EBC Markets Briefing | Gold hit near two-week high on US slowing

Gold prices hovered around a near two-week high on Thursday, driven by increased bets for a September interest rate cut by the Fed after recent data showing an easing in labour market.

First-time applications for US unemployment benefits increased last week, while the number of people on jobless rolls rose further to the highest within two and a half years.

A measure of the services sector activity slumped to a four-year low in June amid a sharp drop in orders, potentially hinting at a loss of momentum in the economy at the end of Q2.

Citi analysts have introduced a framework for understanding and forecasting gold prices. According to the model, investment demand as a share of gold mine supply is the primary driver of gold pricing.

The bank predicts that gold investment demand will continue to rise, potentially absorbing almost all mine supply over the next 12-18 months. Their base case for gold prices is to reach $2,700 - 3,000 by 2025.

Growing political uncertainties emerge from Biden's awful debate performance. Democrats across the country have begun questioning whether the president is the best candidate for the party.

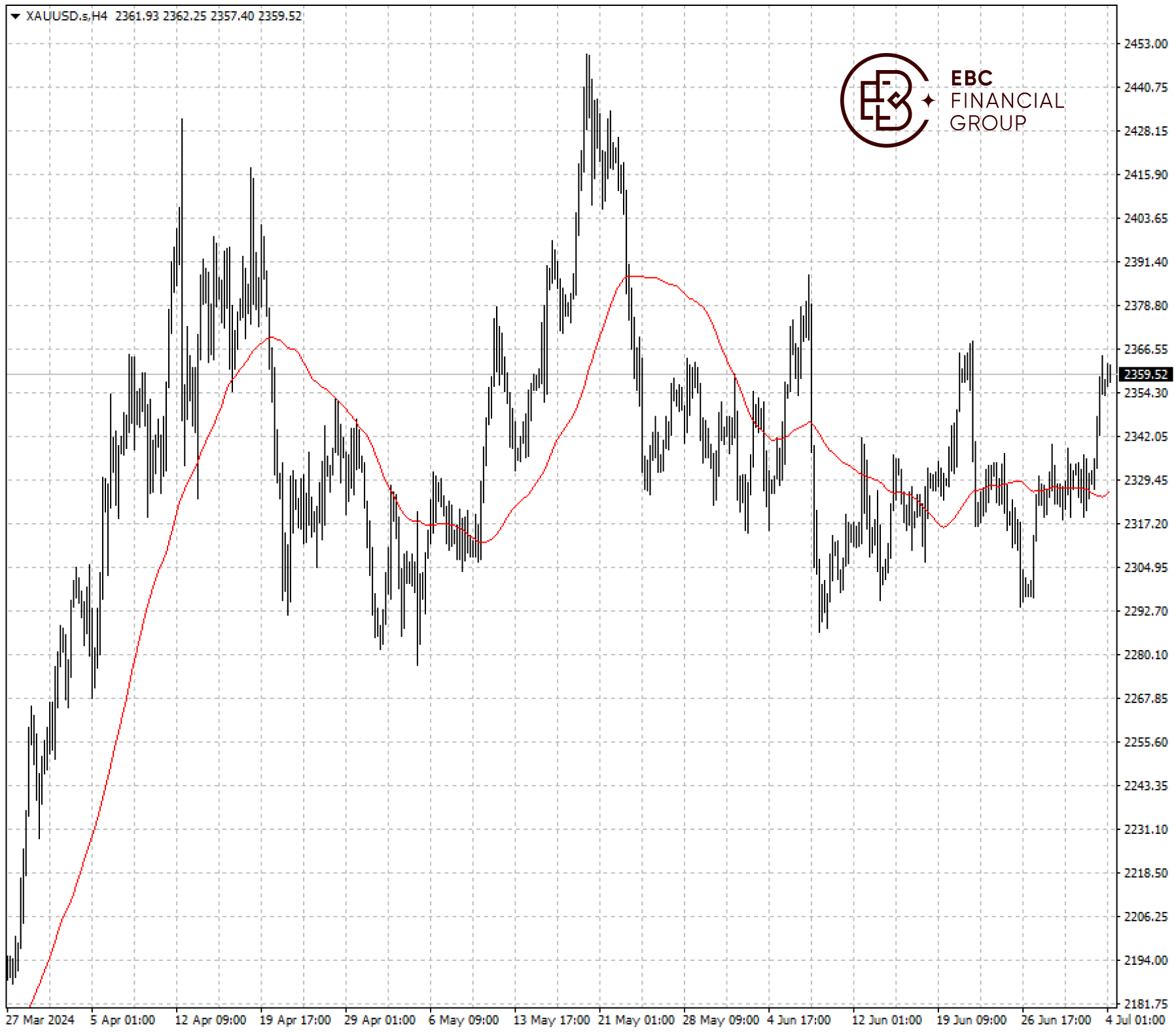

Bullion rose above its 50 SMA, a bullish sign for the short-term direction, but it sits close to the resistance around $2,370 that reversed the uptrend last month. A push above the level could carry it forward to $2,400.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.