EBC Markets Briefing | Euro remains shaky on political uncertainty

Sterling fell on Friday against the euro but the pair still perched at the highest level in over two years. US tariffs will likely hurt the eurozone and its impact on the UK is unclear, said BOE policymaker Megan Green.

The ECB cut interest rates for the fourth time this year on Thursday and kept the door open to further easing ahead as inflation closes in on its goal and the economy remains weak.

It removed a reference to keeping rates "sufficiently restrictive", while the bloc has been unsettled by Trump’s protectionism and political turmoil in Germany and France.

German Chancellor Olaf Scholz on Wednesday formally applied for a vote of confidence in his government. This is the first step on the road to snap elections scheduled for February.

French president Emmanuel Macron is expected to announce his choice for France's next prime minister, according to the Elysée palace, eight days after Michel Barnier was ousted in a no-confidence vote.

British consumer morale hit a four-month high in December as households grew more comfortable with their finances, a survey showed, while other indicators showed a post-budget slide in business sentiment.

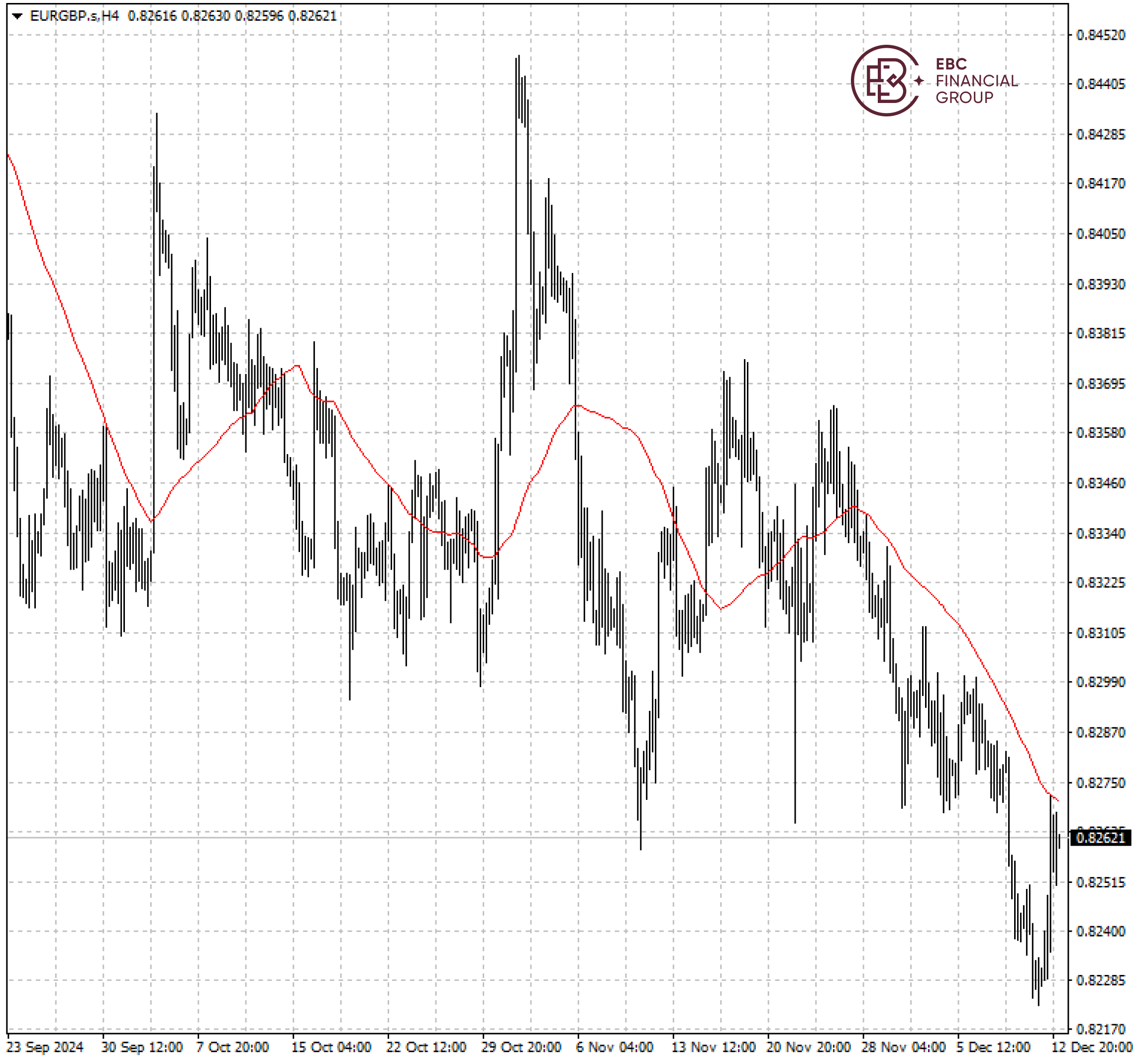

The single currency languished well below 50 SMA around 0.8326 per pound, signalling further weaknesses. The rally could be capped by the resistance of 0.8310.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.