USDJPY on the rise again, but for how long?

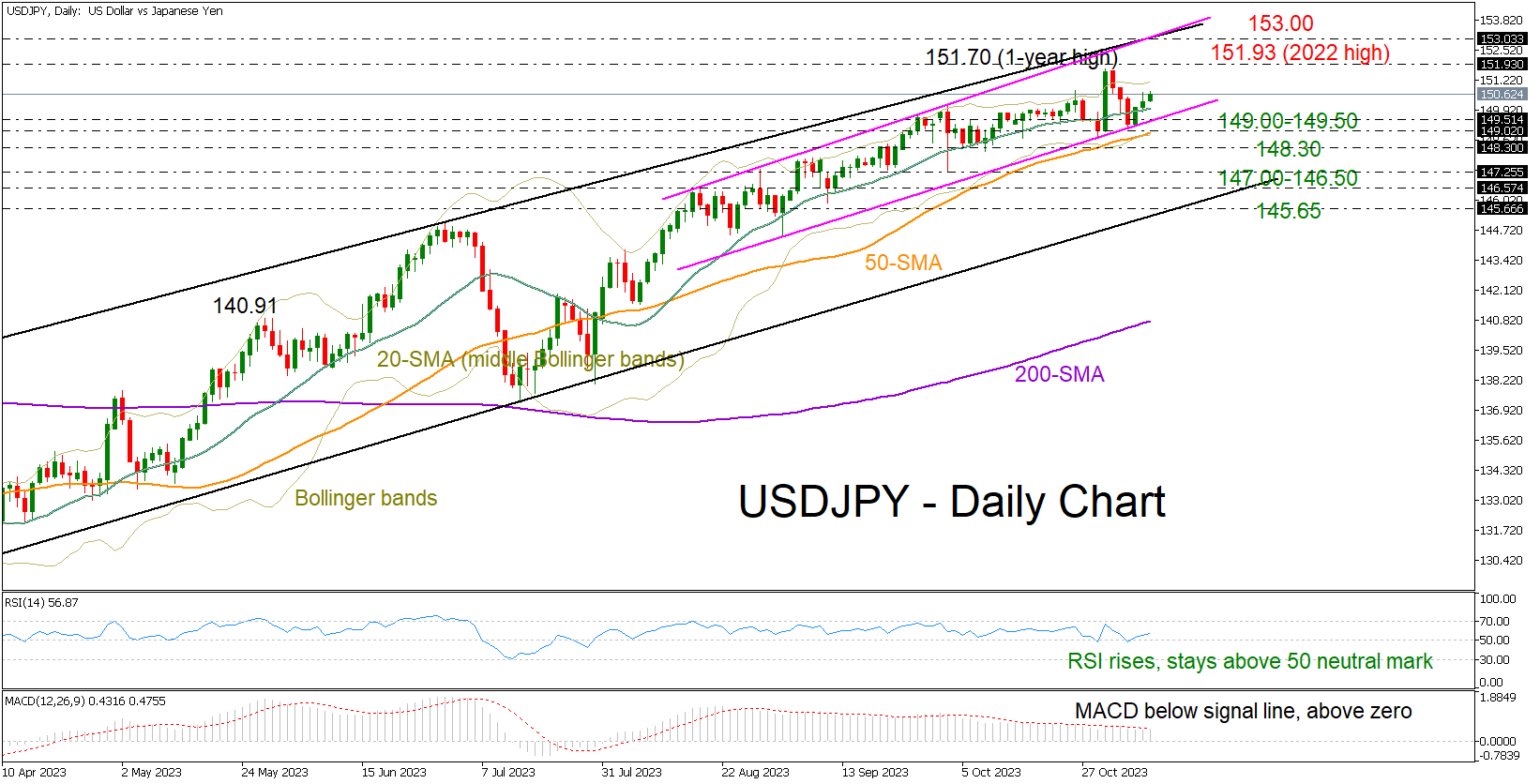

USDJPY is looking to resume its bullish trend ahead of Powell’s speech, having softly pivoted near the 149.30 level at the start of the week.

To attract new buyers, the bulls will have to surpass the nearby resistance of 151.65 and move beyond the 2022 top of 151.93. In this case, the price could pick up steam towards the important resistance trendline area at 153.00. Another successful battle there could see the price jumping into the 155.40-156.60 constraining zone taken from March-June 1990.

However, the mixed technical indicators do not convince traders of the bullish scenario. The narrowing Bollinger bands indicate a potential explosive move but the direction is unclear as the rising RSI has recently escaped a drop below its 50 neutral mark, whereas the MACD keeps lacking power below its red signal line.

Hence, a downside correction could still be possible in the coming sessions. If the pair slumps below the 149.00-149.50 range formed by the short-term ascending trendline from September and the 50-day simple moving average (SMA), it could stabilize near the 148.30 mark. Otherwise, the sell-off could expand towards the 146.55-147.30 territory. Yet only a clear close below the lower boundary of the broad bullish channel at 145.65 would disappoint medium-term traders.

Summing up, USDJPY has not eliminated downside risks yet, despite marking a positive week. To boost buying confidence, the pair will need to crawl above 151.93, and more importantly, strengthen its uptrend above 153.00. In such a case, though, it is worth considering that a sharp depreciation in the yen could prompt another round of FX intervention by Japanese authorities.