The pound ignores lousy news, including labour market

The pound ignores lousy news, including labour market

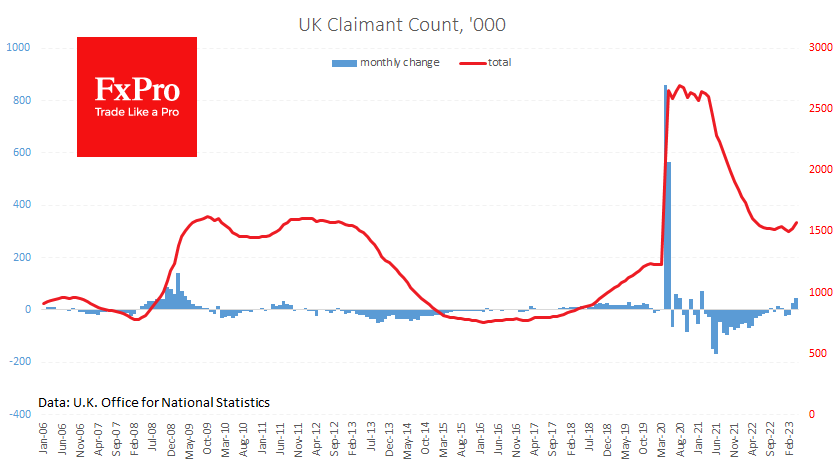

The UK labour market is deteriorating at an increasing rate. Data released this morning showed that jobless claims rose by 46.7k in April, following a 26.5k increase in March. Analysts had, on average, expected a rise of 31.2k.

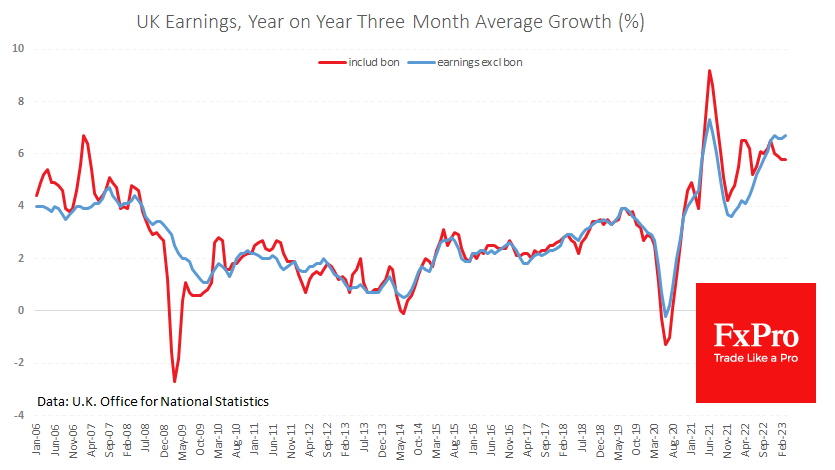

The unemployment rate rose to 3.9% (the highest since January 2022) from a low of 3.5% in August. This turnaround in employment trends has yet to lead to significant wage pressures. Average weekly earnings in the three months to March were up 5.8% year-on-year total pay and 6.7% excluding bonuses. Although this is slightly below expectations, it is difficult to see a reversal of the weakening trend.

The juxtaposition of two trends - falling employment and rising wages - does not make things any easier for the Bank of England. On the one hand, increasing wages when inflation is already falling is a worrying signal, forcing a further tightening of policy. On the other hand, rising wages create the conditions for an inflationary spiral to take hold despite falling employment.

The GBPUSD reacted to the weak employment figures by falling 0.4% to 1.2465. However, the pair quickly digested the negativity and climbed out of the hole over the next few hours to reach 1.2545. Interestingly, the GBPUSD has rallied on relatively negative economic news this week. On Monday, the IMF said that the UK was the only G7 country facing a recession this year, but that didn't stop GBPUSD from gaining 0.7%. Too much negativity may be already in prices.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)