The UK labour market is cooling, but GBPUSD is set to rise

The UK labour market is cooling, but GBPUSD is set to rise

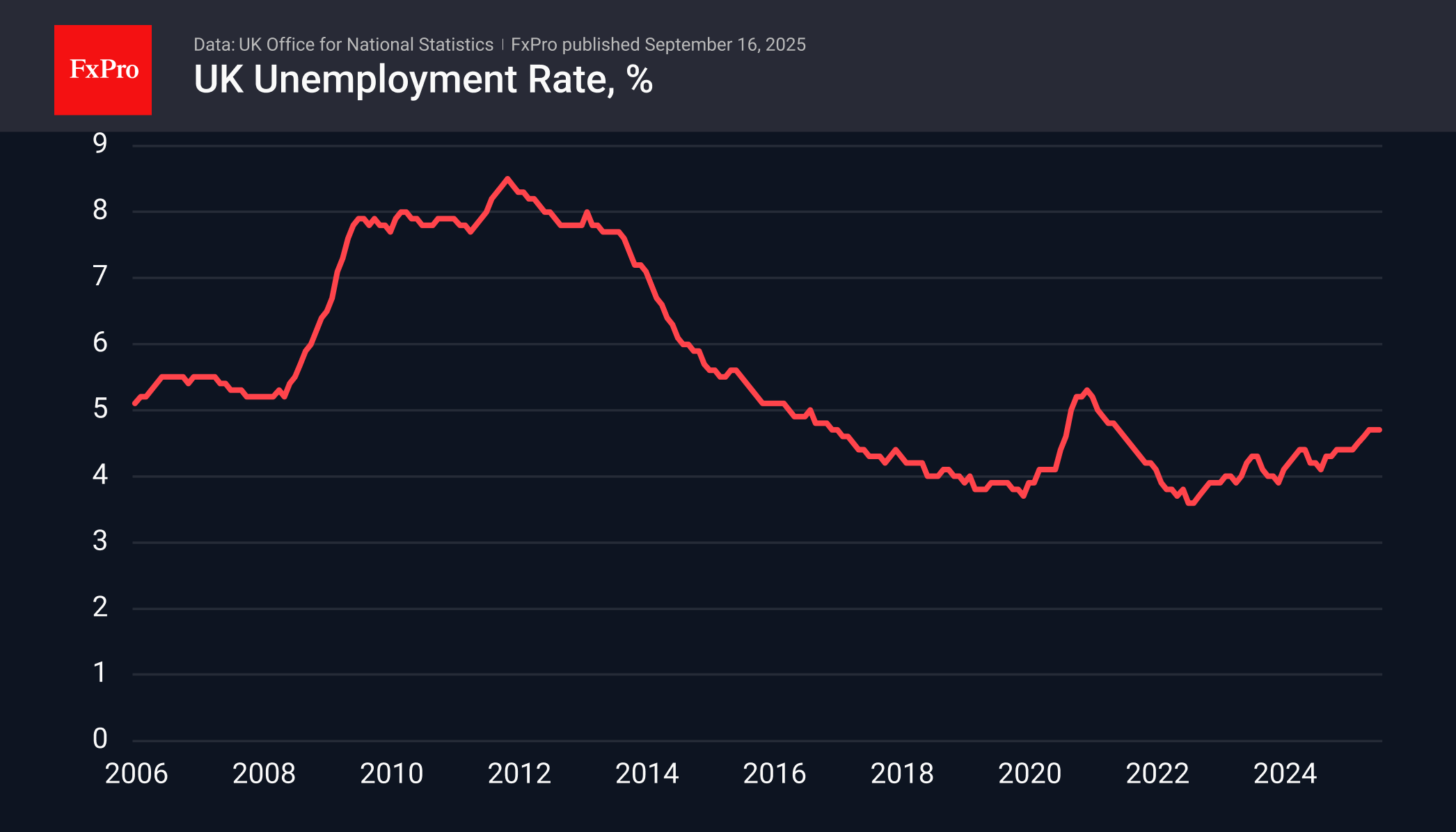

The UK labour market is cooling, but not collapsing, allowing focus to remain on rising inflation. The Bank of England's task remains to time the rate cut correctly so as not to allow the economy to cool excessively.

