ECB, BoE, and BoJ take different paths

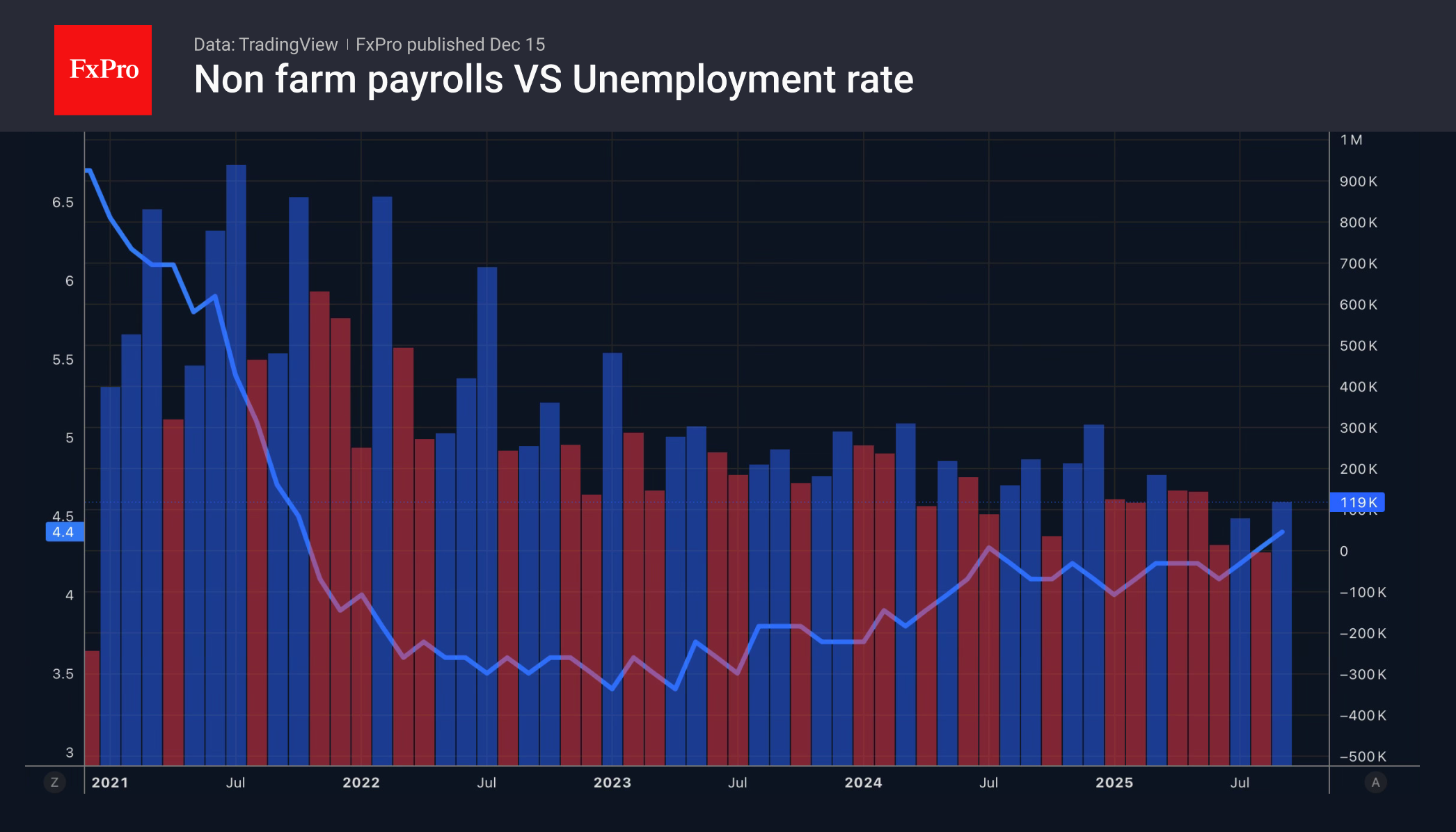

The US dollar is consolidating ahead of vital labour market statistics. Bloomberg experts forecast an increase in employment of 50K in November and unemployment remaining at 4.4%, the highest level since 2021. Such statistics would justify a pause in rate cuts until March or April, which is currently being priced in by the futures market. Donald Trump wants more. He has stated that he is fighting high interest rates and that they should ultimately fall to 1% or even lower, which would reduce the cost of servicing debt. The president believes that the new Fed chair should consult with him, as was done in the past.

Donald Trump wants more. He has stated that he is fighting high interest rates and that they should ultimately fall to 1% or even lower, which would reduce the cost of servicing debt. The president believes that the new Fed chair should consult with him, as was done in the past.

The White House is intent on increasing pressure on the central bank and increasing the number of ‘doves’ on the committee. Markets fear that his plans to turn the Fed into a puppet will come to fruition. This will undoubtedly be facilitated by the rotation of voting members of the committee, which will see FOMC hawks Ostan Gulsby and Jeff Schmid no longer voting in 2026.

