EBC Markets Briefing | Aussie dollar dips despite Chinese stimulus plan

The Australian dollar was down on Wednesday after the latest round of US tariffs stoked fears of an escalating trade war. China and Canada retaliated while Mexican President Claudia Sheinbaum vowed to respond likewise.

China set its GDP growth target for 2025 at “around 5%” and laid out stimulus measures to boost its economy. It also raised its budget deficit target to “around 4%” of GDP.

That would mark the highest on record going back to 2010, according to Wind Information data. Trump has imposed fresh tariffs on Chinese goods — an additional 20% in duties in just about a month.

Australia’s economy expanded 1.3% year on year in Q4, accelerating for the first time since September 2023. The RBA has forecast a GDP growth rate of 2.4% and 2.3% for 2025 and 2026, respectively.

Market pricing implies the RBA will cut at least two more times to bring the cash rate to 3.6% by year-end, though policymakers remain cautious with inflation unlikely to normalise through the forecast horizon.

Iron ore futures languished near a 6-week low on weak Chinese demand. To mitigate the pain, Chinese manufacturers have set up production in Southeast Asia and Mexico, and some are considering US reshoring.

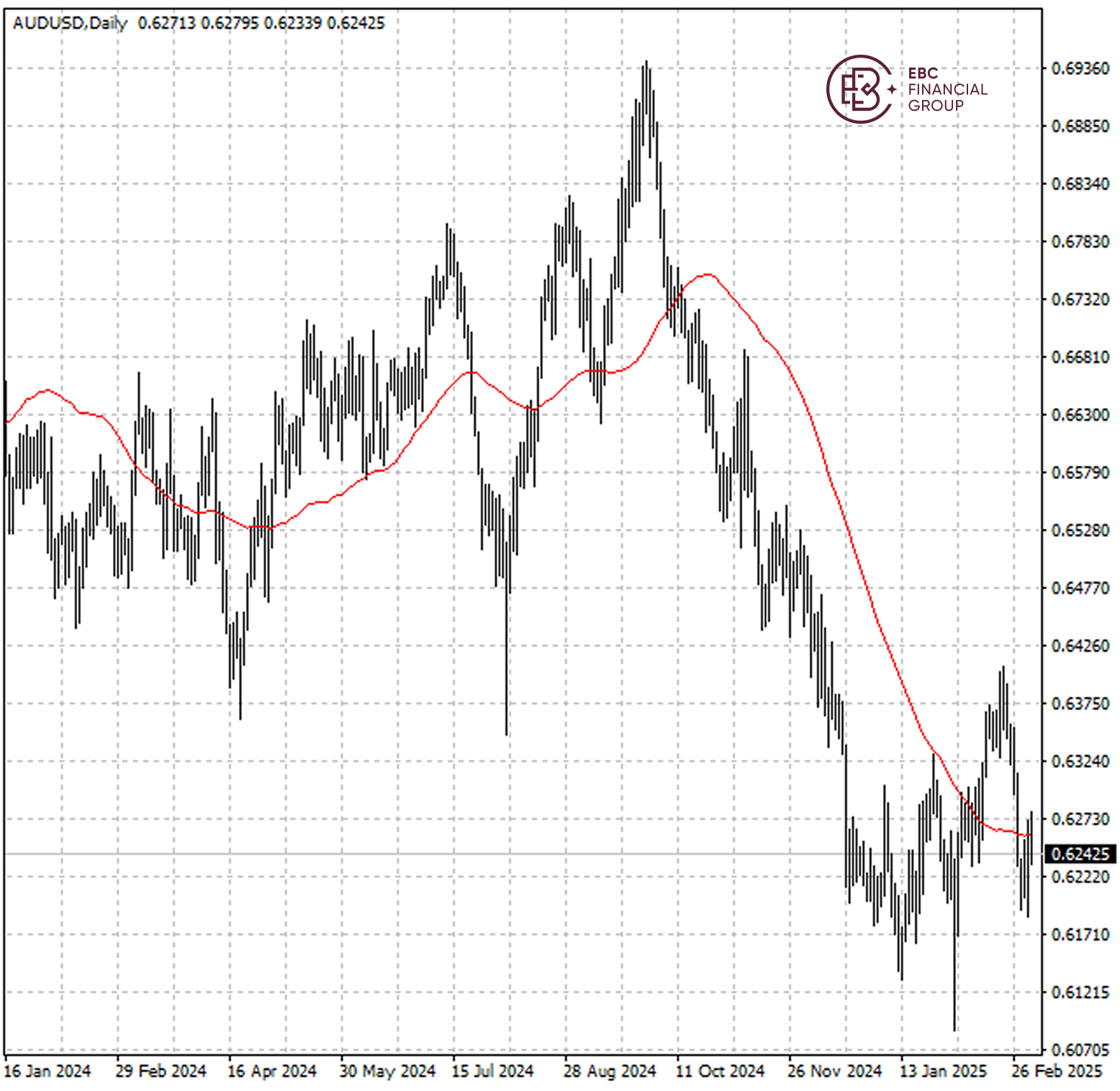

The Aussie dollar has broken above its 50 SMA, trading at the support around 0.6235. The rally could have more room to run until it gets close to 0.6310.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.