Fed's hawkish inaction favours the dollar

The Fed acted as a market balancer on Wednesday, smoothing out buyers' bullishness following the earlier inflation report.

There was little doubt that the FOMC would leave the key rate unchanged in the 5.25-5.50% range, so all eyes were on the Fed's outlook and comments. They turned out to be more cautious about inflation than market participants expected.

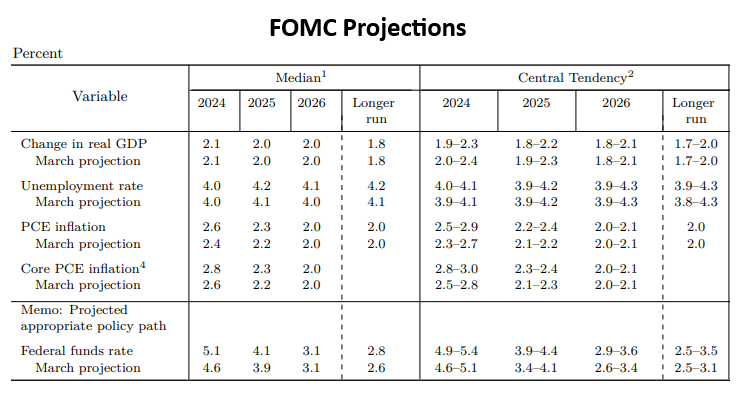

FOMC members' median forecast for the key rate for 2024 rose to 5.1% from 4.6% in March, suggesting one cut versus two or three earlier.

In fact, the Fed got tougher on inflation, raising the Personal Consumption Price Index forecasts by only 0.2 percentage points from 2.4% to 2.6% for the overall index and from 2.6% to 2.8% for the core index.

The Fed Funds rate futures market reacted rather peculiarly to these forecasts, zeroing in on rate hike expectations (previously, there was a 1% chance of a rate hike) but reduced the odds of more than one rate cut to 61% from 68% a week earlier. So, the spread of expectations has narrowed, but the comments had little impact on expectations of two cuts this year.

Still, this is not the bold leap that one might have expected after the low CPI numbers from hours before the FOMC comments.

The Fed's stance is tighter than that of the Swiss National Bank, the ECB and the Bank of Canada, which have already eased policy. There is a chance that the Bank of England will cut its rate in a week in response to signs of deterioration in the labour market and industrial production.

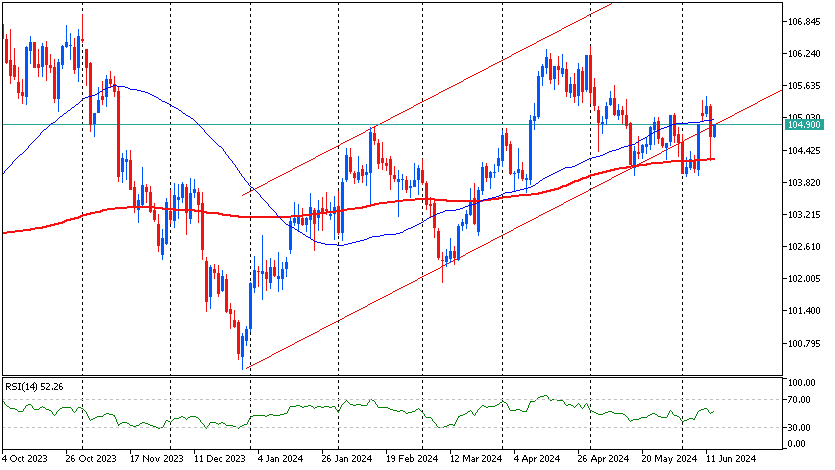

The dollar, which lost about 0.8% against a basket of the most popular currencies, has recovered half of its initial decline. Technically, the dollar index attracted buyers after touching the 200-day moving average, which has repeatedly acted as support since April. Right now, another test of the 50-day moving average and a new attempt to cling to an upward range are underway.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)