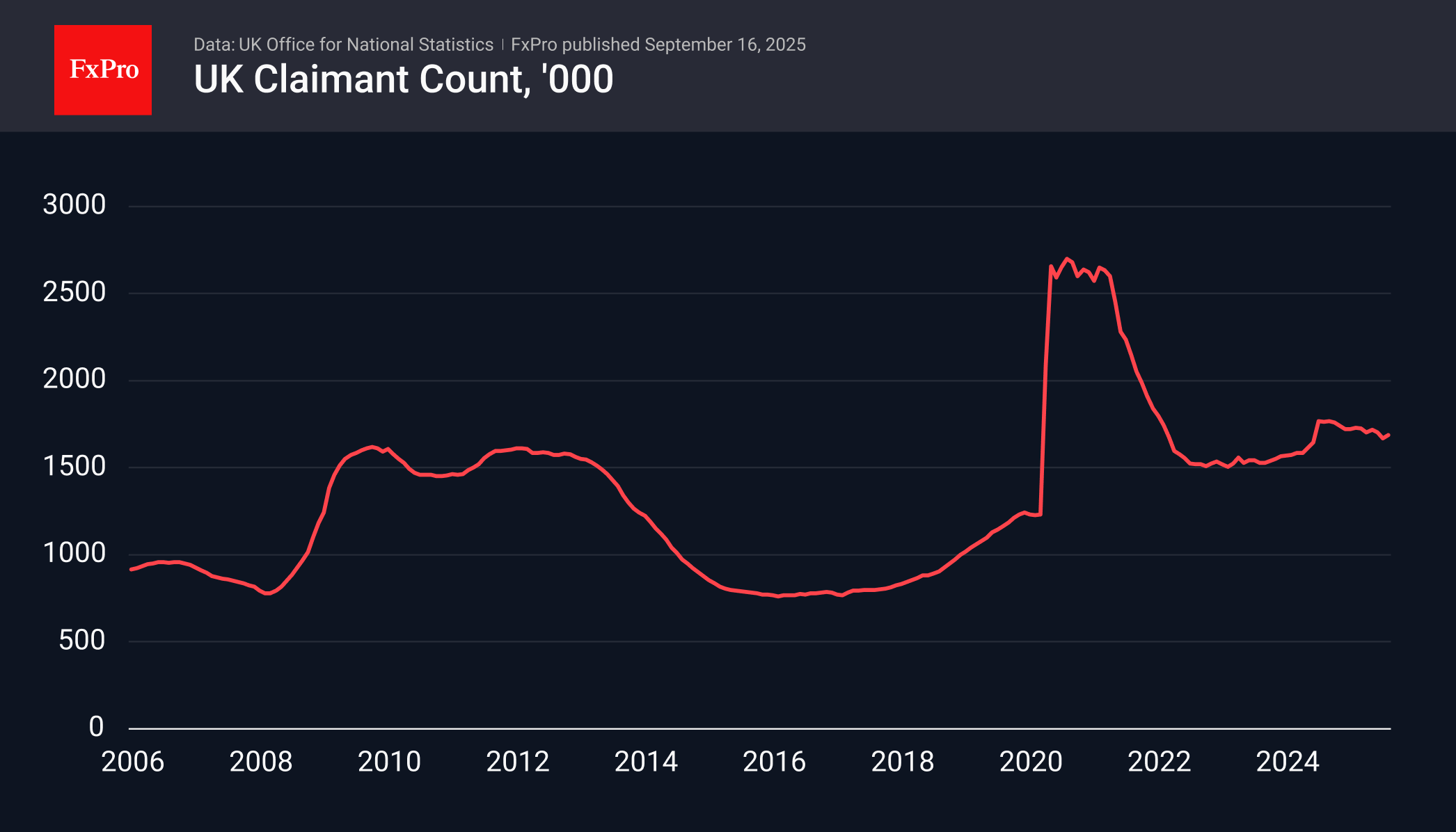

The number of applications for unemployment benefits rose by 17,400 in August, slightly above the average expectation of 15,300, but following declines of 33,300 and 15,500 in the previous two months. Another indicator, the change in the number of unemployed over the last three months, showed an impressive increase of 232,000. Unemployment has remained at 4.7% for the last three months, but it is significantly higher than the 4.1% recorded in August 2024. In such conditions, the gradual decline in the number of benefit recipients appears to reflect a decrease in the number of people eligible for this type of payment, rather than an increase in employment.

Earnings growth also continues to decline. In May-July, earnings with bonuses were 4.7% higher than a year earlier, continuing the downward trend since the beginning of the year. Excluding bonuses, earnings growth was at its lowest in more than three years, reflecting both a cooling in the labour market and a slowdown in import inflation.

On Tuesday, the GBPUSD pair exceeded 1.3640, approaching the 4-year highs recorded in early July. The strengthening is largely due to the weakness of the dollar amid growing expectations of a Fed rate cut in the coming quarters. Breaking through 1.38 will end the corrective pullback, opening the way to 1.48, near which the 161.8% Fibonacci extension levels and the levels prior to the Brexit referendum promises at the end of 2015 are located.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)