GBPUSD ticks up in trading range

· GBPUSD surpasses 20-day SMA

· RSI points up in bullish area

· Short-term bias positive, but there are more threats higher

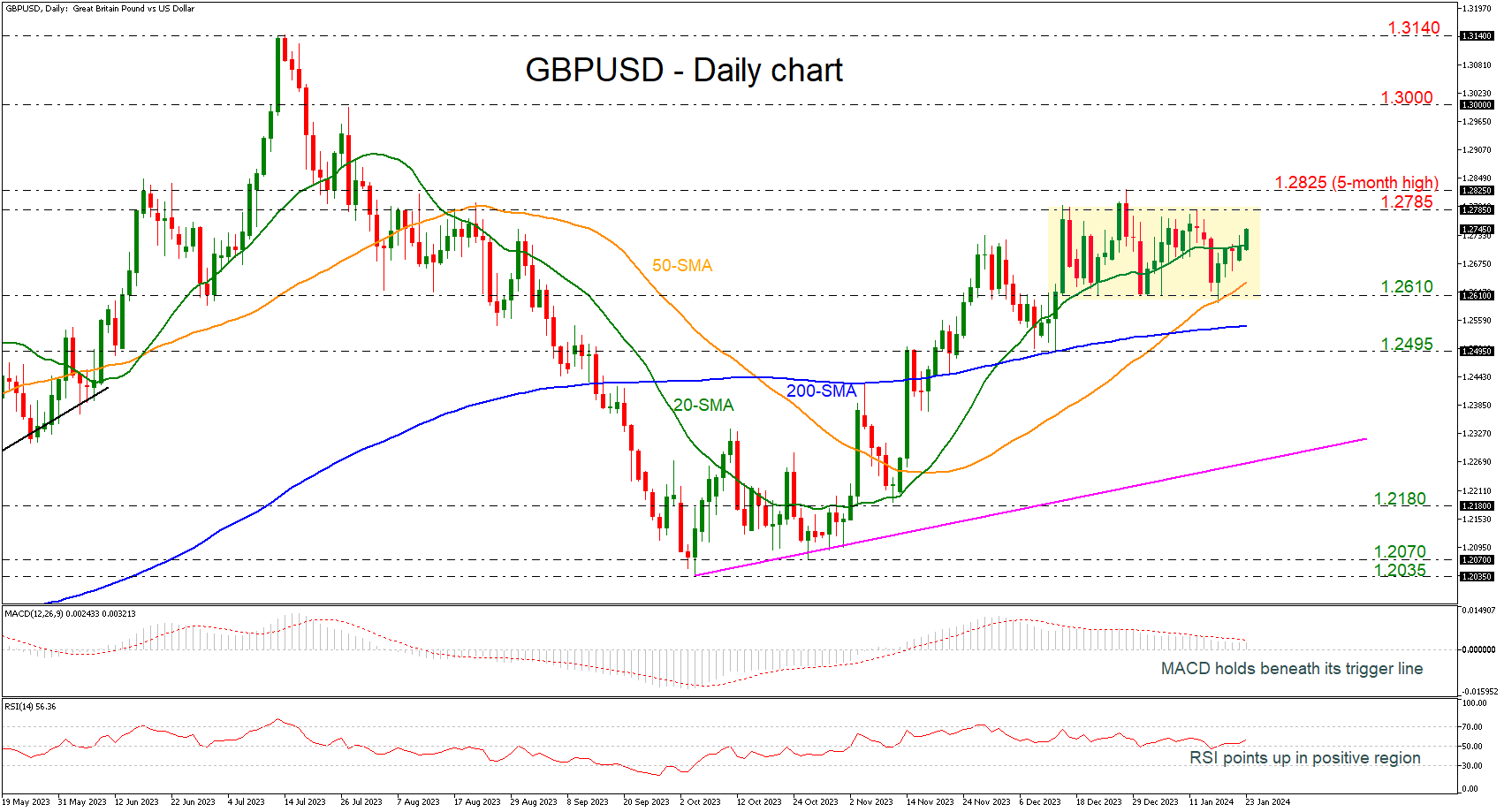

GBPUSD has reversed back higher again after finding support at the lower boundary of the trading range of 1.2610-1.2785. Currently, the price is rising beyond the 20-day simple moving average (SMA) and is approaching its previous highs.

Momentum indicators are showing some mixed signs. The MACD is still losing momentum beneath its trigger line in the positive region, while the RSI is pointing north in the bullish area after a flattening period in the past.

Should the pair manage to strengthen its positive momentum, the next resistance could come around the 1.2785-1.2825 restrictive zone. A break above it would shift the bias to a more bullish one and open the way towards the 1.3000 psychological mark.

However, if prices are unable to break into the upper band of the range in the next few sessions, the risk would shift back to the downside, with the 50-day SMA at 1.2635 once again coming into focus, as well as the 1.2610 support. The next key level to watch lower down is the 200-day SMA at 1.2545 ahead of the 1.2495 barrier.

In the medium-term, the outlook remains bullish since prices hold above all the moving average lines and the ascending trend line, which has been drawn since October 4.

.jpg)