Crypto: Bears trying to break the neck of bull trend

Market Picture

The cryptocurrency market is moving up and down, experiencing increased volatility with swings between 2.0 and 2.15 trillion. These are very intense swings, reflecting the massive amounts of capital flowing through the market. The Cryptocurrency Fear and Greed Index is at 28 (fear), and on Saturday, it fell to 26, its lowest level since January 2023.

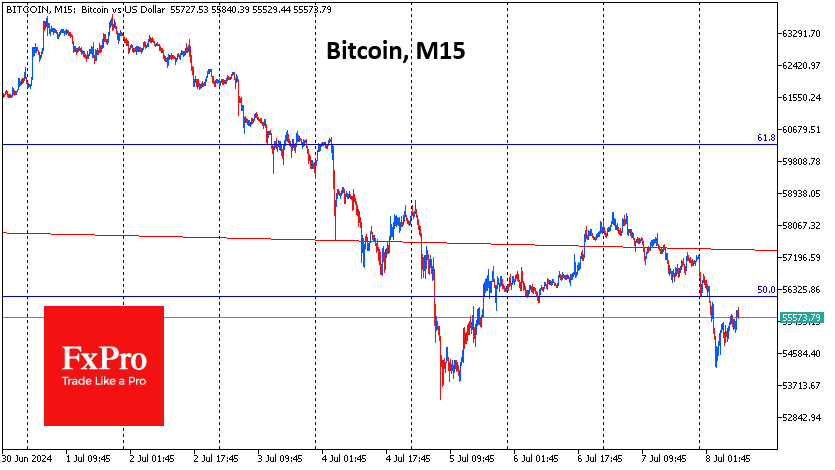

On Bitcoin's intraday timeframe, it's easy to see how strong downward momentum is being replaced by longer recovery periods. But for now, the balance of power is with the bears, who on Friday and Sunday unleashed a hefty portion of off-target gains as the price reached the $58.3K level—the level of the 200-day moving average. This is a clear attempt to reverse the bullish trend since January 2023, which is in line with the dynamics of the Cryptocurrency Fear and Greed Index.

Santiment noted that the crypto market is under pressure from negative news, and social media is at its highest level of fear, uncertainty, and doubt. Analysts believe that now is an opportune time for traders willing to take risks and buy cryptocurrencies while the market is down and frustrated.

In another recalculation, the difficulty of mining Bitcoin fell by a notable 5% to 79.5T. According to Glassnode, the smoothed 7-day moving average hash rate fell to 580 EH/s, down 11.5% from the May high of 656 EH/s.

News background

The MtGox trustee, who went bankrupt in 2014, announced plans in July for a gradual refund of 137,000 BTC to the platform's customers. Arkham celebrated the transfer of 47,228.7 BTC (~$2.71 billion) from the exchange's cold storage to a new address. Nobuyaki Kobayashi confirmed that some payments in Bitcoin and Bitcoin Cash have been honoured.

Notcoin (NOT) soared by 50% over the weekend, fuelled by a massive coin burn. On Wednesday, Notcoin also announced the launch of a new project with the well-known analytics platform Helika. It aims to develop the ecosystem of cryptocurrency games in Telegram.

Bitcoin sales by German and US authorities are also putting pressure on BTC. In recent weeks, German authorities have sold the first cryptocurrency for a total of $195 million through various exchanges. The German parliament has criticised the German authorities for selling bitcoins.

The actions of the bitcoin whales are exacerbating the asset's fall. After "Sleeping" for more than ten years, the wallet moved 1,004 BTC worth $57 million to a new address, pointed out ‘Spot On Chain’. Since 27 June, two wallets have moved 9,301 BTC (about $563 million) to the Binance, according to Lookonchain.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)