USDCHF climbs from 14-year low; SNB in focus

USDCHF is showing modest gains today as traders await the SNB interest rate decision later in the day. Market consensus points to the SNB holding rates steady, following a series of five 25 bps cuts over the past year.

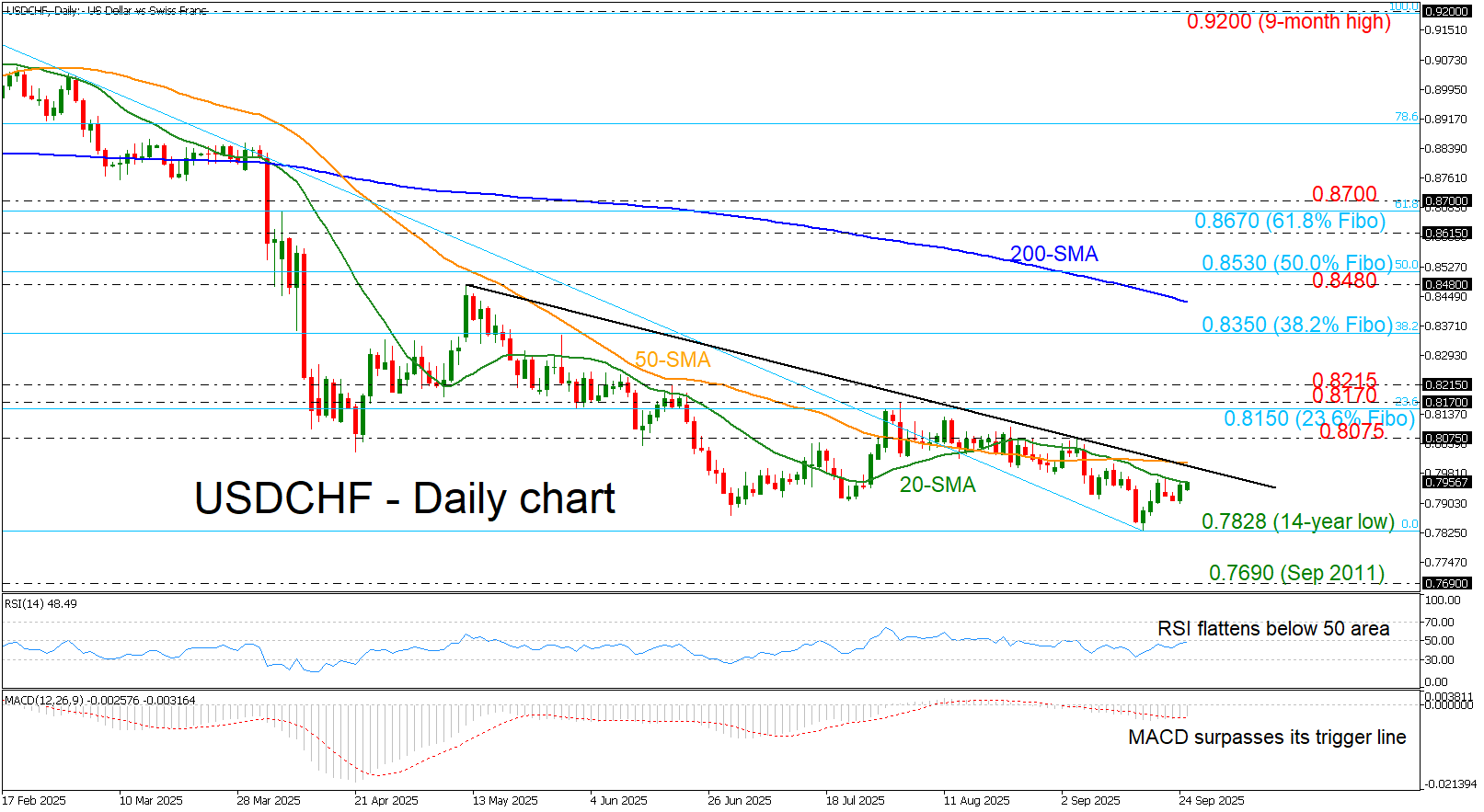

The pair has rebounded from the 14-year low of 0.7828, currently testing the 20-day simple moving average (SMA) near 0.7960. A sustained move above this level could pave the way for a retest of the medium-term descending trendline and the 50-day SMA around 0.8000. If these resistance levels are breached, the outlook may shift to neutral, with further upside potential toward the 0.8075 resistance and the 23.6% Fibonacci retracement level of the broader downtrend from 0.9200 to 0.7828, located at 0.8150.

On the flip side, a failure to overcome the 20-day SMA or the downtrend line could trigger renewed selling pressure. In such a scenario, the pair may revisit the 0.7825 support zone, with a deeper decline possibly targeting the September 2011 lows at 0.7690.

Momentum indicators offer mixed signals. The RSI is moving sideways below the neutral 50 level, suggesting a lack of strong directional momentum. Meanwhile, the MACD has crossed above its trigger line but remains below the zero threshold.

To sum up, USDCHF is ticking higher, but key resistance levels must be cleared to confirm a neutral-to-bullish reversal. Until then, downside risks remain in play.

.jpg)