Markets await key US payrolls report

OVERNIGHT

Equities across the Far East are trading noticeably higher following the news that the US Senate had passed the debt ceiling bill. It will now go to the President to sign, thus averting the possibility of the US defaulting on its debt. The Hang Seng saw the biggest gain, up around 4% on the day, meaning that despite declines earlier in the week on the back of concerns over Chinese growth, the index is set to end the week up.

THE DAY AHEAD

Aside from the debt ceiling, financial markets are likely to be highly tuned in to today’s US payrolls report. Up until recently, markets had been buoyed by the prospect that the Federal Reserve was about to pause its interest rate hikes. However, recent comments from a number of Fed policymakers, and the minutes of the last policy meeting, suggested that support for a pause is not universal. This led interest rate markets to at one point this week price in a c.70% probability that the Fed would deliver another hike in the Fed Funds rate at its upcoming June policy meeting. Over the last couple of days, however, further comments from Fed governor Jefferson (who is viewed as the most likely to replace the current vice-chair, Lael Brainard) and Philadelphia Fed President Harker signalled their preference to forgo a June hike, albeit both also stated that further increases were not off the table. In response expectations around a June 25bp hike slipped to around 30% (c.7bp priced in for June with a total of around 17bp of tightening through the July meeting).

Today’s US labour market report, however, could see expectations shift again, particularly if the report shows strong jobs growth and an upturn in wage growth. Market expectations are centred on a 195k rise in payrolls in May, slower than the 253k rise seen in April. However, other recent data have pointed to a more resilient US labour market, raising the risk of a stronger payrolls report. Notably, the JOLTS job openings survey – an indication of labour demand – showed vacancies surge back above the 10mn mark, while yesterday’s ADP report showed a much stronger-than-expected rise in hiring in May (+278k vs market expectations of 170k). The focus will also be on other parts of the labour market report – particularly the unemployment rate and wages data – for further insight on labour market tightness.

Elsewhere, there are no major data or events due in the UK or Eurozone. Some attention is likely to be on comments from ECB’s Vasle, particularly following the sharper-than-expected slowdown in inflation in May. Speaking yesterday, ECB President Lagarde pledged to lift interest rates further despite that outturn.

MARKETS

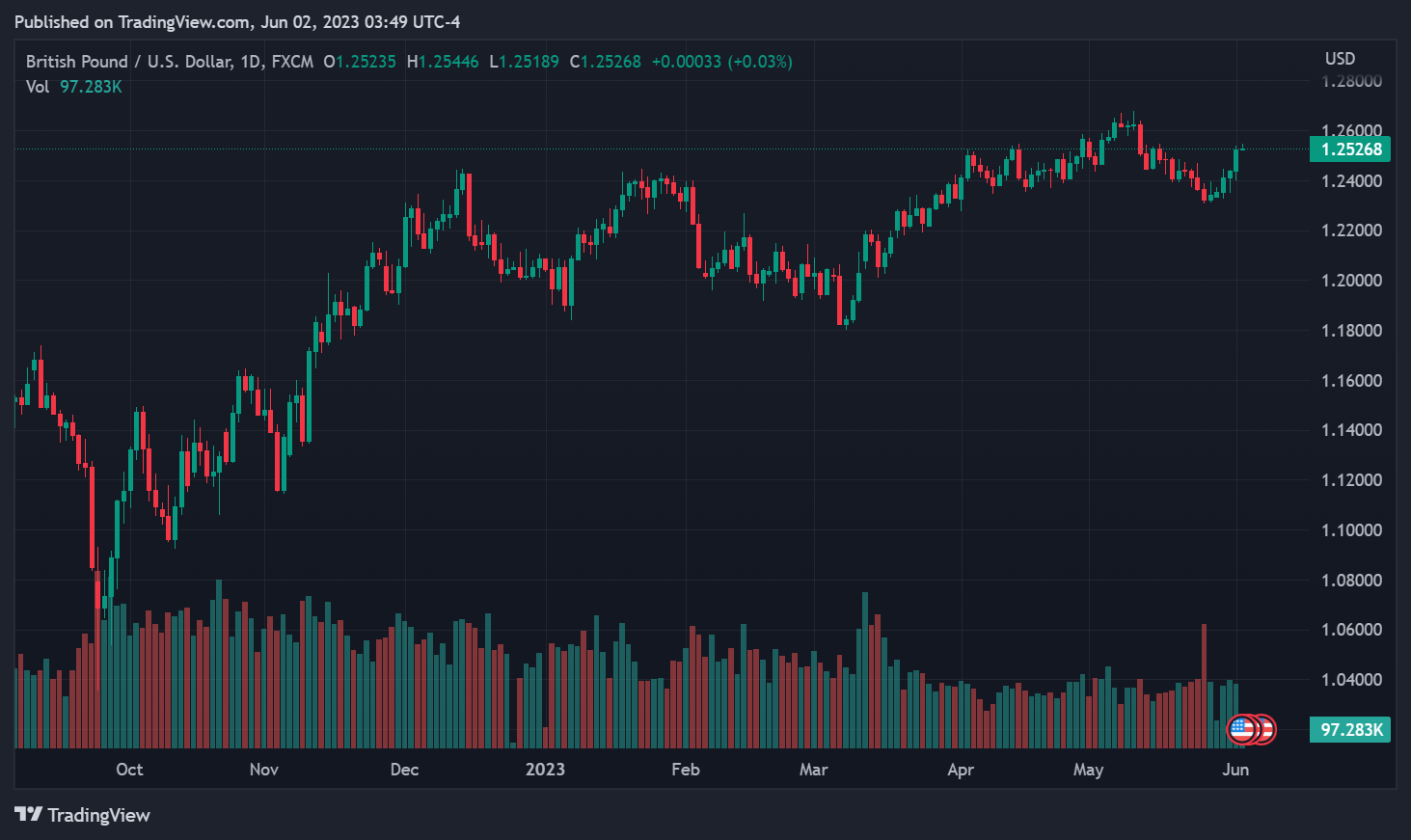

The improvement in risk sentiment, following the passing of the debt ceiling legislation by the Senate, has led to the US dollar moving lower. As a result, GBP/USD has pushed back above 1.25 for the first time since mid-May, despite little to no news on the domestic front.