Global risk appetite pauses crypto sell-off

Market picture

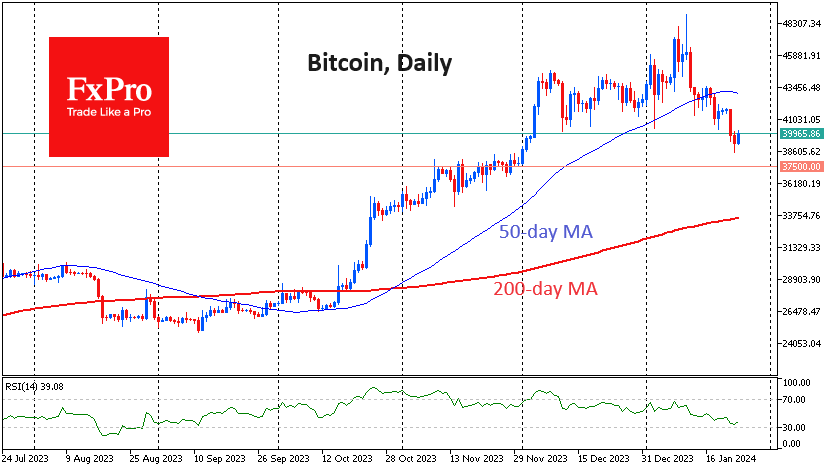

Bitcoin reversed to the upside on Tuesday afternoon. The price drop to $38.5K attracted buyers on the background of another update of all-time highs by leading US indices, which supported risk appetite.

In early trading on Wednesday, Bitcoin's price is testing the $40K level. This is an attempt to break the downtrend by climbing above the previous day's highs. Now, it seems that the sellers in Bitcoin have not yet exhausted their potential, and we should be ready for a new momentum of decline to $37.5K.

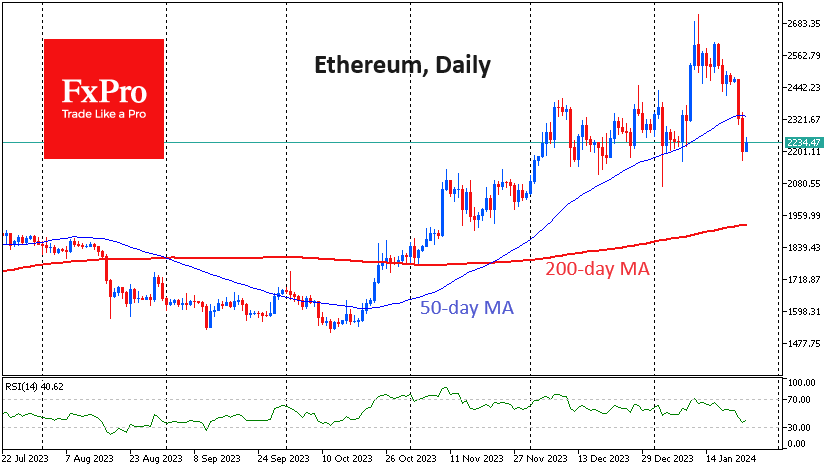

Some downside room remains in Ethereum also. It has rolled back to the lower boundary of the December consolidation, but from current levels, there is still potential for a correction to $2000, where the rally started at the end of November.

The pressure on Grayscale's GBTC bitcoin fund has not diminished. According to CoinDesk, the FTX exchange going through bankruptcy proceedings got rid of 22.3 million GBTC shares worth around $908 million. Bloomberg calculated that, in total, investors got rid of GBTC shares worth $3.45 billion after spot ETFs were approved. Bitcoin outflows from GBTC exceed demand.

News background

BitMEX co-founder Arthur Hayes does not rule out a further fall in Bitcoin and bets on the asset dropping to $35K by the end of March. At the same time, he sticks to the bullish scenario in the long term.

MN Trading founder Michael van de Poppe urged buying Bitcoin below $40K, calling it a good opportunity. He said BTC had gathered liquidity and is nearing a localised bottom, with altcoins "showing strength".

The US Congress has taken an interest in Meta's plans for cryptocurrencies. Maxine Waters, a member of the Financial Services Committee of the US House of Representatives, requested information from Meta about the corporation's possible plans for digital assets.

OKB, the native token of the crypto exchange OKX, collapsed by 50% in less than a minute. The exchange said it has launched an investigation into the incident, details of which it will disclose at a later date.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)