Ethereum nears the recent turning point

Market picture

The crypto market cap remained at $1.65 trillion. Bitcoin spent another day almost unchanged at $42.8K.

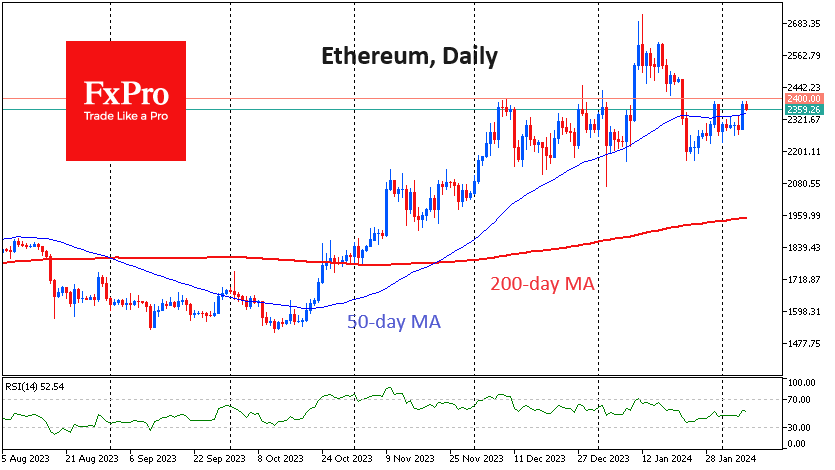

Ethereum was a major growth driver, gaining 1.6% on the day to $2350 and reversing to the downside as it approached $2400. This is the same place where we saw a reversal at the end of January and for a month since the beginning of December. In December, the coin managed to hold above this reversal level for almost a fortnight, but with the current lull in the markets, a temporary pullback to the lower end of the range towards $2200 looks more likely.

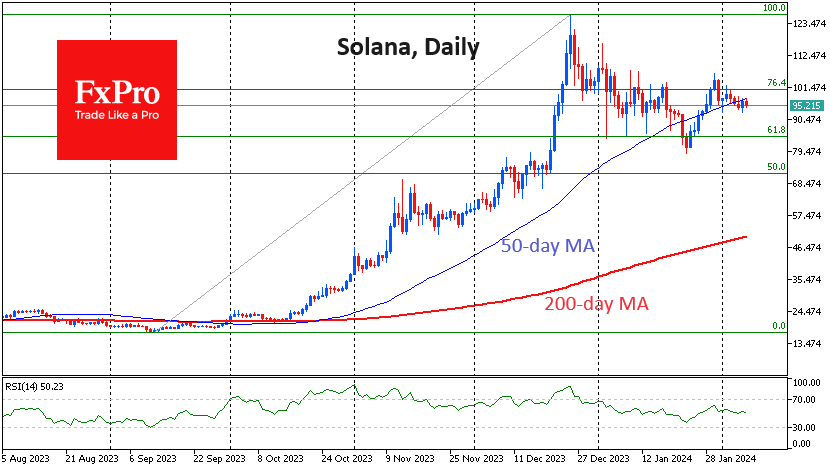

With a loss of 6% over the last seven days, Solana has moved slightly below its 50-day moving average, raising the question of the sustainability of the recent rally. However, the fall to $85 will be within the correction pattern after the September-December rally.

News background

The Solana blockchain suffered a glitch on the 6th of February when the network stopped processing blocks. Laine, the developer of the Solana blockchain software and validator, clarified that the outage was due to a "performance degradation" of the underlying network.

Anonymous cryptocurrency Monero (XMR) plunged 15% after reports of its delisting on Binance. Monero's developers said they would never compromise privacy and advised people to trade XMR on other platforms.

A US court ordered Ripple to disclose its 2022-2023 sales of XRP tokens to retail investors. Ripple CEO Brad Garlinghouse criticised the SEC at the World Economic Forum in Davos, calling it hostile to the crypto industry.

Bitcoin is displacing gold as a capital preservation asset in times of economic uncertainty, a situation that will continue thanks to the emergence of ETFs, said Katie Wood, CEO of ARK Invest. ETFs are an easy and seamless way to buy the first cryptocurrency, she said.

According to CoinGecko, Europe and Canada account for nearly 98% of the $5.7 billion Ethereum ETF market. This could change dramatically with the emergence of spot ETH funds in the US.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)