What Triggered the Recent Market Mood Swing?

The market kicked off today with a more cautious tone following last week's steep pullback in equities, as traders increasingly expect the Federal Reserve to hold off on further easing in December. The shift has pushed sentiment away from the earlier "Risk-On" appetite and toward a more defensive "Risk-Off" mindset.

Markets Reel as Cut Bets Plunge

The sharp pullback in expectations for a December rate cut has become the key force driving recent market repositioning. CME FedWatch data shows the probability of a 25bps cut sliding from almost 95% a month ago to roughly 50% today.

The shift follows a series of hawkish comments from Federal Reserve officials last week, including Cleveland Fed President Beth Hammack, Dallas Fed President Lorie Logan, and Kansas City Fed President Jeffrey Schmid.

- Hammack indicated that there is no clear case for additional policy easing at this stage.

- Logan noted that supporting another cut would be difficult without clearer progress on inflation or a softer labour market.

- Schmid, who dissented against the October cut, cautioned that further easing would not fix longer-term workforce challenges tied to technology and immigration, and could undermine the Fed's inflation credibility.

Chair Jerome Powell has stayed in a cautiously neutral posture, reiterating a data-driven approach after the October move. Meanwhile, Governor Stephen Miran, one of the more dovish voices, continues to argue that larger cuts remain appropriate.

Market takeaway

With the odds of additional easing diminishing, risk assets face a more challenging backdrop. The environment remains supportive of the US Dollar while putting pressure on high-valuation and high-beta segments of the market.

Is the Tech Bubble Finally Cracking?

Last week’s sharp downturn in equities highlighted how vulnerable valuations still are and highlighted ongoing technical weaknesses across major indices.

Valuation concerns resurfaces

The Nasdaq's drop of more than 2% reflected growing anxiety that AI-related stocks have stretched too far. Heavy selling in leaders like Nvidia and AMD showed just how quickly investors are taking profits when pricing looks overheated.

Risk-off mood builds

As confidence pulls back, money is flowing out of high-beta tech names and into more defensive areas of the market. This rotation is likely to continue until major earnings, including Nvidia's results on Wednesday, or fresh macro releases help restore direction.

All eyes on incoming data

With the government shutdown now over, traders are waiting for the backlog of key US reports such as NFP and CPI. Until those numbers land, many are choosing to stay cautious and limit exposure.

Factors that Drive the US Dollar

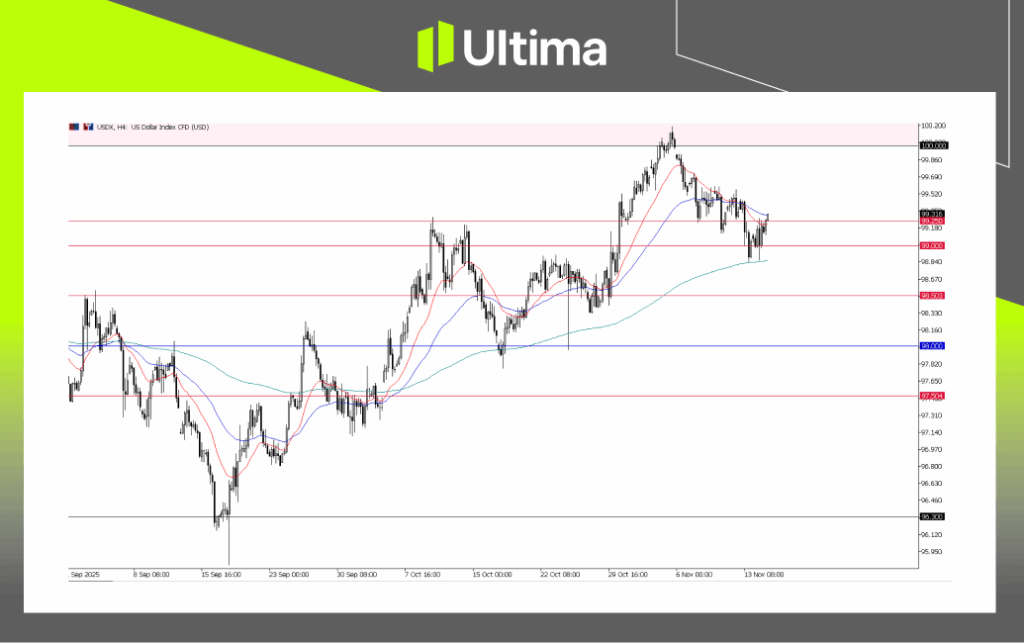

The US Dollar Index is currently caught between competing market drivers. Hawkish messaging from the Federal Reserve and weakness in risk assets are keeping safe-haven demand elevated, while uncertainty around the release and impact of delayed US data is preventing a stronger breakout. For now, the Fed's firmer tone remains the dominant influence, helping maintain the Dollar's broader upward trend.

From a technical standpoint, the Dollar is still holding above the 99.00 support region, a level that continues to anchor its uptrend. As long as this floor remains intact, the near-term outlook still leans toward a move back to 100.00.

The Calm Before a Wild Market Week

Monday is set to be fairly quiet with no major data on the calendar, but the market is heading into a potentially volatile week driven by both key economic releases and a major earnings catalyst. Nvidia's Q3 FY2026 results on Wednesday, the most anticipated report of the week, could either revive the momentum in tech or deepen the current valuation anxiety. A strong beat with optimistic guidance may reignite the AI-led rally, while any hint of softer outlook risks triggering another sell-off across the Nasdaq.

Adding to uncertainty, the long-delayed NFP and CPI prints are finally expected this week, injecting fresh macro risk into an already cautious market. With both tech earnings and critical economic data landing within days, traders are bracing for a pivotal shift in sentiment.

Navigating the Markets with Ultima Markets

Successfully navigating fast-moving markets, especially in weeks dominated by shifting Fed expectations, key data releases, and major tech earnings, requires staying informed and grounding every decision in solid analysis. Ultima Markets remains committed to providing timely insights and clear, data-driven perspectives to help you understand what’s moving the market and why.

By being part of Ultima Markets, you also gain access to a comprehensive trading ecosystem, including educational resources from UM Academy, to help you strengthen your market knowledge and skillset.

Stay connected for more real-time updates and expert commentary from the Ultima Markets team as the week unfolds.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.