US statistics fuel hopes for more dovish Fed

Data from the US on Friday supported risk appetite and provided a technically significant blow to the dollar against many of its peers.

The monthly report showed that the US economy created 223k new jobs in December after 256k a month earlier. The unemployment rate declined to 3.5%. The data came out better than expected but did not help the dollar. On the contrary, the markets interpreted the report as a sign of weakness rather than strength in the labour market, and it is hard to argue with such an interpretation.

Wage growth slowed to 4.6% y/y against 4.8% a month earlier and peaked at 5.6% in March. This data remains an anti-inflationary factor.

We also point to the decline in the working week. So strong is this fact that the index of working hours in the economy has fallen for the second month in a row, despite the growth of jobs. Companies prefer to grow in terms of staff but not wages. Possible reasons are that low-skilled people are more actively returning to the labour market. However, they had previously avoided returning to work because of covid pay and fear of contagion.

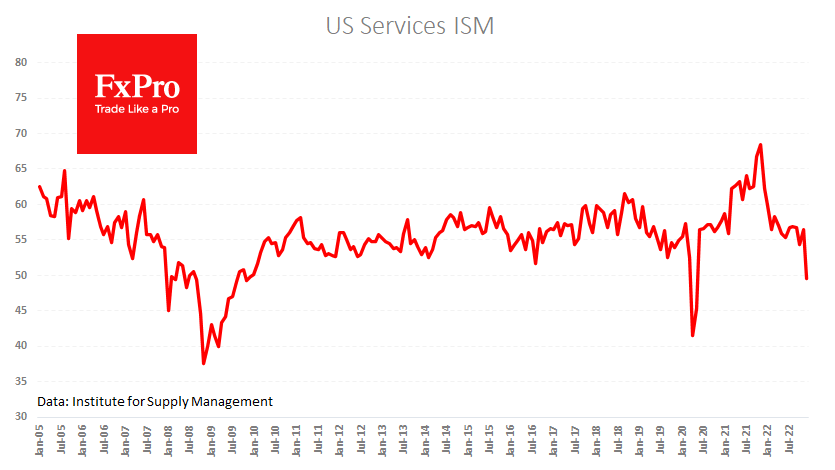

Aside from the NFP publication, the ISM Non-Manufacturing Index was also released on Friday, which suddenly fell from 56.5 to 49.6 (55.0 was expected). Values below 50 indicate a contraction in activity after 30 months of consistent growth. The index was pulled down by a slump in new orders and business activity. The employment and orders indices moved into a decreasing territory, indicating a pessimistic view of the near-term economic outlook. The ISM notes that such index values indicate a GDP contraction of around 0.2% for December.

The latest economic data package from the USA turned out to be a significant factor in favour of the Fed raising interest rates by 25 points at the start of February, continuing the slowdown. Furthermore, markets are still laying into the futures quotations that the Fed will reverse to a policy easing by the end of 2023 despite the bombardment from the FOMC members. The latter continues to reassure that they are ready to raise the rate above market expectations and do not intend to cut it this year.

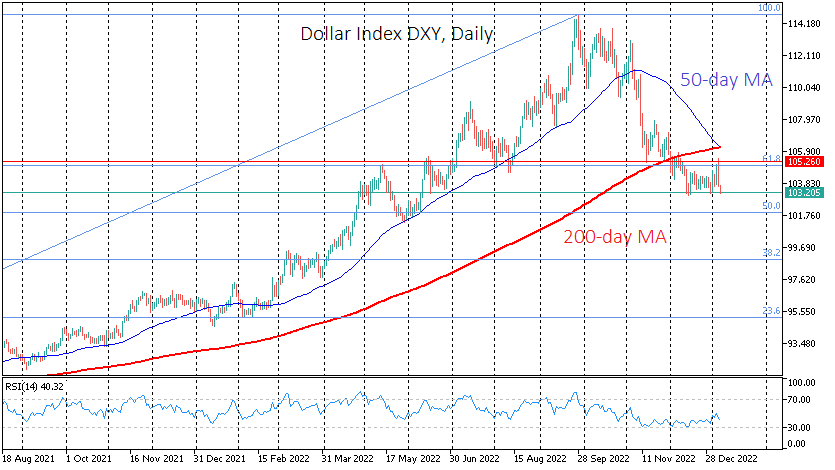

The publication of reports showing the shrinking economy and looming recession caused a bearish reversal on the dollar index. The Dollar Index lost over 2% from levels before Friday's release. But more importantly, a strong move reversed the previous bullish candlestick, taking the Dollar Index back to 103.3, the lows of December and under the 61.8% Fibonacci retracement area from the early 2021 rally.

In addition, a "death cross" is forming on the daily charts above the DXY when the 50-day average slides below the 200-day average. And the price is under both lines at the same time, reinforcing the bearish signal. The following potential stopping points in the decline of the DXY are waiting at 101.50-102 (local lows of May-June) and 50% of the rally. A more distant target is 97.8-99.0.

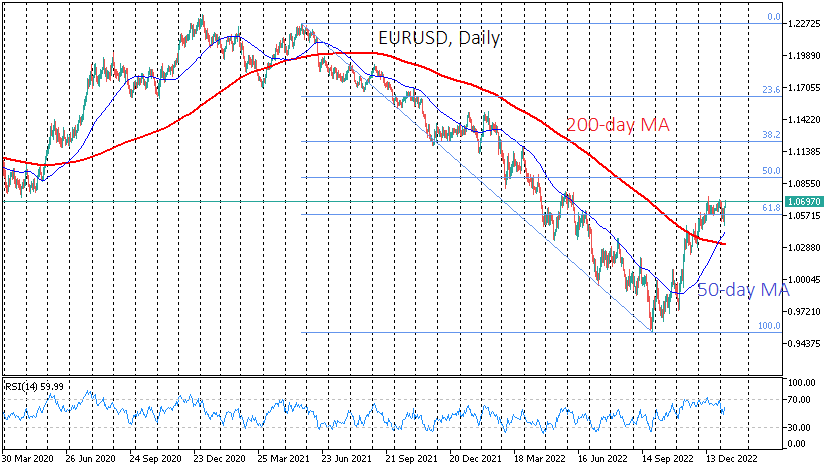

In EURUSD, the first target for the bulls in a couple of weeks is 1.09 and up to 1.12 before the end of the first quarter.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)