Risk rally struggles for momentum as tariff uncertainty persists

Relief and fear as tariff deadline nears

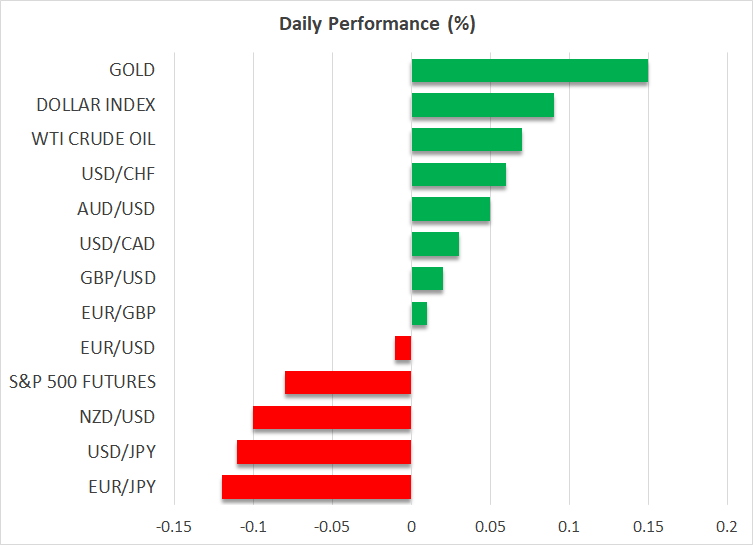

Shares on Wall Street closed at a more than two-week high on Monday but the positive sentiment is struggling to take off as it’s been a mixed start for equities globally on Tuesday. US stocks rallied yesterday after President Trump indicated that some countries may be exempt from the reciprocal countries that are due to be unveiled next week, pointing to a more flexible stance than previously suggested.

The S&P 500 closed 1.8% higher, while the Nasdaq 100 surged by 2.2%. Asian indices weren’t able to enjoy much of a bounce, however, as Chinese stocks in particular came under pressure from Trump’s announcement of secondary tariffs on any country that buys oil and gas from Venezuela.

Oil heads higher as Trump punishes Venezuelan oil buyers

China is the main destination of Venezuela’s oil exports and risks facing an additional 25% tariff on top of the levies already imposed by Washington under the Trump administration.

Oil futures jumped by more than 1% yesterday, notching up a fourth consecutive session of gains on concerns that Trump’s latest measures will hit global supply.

Trump confirms auto tariffs

But the secondary tariffs aren’t the only thing that’s worrying the markets. Hopes that the next round of duties will be narrower than initially feared were dashed after Trump confirmed that more sectoral tariffs are on the way on top of the reciprocal tariffs.

Trump is prioritizing the auto sector and could announce new tariffs on car imports within the next few days. So, whilst the White House is open to negotiating with countries and some of the levies will likely be delayed or suspended, Trump is keen on celebrating ‘Liberation Day’ on April 2 when most of the reciprocal tariffs will kick in.

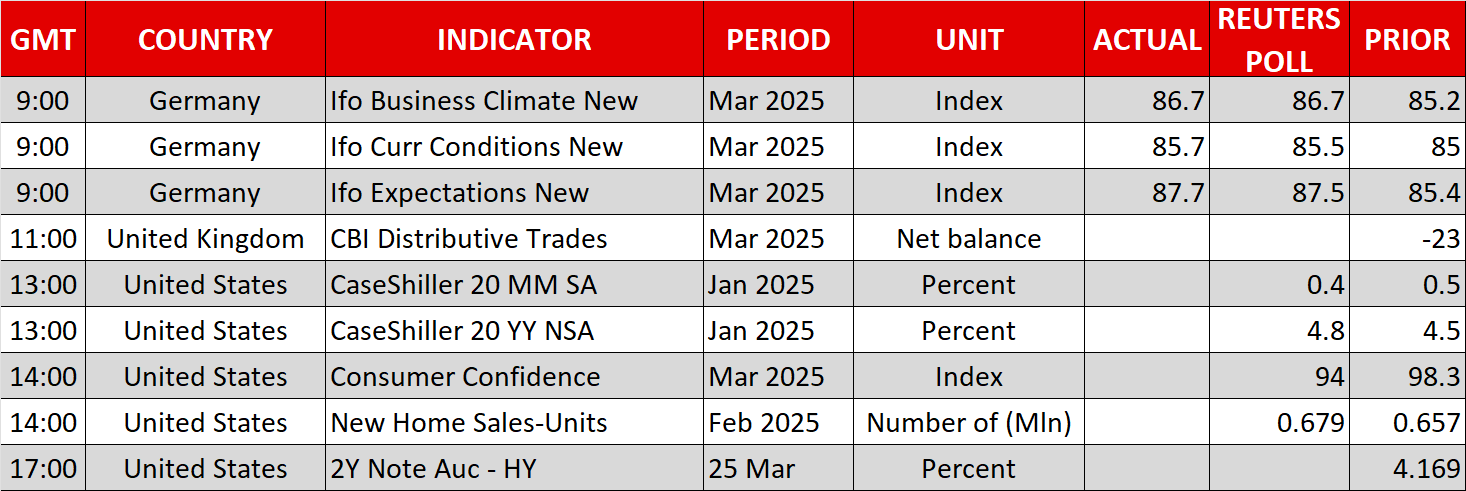

Dollar boosted by upbeat services PMI

For the time being, however, Trump’s somewhat softened stance has offered markets a bit of respite from all the uncertainties that investors had to contend with lately. Further supporting sentiment was yesterday’s stronger-than-expected services PMI out of the US. S&P Global’s flash reading for March showed a surprise jump to 54.3, easing fears about a recession.

The US dollar pushed higher against most of its major peers, with its index against a basket of currencies reaching a near three-week high. Treasury yields have also been climbing in recent days and the trend was reinforced by the Atlanta Fed’s Bostic on Monday who said he doesn’t see the Fed cutting rates more than once this year.

Fed Governor Kugler and New York Fed President Williams will also be speaking later today, while on the data front, the March consumer confidence index will be the highlight.

Yen eases from lows on Ueda comments

The Japanese yen is trading slightly firmer today, recouping some of yesterday’s sharp losses on the back of the poor PMI numbers, helped by hawkish remarks by Bank of Japan Governor Ueda. Speaking in Japan’s parliament, Ueda warned about the impact on underlying inflation from higher food prices and stronger wage growth.

Aussie bets on China stimulus, gold regains positive footing

Both the euro and pound are flat against the dollar, and apart from the yen, only the Australian dollar is notably higher on Tuesday. Hopes that China will outline more stimulus measures on Thursday are supporting the risk-sensitive aussie.

Gold, meanwhile, is reversing yesterday’s losses and is ticking above $3,020 amid the ongoing uncertainty about Trump’s tariffs policies and signs that the talks between the US and Russia on a Ukraine ceasefire deal do not appear to be making significant progress.

.jpg)