EBC Markets Briefing | Loonie closer to key support on easing policy

The Canadian dollar recovered from an 11-week low on Thursday after the BOC cut interest rates by an unusually large amount and the greenback added to its recent broad-based gains.

The central bank reduced its benchmark rate by 50 bps as expected and hailed signs Canada has returned to a low-inflation era. That increased the amount of easing since June to 125 bps.

Markets are betting that the policy rate will be further lowered by 50 bps as soon as January. The country’ exports of dropped by 1.0% in August, driven mainly by decreased exports of energy products.

The greenback notched its 16th gain in 18 sessions as Trump is beginning to gain the upper hand and a run of positive economic data has dampened expectations about the pace of Fed rate cuts.

Goldman Sachs expects oil prices to average $76 a barrel in 2025 based on a moderate crude surplus and spare capacity among major producers, with concerns easing over a potential disruption in Iranian supply.

US crude oil inventories rose sharply last week as imports ticked higher, while gasoline stocks rose unexpectedly as refineries ramped up output after seasonal maintenance, the EIA data showed.

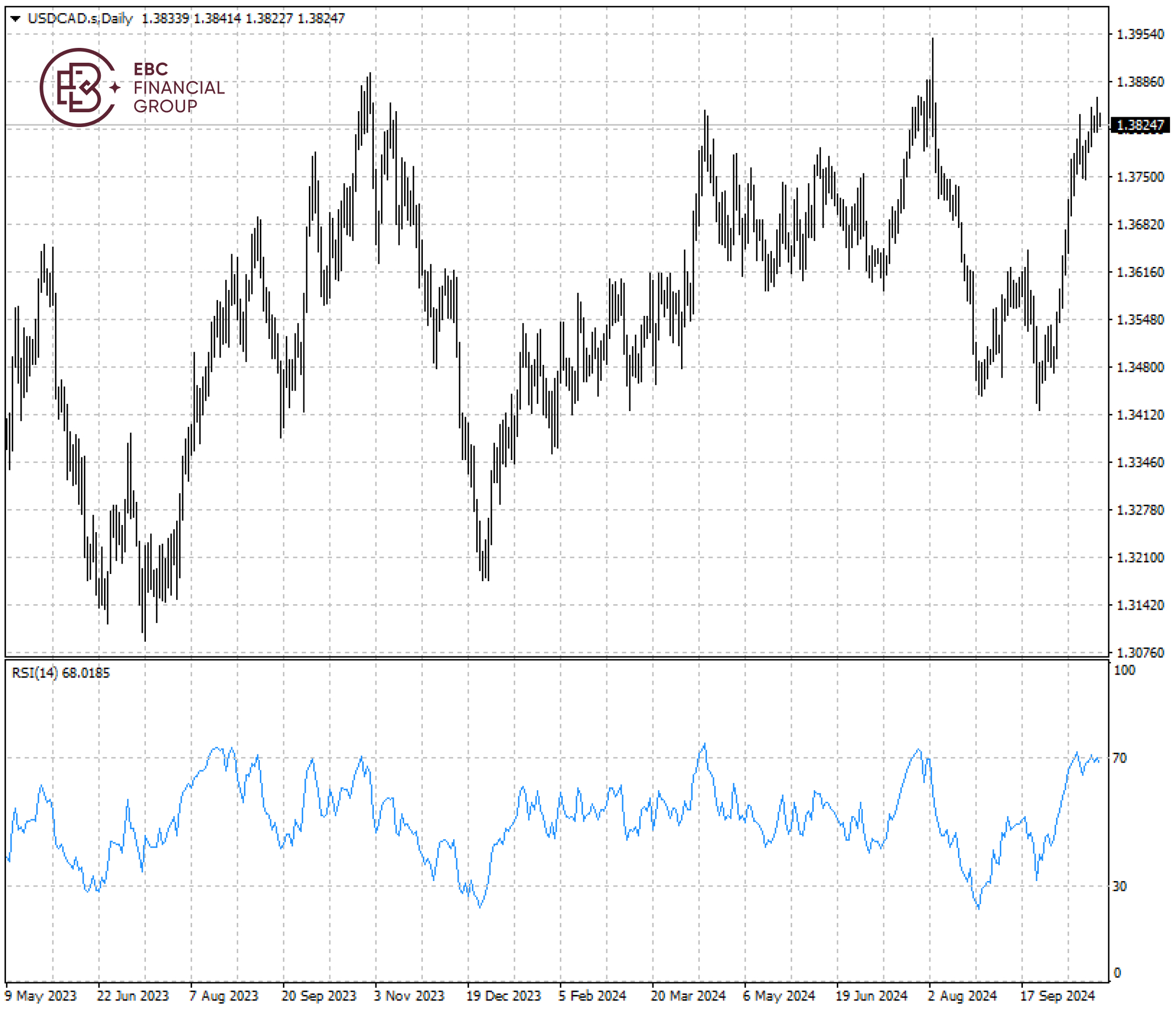

Loonie may weaken towards 1.39 per dollar in the immediate term but a reversal appears to be in the making given the RSI reading and its trading pattern over the past year.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.