Pushing down crypto isn't easy

Market picture

Buying on dips remains the dominant tactic in the crypto market. Capitalisation rose 1.8% in seven days to $1.65 trillion. Previously, the 'what doesn't rise, falls' formula was often applied to cryptocurrencies, however, recent attempts to sell off after a period of stabilisation have been met with increased buying.

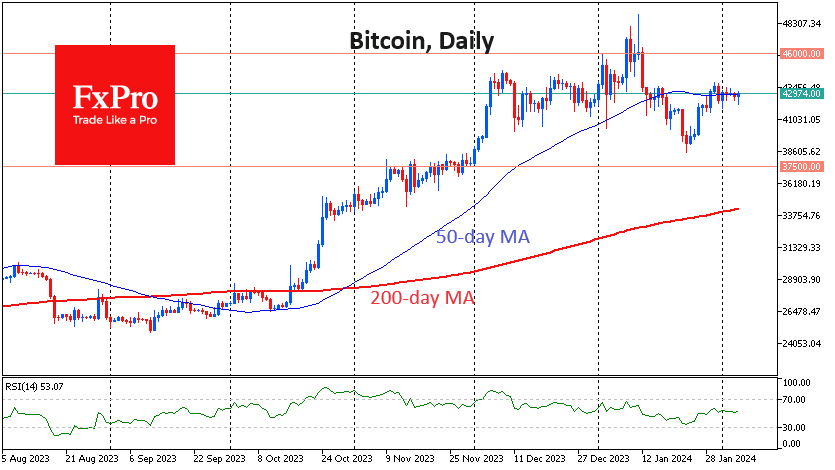

Bitcoin remains at $43.0K. At the start of trading on Monday, there was an attempt to sell the price lower amid weakness in the Chinese markets. However, BTCUSD was bought back twice on dips to $42.2K. This solid support significantly weakened the sellers' onslaught, which quickly brought the price back to $43,000 - the centre of gravity for the exchange rate since early December. That's also where the 50-day moving average now sits, suggesting that the market is still undecided about direction.

In traditional financial markets, the dollar and equity indices are simultaneously rising, but overall risk appetite is more accurately described as subdued. Exclusive drivers for the crypto market (such as bitcoin ETFs, etc.) have so far played out, forcing investors to wait for the next signal.

News background

According to Coinbase, the selling pressure on bitcoin is easing, and macroeconomic factors favour the growth of the first cryptocurrency. The technical factors that supported Bitcoin's decline are starting to weaken. In addition, there is steady interest in the spot bitcoin ETFs that have been launched.

Popular crypto analyst Michael van de Poppe believes that Ethereum could rise to $3500-$4000 in the next three to six months. The upcoming Dencun update and the likely launch of spot ETFs on the second cryptocurrency could contribute to the growth.

The growing dominance of Tether is a negative factor for the stablecoin market and the crypto ecosystem, says JPMorgan Bank. Tether is at risk due to its lack of regulatory compliance and transparency.

Tether's success is due to its financial strength, significant reserves and commitment to emerging markets, where entire communities use USDT as a lifeline to protect against high inflation and devaluation of national currencies, said Tether CTO Paolo Ardoino.

The US Department of Energy will survey mining companies about their electricity use. The agency plans to complete the survey within six months. Last year, miners accounted for between 0.6% and 2.3% of total US energy consumption. According to MinerMetrics, the US accounts for around 40% of the total BTC hash rate.

Bankrupt crypto platform Celsius has begun paying off $3 billion in debt to creditors under an approved restructuring plan.

Singapore's law enforcement agencies issued cybersecurity guidelines for citizens investing in crypto assets, recommending that funds be kept in hardware crypto wallets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)