EUR/USD rises as Trump hits the snooze button again

EUR/USD started the week on a positive note after investors woke up to news that President Trump would delay the implementation of 50% tariffs on EU goods to July 9, from the previously scheduled June 1, to allow more time for negotiations after a call with Commission President Ursula von der Leyen.

This move aligns with the U.S. president's usual negotiation tactics, following the announcement of aggressive reciprocal tariffs a month ago. Nevertheless, EURUSD managed to capitalize on the headlines, advancing toward the lower boundary of the broken bullish channel at 1.1415 ahead of a speech by ECB President Christine Lagarde.

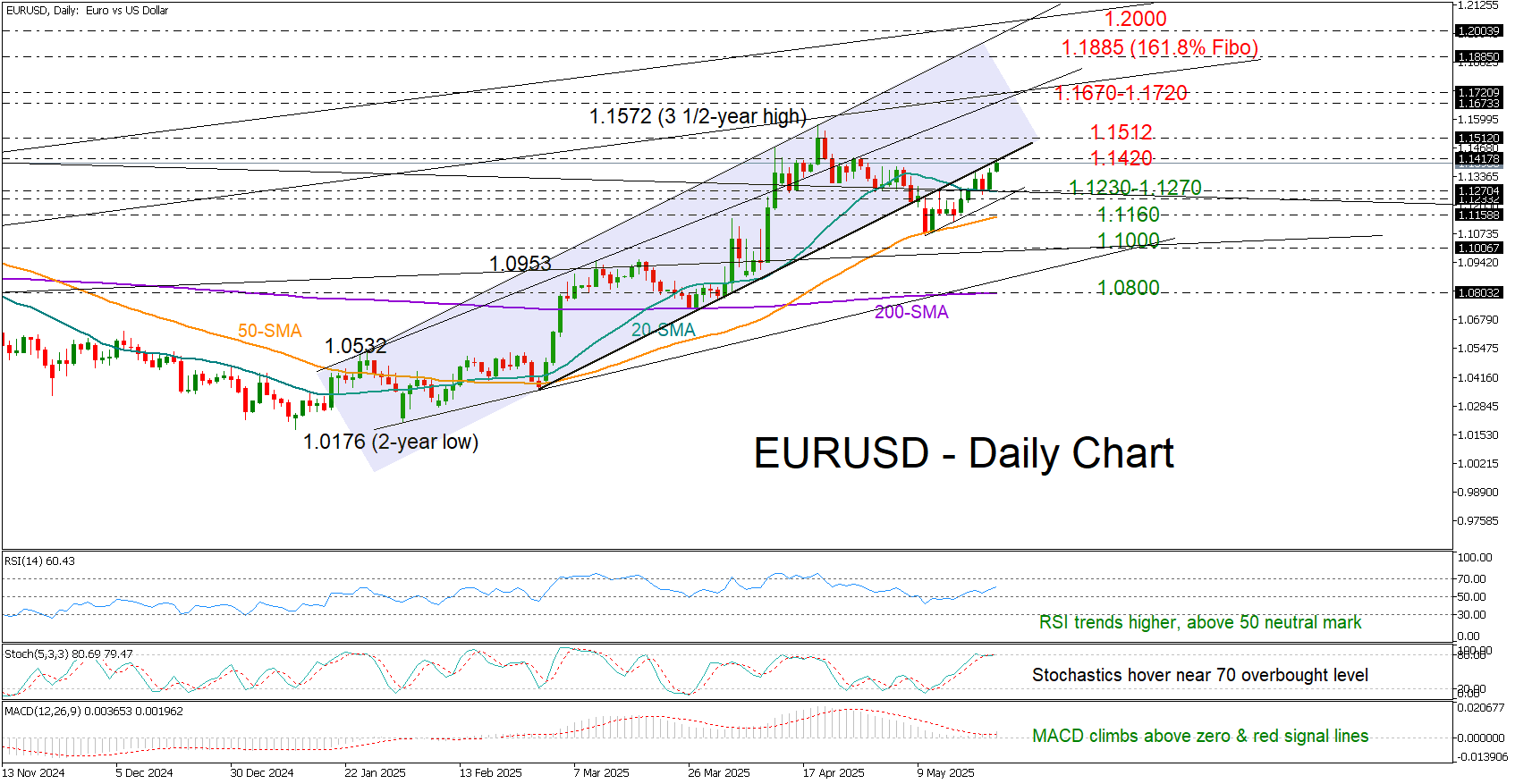

Technically, the short-term bias remains tilted to the bullish side, as the RSI continues to rise above its neutral 50 mark and the MACD is gaining ground above both its red signal line and the zero level. However, with the stochastic oscillator hovering near its overbought mark of 70, some caution may be warranted.

A decisive close higher could allow the pair to re-test April’s barrier around 1.1512. If this level is breached convincingly, the rally could extend towards the constraining trendline zone of 1.1670–1.1720. Further up, bulls may target the 161.8% Fibonacci extension of the previous downleg at 1.1885, ahead of the key psychological level of 1.2000.

In the event of a bearish reversal near 1.1420, the pair could find support between the 20-day simple moving average (SMA) at 1.1270 and the 1.1230 area. The 50-day SMA remains a critical pivot point near 1.1160; a break below this level could trigger a deeper decline toward the 1.1000 round level.

In summary, EURUSD has more upside potential, pending a sustainable move above 1.1415 to trigger the next bullish wave.

.jpg)