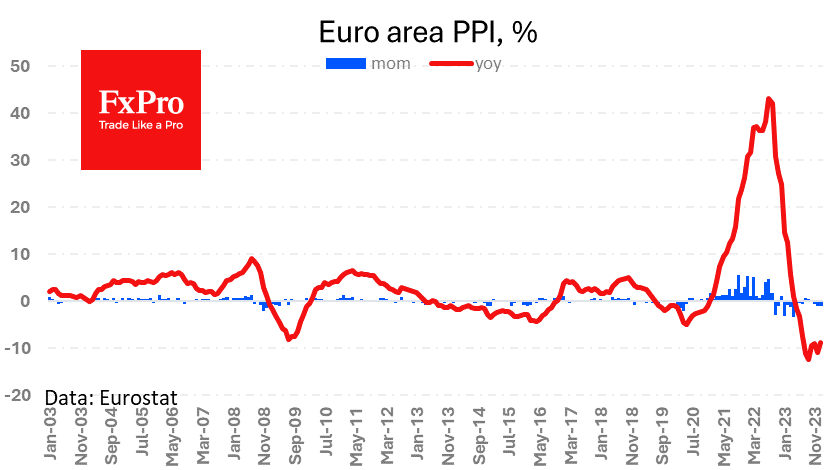

Euro area PPI fell more than expected

Price falls in Europe are faster than expected, bringing the date of ECB monetary easing closer. It is looking more and more realistic that Europe will move to easing sooner than America.

Eurozone producer prices fell by 0.9% in January, following the same decline in the previous month and a 0.5% fall in November. Analysts had, on average, expected a 0.1% fall. Falling prices and slowing economic activity in China should also be seen as a factor weighing on prices in Europe. Both Europe and the US fear deflationary pressures on prices due to overproduction. The public is unlikely to see this as a problem at first and may welcome cheaper goods. In the longer term, deflation is likely to be seen as a sign of economic weakness.

For the FX market, weakness in producer prices is a downward pressure on the currency as it brings the date of policy easing closer and reflects weak demand.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)