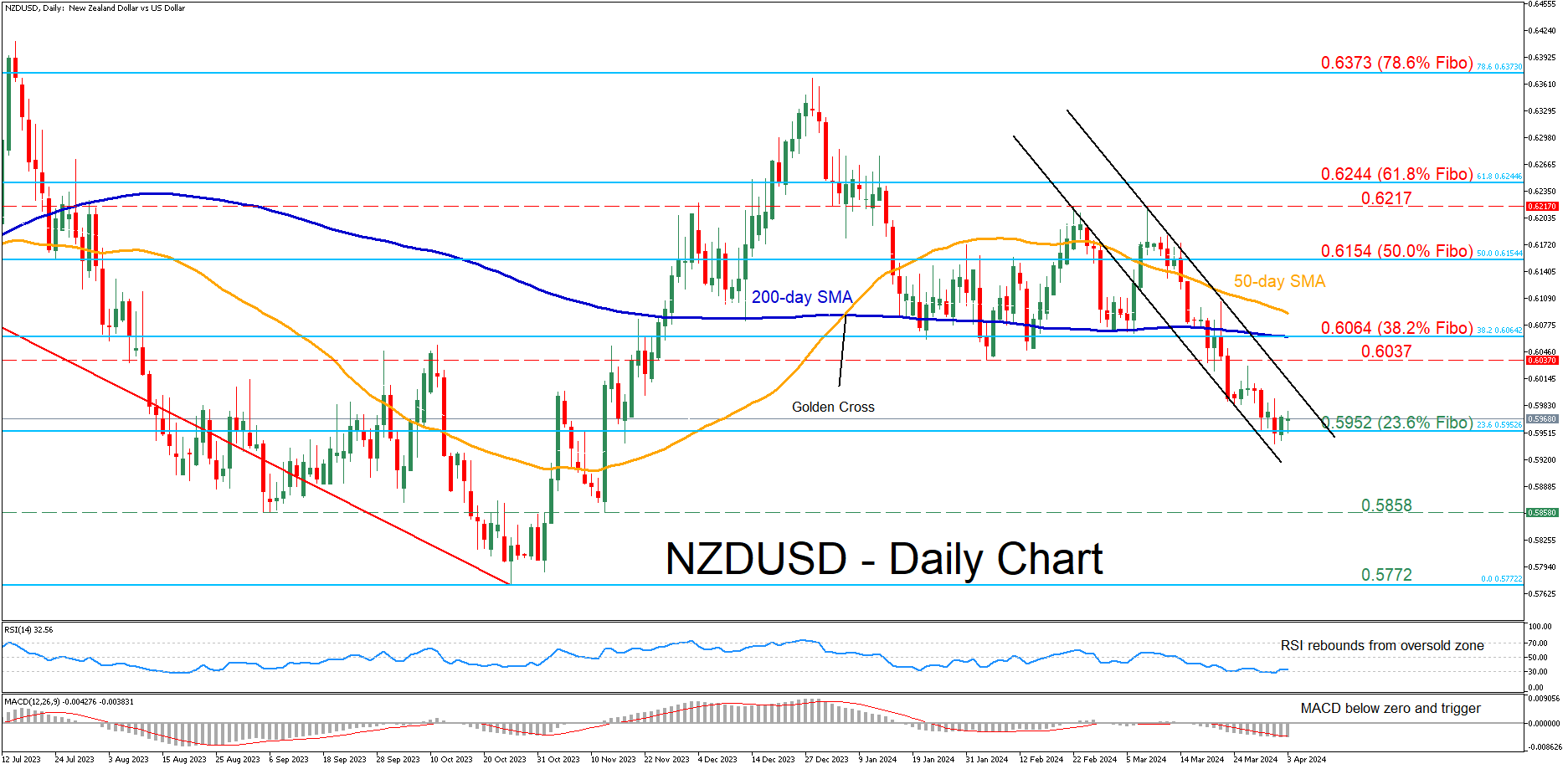

NZD/USD halts decline at 23.6% Fibonacci

NZDUSD has been in an aggressive downtrend since its double rejection at the 0.6217 level in early March. Despite dropping to a fresh four-month bottom this week, the pair seems to be finding its footing around 0.5952, which is the 23.6% Fibonacci retracement of the 0.6536-0.5772 downtrend.

Given that both the RSI and MACD are heavily tilted to the downside, the price might revisit the 23.6% Fibo of 0.5952. A violation of that region could pave the way for the September 2023 low of 0.5858, which also held its ground in November. Failing to halt there, the pair could challenge the 2023 bottom of 0.5772.

On the flipside, should the pair rotate back higher, immediate resistance could be found at the February support of 0.6037. Further advances could then cease around the 38.2% Fibo of 0.6064, which overlaps with the 200-day simple moving average (SMA). Conquering this barricade, the bulls may attack the 50.0% Fibo of 0.6154.

Overall, NZDUSD has plummeted to a fresh four-month low, but the 23.6% Fibo seems to be curbing the bears’ efforts for further downside. Hence, a clear break below that region could accelerate the decline.