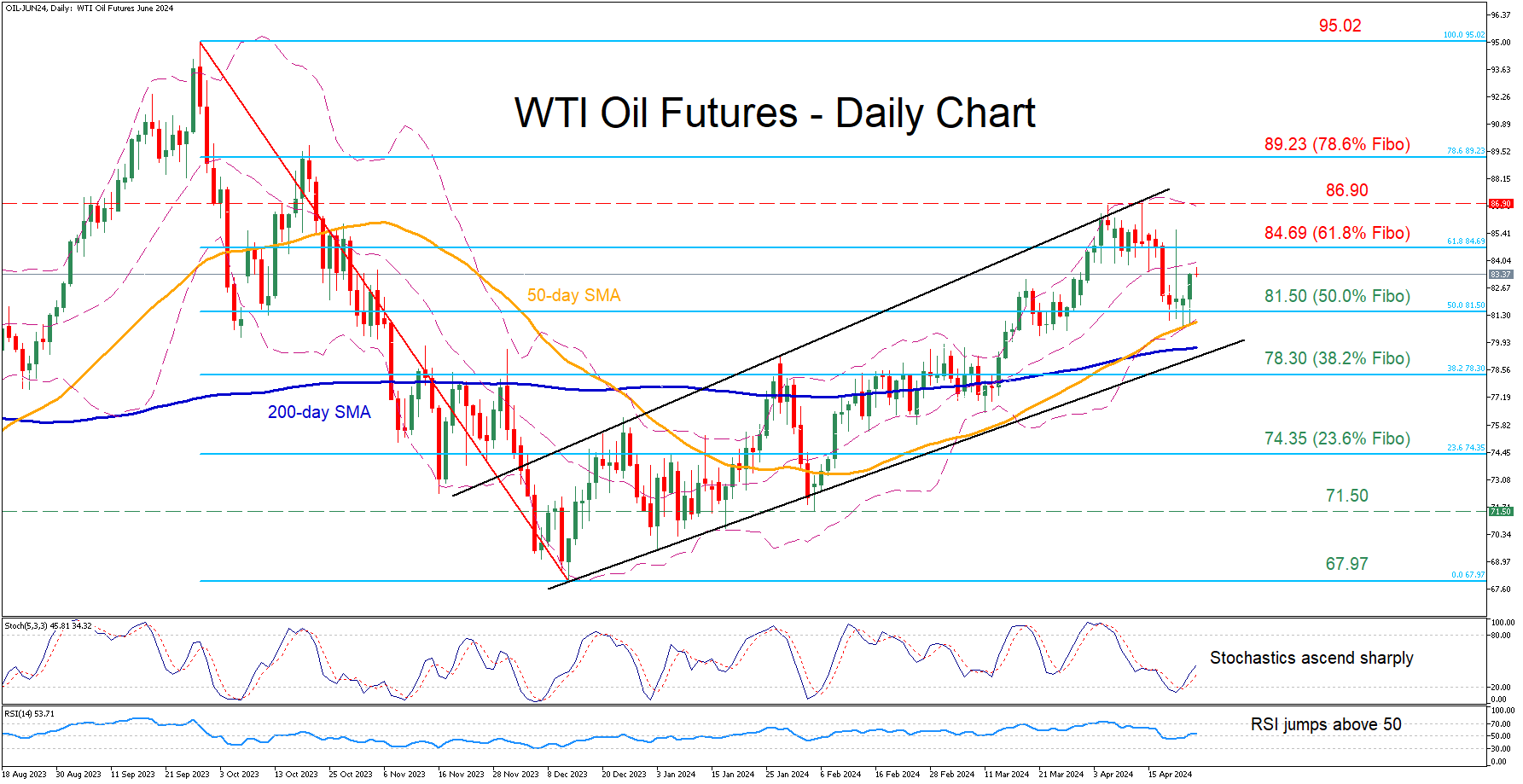

WTI futures tick up after bouncing off 50-SMA

WTI oil futures (June delivery) have been in a constant uptrend since bottoming out at 69.97 in December, posting a fresh six-month peak of 86.90 on April 12. Despite experiencing a pullback from its highs, the price managed to find its feet at the 50-day simple moving average (SMA) and recoup some losses.

Should the rebound resume, immediate resistance could be found at 84.69, which is the 61.8% Fibonacci retracement of the 95.02-67.97 downleg. Jumping above that zone, the price may challenge the recent six-month peak of 86.90. Even higher, the 78.6% Fibo of 89.23 could prevent further upside attempts. Alternatively, bearish actions could send the price lower to test the 50.0% Fibo of 81.50, a region that the price has repeatedly violated in the past few sessions but has failed to close below it. Further retreats could then cease at the 38.2% Fibo of 78.30. Failing to halt there, the price may descend towards the 23.6% Fibo of 74.35.

Alternatively, bearish actions could send the price lower to test the 50.0% Fibo of 81.50, a region that the price has repeatedly violated in the past few sessions but has failed to close below it. Further retreats could then cease at the 38.2% Fibo of 78.30. Failing to halt there, the price may descend towards the 23.6% Fibo of 74.35.

In brief, although WTI futures underwent a setback, they quickly regained traction following the deflection at the 50-day SMA. Hence, a resumption of the recent rebound remains the most likely scenario as the momentum indicators are tilted to the upside.