EBC Million Dollar Trading Challenge II | Capturing the Nikkei 225 Rally

The EBC Million Dollar Trading Challenge II enters its eleventh day, with the Dream Squad leaderboard showing increased stability. @fengzheng01 remains unchallenged at the top.

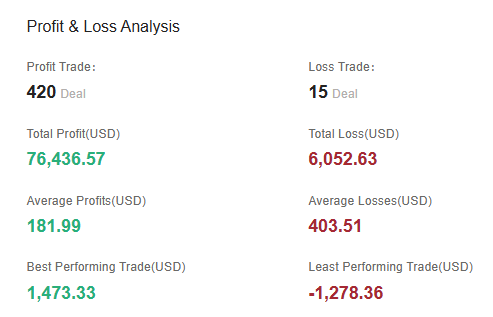

As of 12 PM, @fengzheng01 had amassed over $56,000 in earnings, boasting an impressive 96.5%-win rate. Their follower count has grown to 50, with the total capital of followers reaching over $90,000.

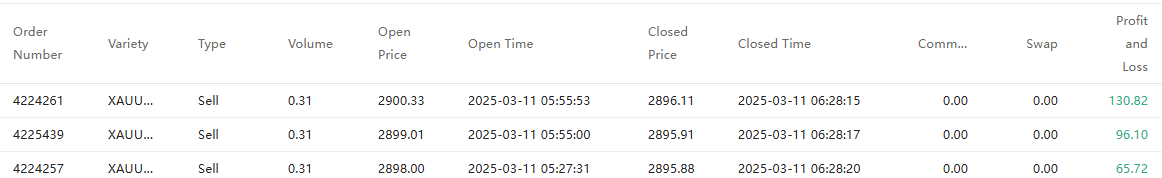

@fengzheng01 capitalized on gold's movement within a narrow range, steadily increasing their earnings. This demonstrates how a skilled trader can achieve success using fundamental strategies.

@3zo3zo broke into the top two positions, maintaining a perfect record with no losses across 11 trades. They successfully captured the brief rally during the downtrend of both the Nikkei 225 and the Nasdaq 100.

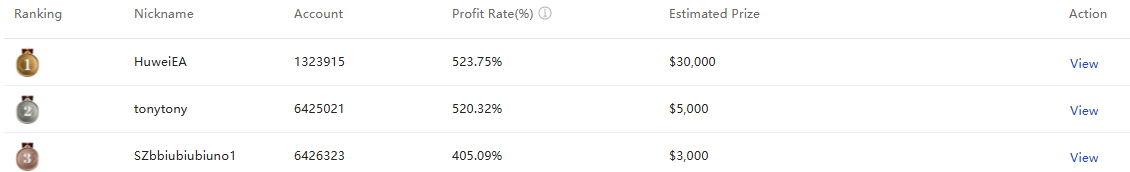

In the Rising Stars category, competition remains fierce. The leader, @HuweiEA, holds a slim lead of approximately 3% over the second place @tonytony. Both traders employ similar strategies, focusing primarily on gold trading. However, @tonytony trades more frequently and with a somewhat more aggressive approach.

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.