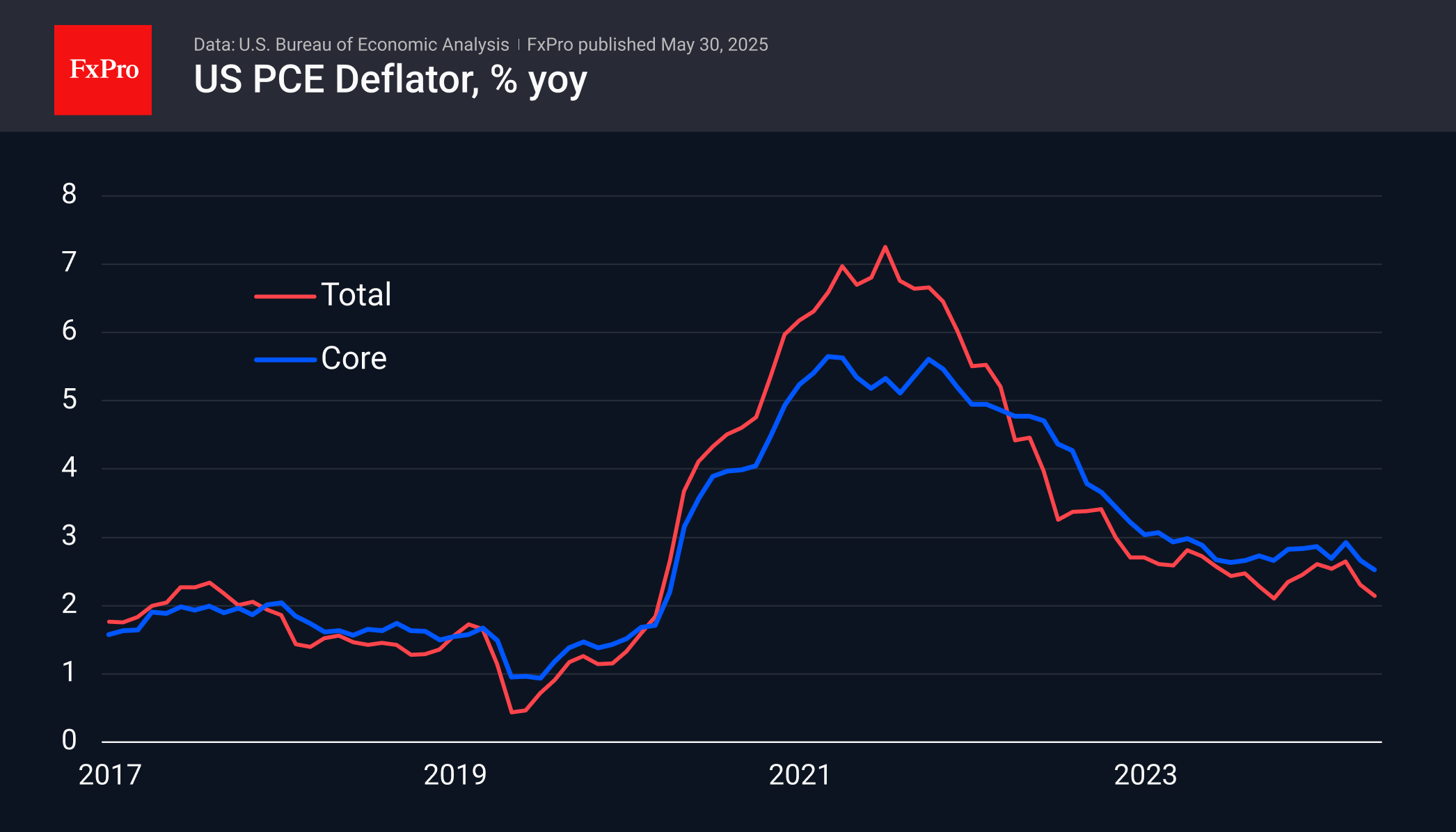

Household personal income in the US rose by 0.8% in April, following increases of 0.7% and 0.8% in the previous couple of months. This is the fourth consecutive month that the figure has exceeded analysts' average expectations, which were 0.3% this time. Meanwhile, we have become accustomed to the much more modest spending increase of 0.2% last month. Consequently, a growing proportion of income is being saved, reaching 4.9%, close to the 25-year average of 5.6%. This normalisation has been made possible by the slowdown in inflation, but it is also contributing to a further slowdown.

For example, the core personal spending price index slowed to 2.5% year-on-year, a four-year low. The data matched expectations, maintaining the slowdown trend and steadily approaching the Fed's 2% target. As the data was as expected, there was no sharp immediate reaction from the stock or currency markets. However, this news should reinforce the dovish stance of Fed members and bring the date of the next rate cut closer, as it has been moving further away since last November.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)