CAD set to end the week higher after a long slide

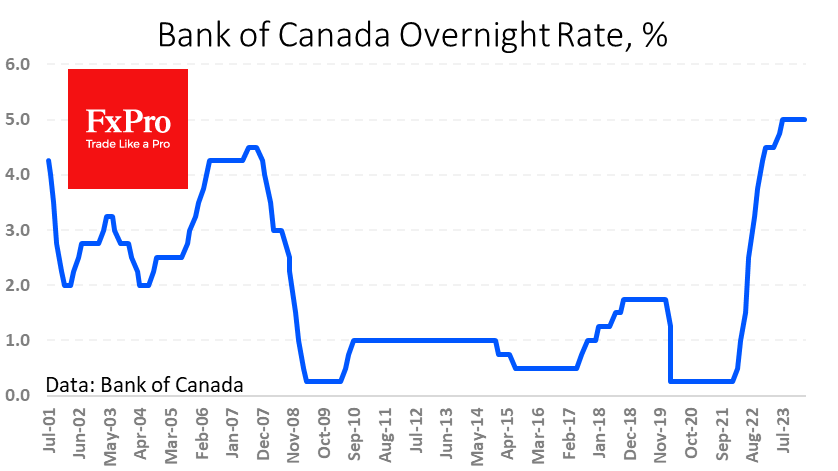

The Canadian dollar gained 0.5% following comments from the Bank of Canada on Wednesday night. The central bank kept its benchmark interest rate at 5% at its regular meeting and continued its quantitative tightening policy.

The Bank of Canada remains concerned about keeping inflation stable and wants to see more evidence that it is returning to target from current levels that are above historical averages.

CAD buying was supported by the fact that the commentary did not hint at an imminent rate hike - Canada is clearly preparing for a long pause.

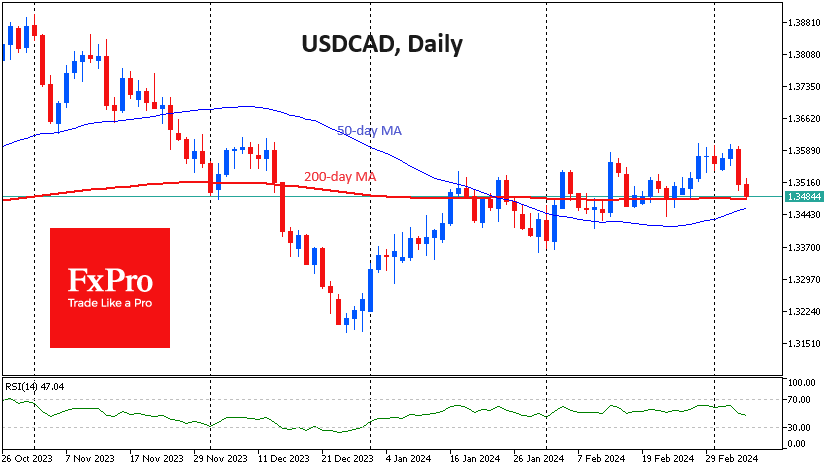

USDCAD's move lower also added to the pressure on the U.S. dollar from Powell's speech and signs of deteriorating economic data in recent days.

Technically, the USDCAD has returned to the 1.3500 level, which is the consolidation level from late March. A critical test for the USDCAD will be the support at 1.3480, the 200-day moving average. It is about to be crossed from below by the 50-day MA, forming a "golden cross". This signal, which is usually followed by increased buying, will be an essential test of the strength of the recent bearish momentum.

Given that the pair's most recent decline was also due to the weakening of the US currency, the bearish momentum could continue, marking the first weekly decline after nine consecutive weeks of gains.

At the same time, the USDCAD may not find significant support until the 1.32-1.3250 area, where the pair was pushed several times last year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)