EBC Markets Briefing | Euro in favour ahead of a key vote

The US dollar wallowed near a five-month trough against the euro and other major peers on Tuesday as investors grappled with the potential economic impact of growing global trade tensions.

The dollar found little support from a Commerce Department report on Monday that showed retail sales rebounded moderately in February, after a revised 1.2% decline in January.

Asset managers pumped up bullish euro positions to a five-month high, while hedge funds pared bets on the currency’s weakness. That underscore a global rethink on the euro’s trajectory.

German conservative leader Friedrich Merz last week reached an agreement with the Green Party on a debt-funded spending package for defense and infrastructure, ahead of a crunch vote in parliament.

The ECB will lower borrowing costs two more times, according to analysts surveyed by Bloomberg who no longer expect interest rates to go below 2%. Back-to-back cuts are seen as likely in April and June.

Survey respondents expect the euro-zone economy to gain momentum, predicting growth of 0.9%, 1.2% and 1.5% in the next three years — broadly in line with the ECB’s own projections.

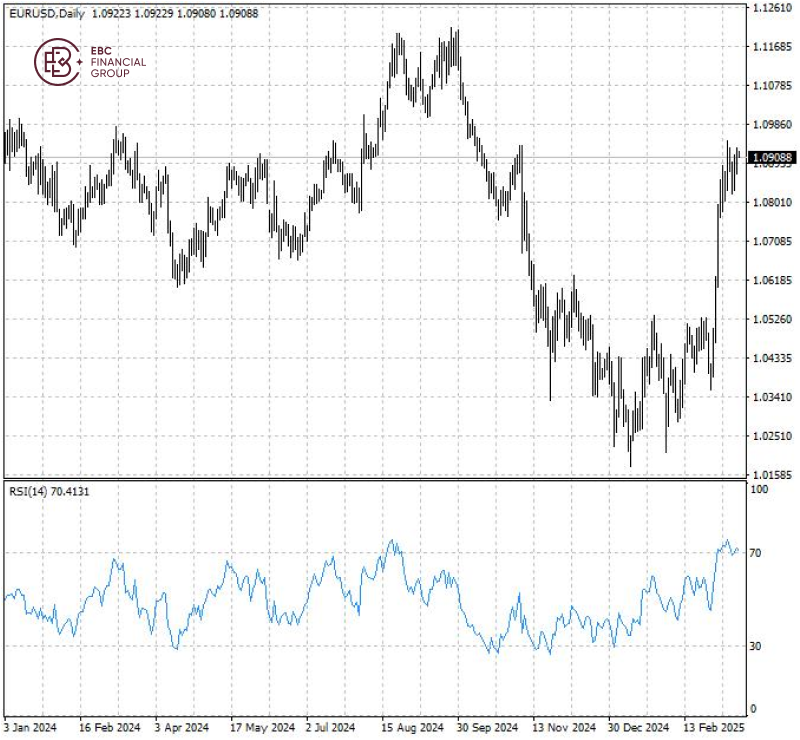

The single currency is trading near the resistance at 1.0930. This, coupled with RSI over 70, signals an immediate treat though it could have more room to run in the longer term.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.