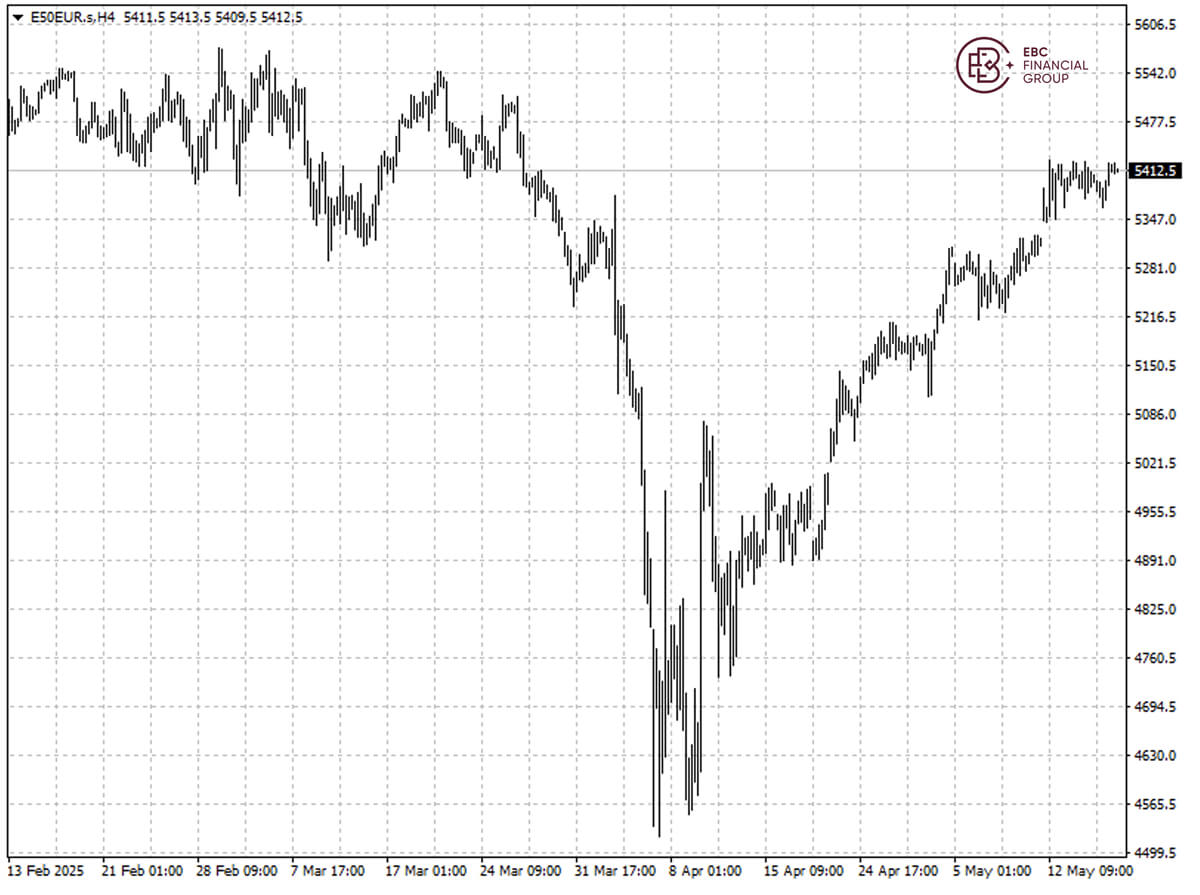

EBC Markets Briefing | EU firms yet to get out of the hole

European shares reversed early declines to close higher on Thursday, with industrial stocks getting the biggest boost. In spite of the newly-minted trade truce, Europe firms still face a fog of uncertainty.

Despite the relatively upbeat first quarter in which 60% of companies beat estimates, consensus estimates for the full year have still been cut aggressively over the last two months.

According to Goldman Sachs, the average relative price reaction for earnings miss has been a 2% drop, the most severe of the last 10 years, and rewards for earnings beats remain in line with the historical average.

The euro zone economy grew slower in Q1 than initially estimated but employment held up well, indicating that the bloc keeps creating jobs despite years of anaemic expansion, data from Eurostat showed.

While the bloc consistently underperformed the US in recent years, the 0.3% quarterly growth rate is far better than the 0.3% contraction reported in the US, partly due to surging imports ahead of tariffs.

Hopes that Ukraine and Russia's leaders would meet for peace talks in Turkey on Thursday were dashed as Putin and Trump opted to skip the trip, tuning Europe into a continent of prepper.

The Stoxx 50 has been in an uptrend for more than a month. It is hovering around support-turned-resistance around 5,410, and the next hurdle may well lie at 5,500.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.