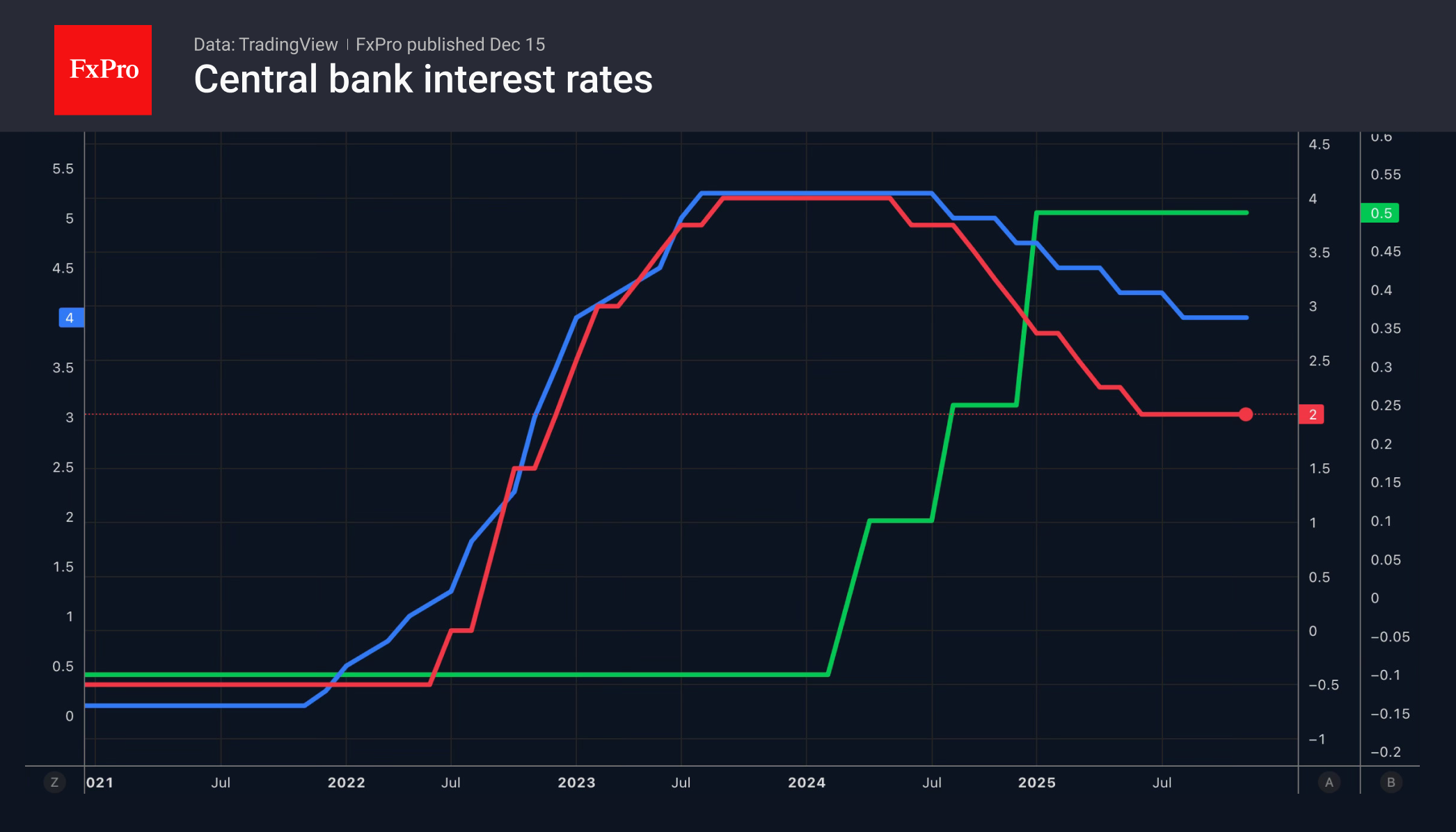

Three meetings of the largest G10 central banks, which issue currencies, are expected to yield different results on 19 December. Analysts do not expect the ECB to cut its rate from 2% at either its last meeting in 2025 or until 2027. The share of those expecting a rate hike over the next year has increased from 30% to 60%, providing support for the euro.

Three meetings of the largest G10 central banks, which issue currencies, are expected to yield different results on 19 December. Analysts do not expect the ECB to cut its rate from 2% at either its last meeting in 2025 or until 2027. The share of those expecting a rate hike over the next year has increased from 30% to 60%, providing support for the euro.

The Bank of England, on the contrary, intends to lower its rate from 4% to 3.75%, but the battle between the hawks and doves in Britain is even fiercer than in the US. Bank of America expects the committee to be split 5-4. The economic contraction in six of the last seven months increases the chances of monetary policy easing. On the hawkish side is the highest inflation in the G7 countries.

The Bank of Japan will almost certainly raise its overnight rate to 0.75%, but investors are in no hurry to buy the yen. They expect monetary policy to normalise extremely slowly. At the same time, the wide interest rate differential with the US allows carry traders to conduct their operations, increasing the chances of USDJPY growth.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)