Powell’s Dovish Tone Hammers Dollar’s Strength

The Federal Reserve's interest rate decision aligned with market expectations, as the U.S. central bank maintained interest rates for a third consecutive meeting. However, despite a positive Nonfarm Payrolls (NFP) report released last Friday and November's Consumer Price Index (CPI) holding above 3%, the Fed chief struck a dovish tone in his statement following the interest rate decision. Discussions around when policymakers might start cutting rates emerged, leading to a boost in U.S. equity markets. The Dow Jones, in particular, led the chart, reaching an all-time high. Conversely, amid a softened U.S. dollar, the Australian dollar found stimulation from upbeat job data. As a result, the Aussie dollar traded at its highest level against the U.S. dollar since early August.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98.0%) VS 25 bps (2%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The Dollar Index maintains its holding pattern within a range as investors eagerly anticipate the Federal Reserve's forthcoming monetary policy decisions. The recently released Consumer Price Index (CPI) data, showing a slight increase in November, hasn't shifted the overall trend for the dollar. Eyes remain fixed on the Fed's statement, with expectations leaning towards a dovish stance, potentially influencing rate cut expectations and impacting the dollar's appeal in the market.

The Dollar Index is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 104.45, 105.60

Support level: 103.55, 102.65

XAU/USD, H4

Gold prices experienced a notable rebound in the wake of the Federal Reserve's dovish monetary policy outlook. The dovish tone triggered a substantial selloff in the US Dollar, consequently enhancing the appeal of dollar-denominated gold.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 68, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2030.00, 2055.00

Support level: 2010.00, 1980.00

GBP/USD,H4

The GBP/USD pair broke above its descending triangle price pattern following the Federal Reserve's interest rate decision. Federal Reserve Chair Jerome Powell delivered a notably dovish statement in his speech after the interest rate decision, leading the market to anticipate a potential rate cut from the Fed early next year. This pivotal move from the Fed profoundly impacted the strength of the U.S. dollar, which was consequently weakened. The British Pound gained momentum by capitalising on the softening dollar, allowing the Sterling to edge higher against the U.S. dollar.

GBP/USD has picked a direction and broken above its descending triangle pattern, suggesting a potential long-term trend reversal. The RSI has rebounded strongly to above the 50-level while the MACD has crossed and is on the brink of breaking above the zero line, suggesting that bullish momentum is forming.

Resistance level: 1.2730, 1.2815

Support level: 1.2528, 1.2440

EUR/USD,H4

The EUR/USD pair staged a sharp rebound from its recent low, registering a gain of nearly 1% last night. The euro, which had been under pressure due to downbeat economic data, experienced a robust recovery by capitalising on the weakening strength of the U.S. dollar. The indication from the Fed's chair that the U.S. central bank may consider cutting rates next year had a profound impact on the market. This led to a significant plunge in U.S. long-term treasury yields, dropping below 4%, and the dollar index fell to its lowest level since early August.

EUR/USD rebounded sharply yesterday and has a potential long-term trend reversal for the pair. The RSI has got into the overbought zone while the MACD has broken above the zero line and diverged, suggesting the bullish momentum is strong.

Resistance level: 1.0954, 1.1041

Support level: 1.0775, 1.0700

USD/JPY,H4

The USD/JPY pair has persistently traded within its long-term bearish trend, following a minor technical rebound earlier in the week. The divergence in monetary policy between the U.S. and Japan plays a pivotal role in shaping the pair's price movement. The Federal Reserve is anticipated to begin cutting rates next year, reflecting a dovish stance, while the Bank of Japan (BoJ) is on the path to normalising its monetary policy and moving away from the negative interest rate territory. This stark contrast in policy directions contributes to the ongoing bearish trend in the USD/JPY pair.

The USD/JPY continues to trade in its long-term bearish trend and has declined to its lowest level since early August. The RSI has once again broken into the oversold zone while the MACD has declined sharply, suggesting the bearish momentum is strong.

Resistance level: 143.70, 145.35

Support level: 140.00, 137.70

AUD/USD, H4

The AUD/USD pair has experienced a strong surge, breaking above its robust resistance level at 0.6677, signalling a bullish bias for the pair. The dovish tone from the Fed's chair in his speech last night significantly weakened the U.S. dollar's strength. Simultaneously, the Australian dollar was boosted by upbeat job data in Australia. This positive economic indicator contributed to the pair trading at its highest level since late July.

The AUD/USD pair has broken above its strong resistance level at 0.6677 and avoided a triple-top price pattern from forming, suggesting a bullish bias for the pair. The RSI rose sharply and broke into the overbought zone while the MACD broke through the zero line from below and diverged, suggesting a strong bullish momentum has formed.

Resistance level: 0.6745, 0.6800

Support level: 0.6677, 0.6614

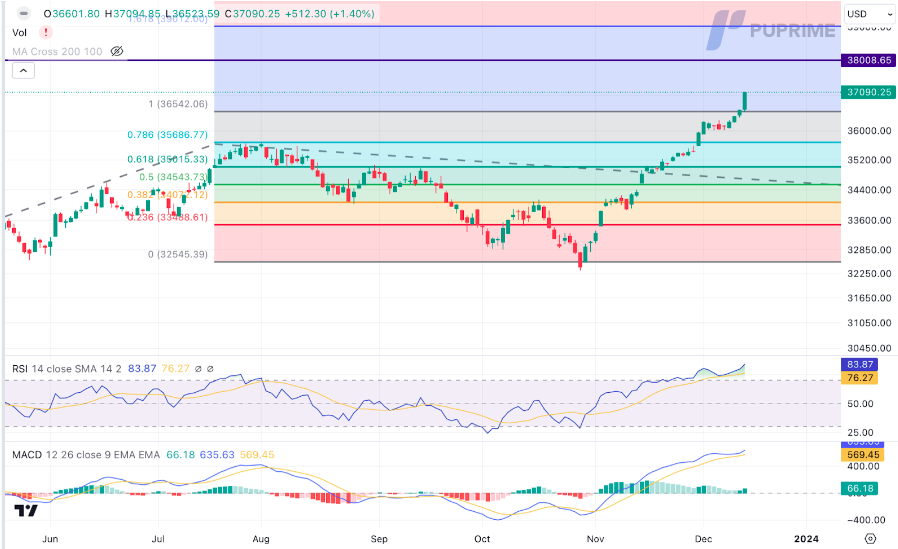

Dow Jones, H4

US Treasury yields declined significantly as market participants anticipated potential rate cuts from the Federal Reserve. The majority of the US equity market responded with substantial gains. The Dow Jones Industrial Average achieved a record closing high, marking its first since January 2022. Both the S&P 500 and Nasdaq rallied over 1%, reflecting the positive sentiment following the Federal Reserve's indication of concluding its interest rate hiking policy.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 84, suggesting the index might enter overbought territory.

Resistance level: 38000.00, 39000.00

Support level: 36540.00, 35685.00

CL OIL, H4

Oil prices edged higher from a five-month low, propelled by an upbeat US Energy Information Administration (EIA) inventory report. The unexpected decline of 4.259 million barrels in US crude oil inventories, surpassing market expectations, contributed to the positive momentum. The Federal Reserve's dovish statement further supported oil prices, hinting at potential future expansionary monetary policies that could stimulate economic momentum and increase oil demand.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 47, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 72.15, 74.85

Support level: 69.25, 66.85