Can Gold keep shining above 3,000

Gold is on fire, smashing through the 3,000 psychological level, having surged by 5.0% in just two weeks. With worries about a slowing U.S. economy, trade tensions, and geopolitical risks, investors are flocking to safe havens – pushing the yellow metal higher as the world is eagerly waiting for the Trump-Putin call between 13:00-15:00 GMT today.

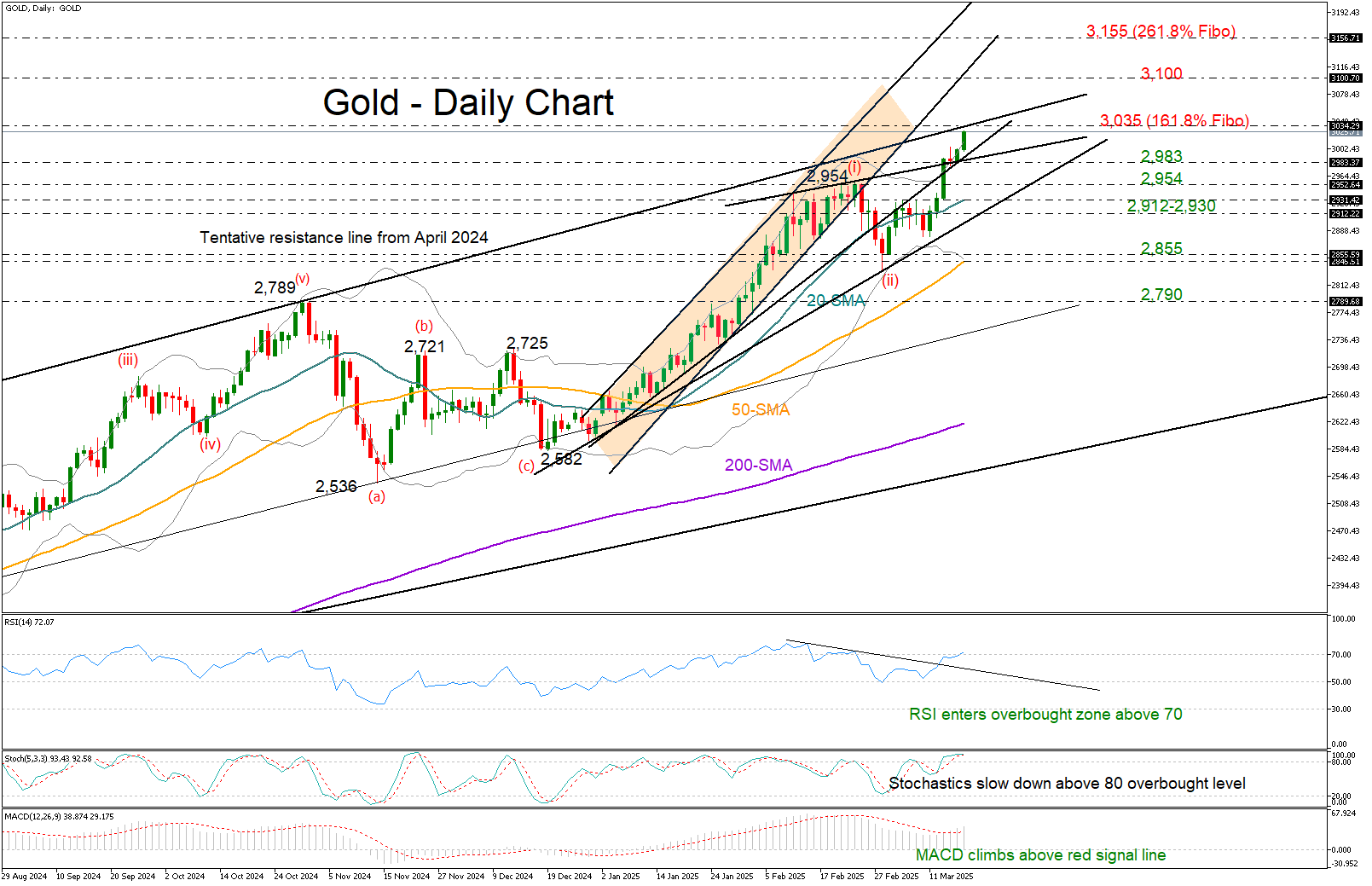

Right now, all eyes are on the resistance line connecting 2024’s highs, sitting near 3,035. After closing above 2,983, this level is the next big test. The 161.8% Fibonacci extension of February’s dip adds even more weight to this zone – if gold breaks through, we could see an explosive rally toward 3,100 and even the broken support trendline from January. Beyond that, the 261.8% Fibonacci extension at 3,155 could come into play.

Technically, however, the precious metal is currently looking overbought according to the RSI and the stochastic oscillator, and with the price pushing for another close above the upper Bollinger band, the rally could run out of steam soon.

If prices slip back below 2,983, February’s high of 2,954 and the 20-day simple moving average (SMA) near 2,912 could delay a test near the support trendline at 2,912. If sellers take control there, the price could dive towards the 2,855 base and the 50-day SMA. A deeper drop might even put the 2024 peak of 2,789 back in focus.

Overall, the gold is still shining, riding the wave of higher highs as Elliott Wave 3 – the longest in the 1-5 bullish pattern – continues to unfold. But with a key resistance level just ahead and overbought signals flashing, a bit of caution might be necessary.

.jpg)