EBC Markets Briefing | Loonie on the defensive after BOC rate cut

Canadian stocks and bonds rallied on Wednesday, while the loonie touched a near two-week low, after the BOC became the first central bank among G7 countries to cut interest rates.

The central bank lowered its benchmark interest rate by 25 bps, its first cut in four years, in a move that will ease pressure on highly indebted consumers. And the ECB is expected to follow suit later this week.

Inflation in the country has slowed this year to hit a three-year low of 2.7% in April. While inflation has stayed below 3% for four months in a row, it is still higher than the 2% target.

Economic growth in Q1 was slower than expected at an annualised rate of 1.7% following a downwardly revised 0.1% increase in Q4 2023. The rebound was not strong enough to keep rate-setters on hold.

The services sector grew in May for the first time in a year as firms saw an increase in new business and hired workers at a faster pace, data from S&P Global showed. But falling oil prices become fresh headwind.

Brent crude broke below $80 earlier this week. US crude stocks jumped by 1.2 million barrels in the week to May 31, compared with analysts' estimates for a draw of 2.3 million barrels, data from the EIA showed.

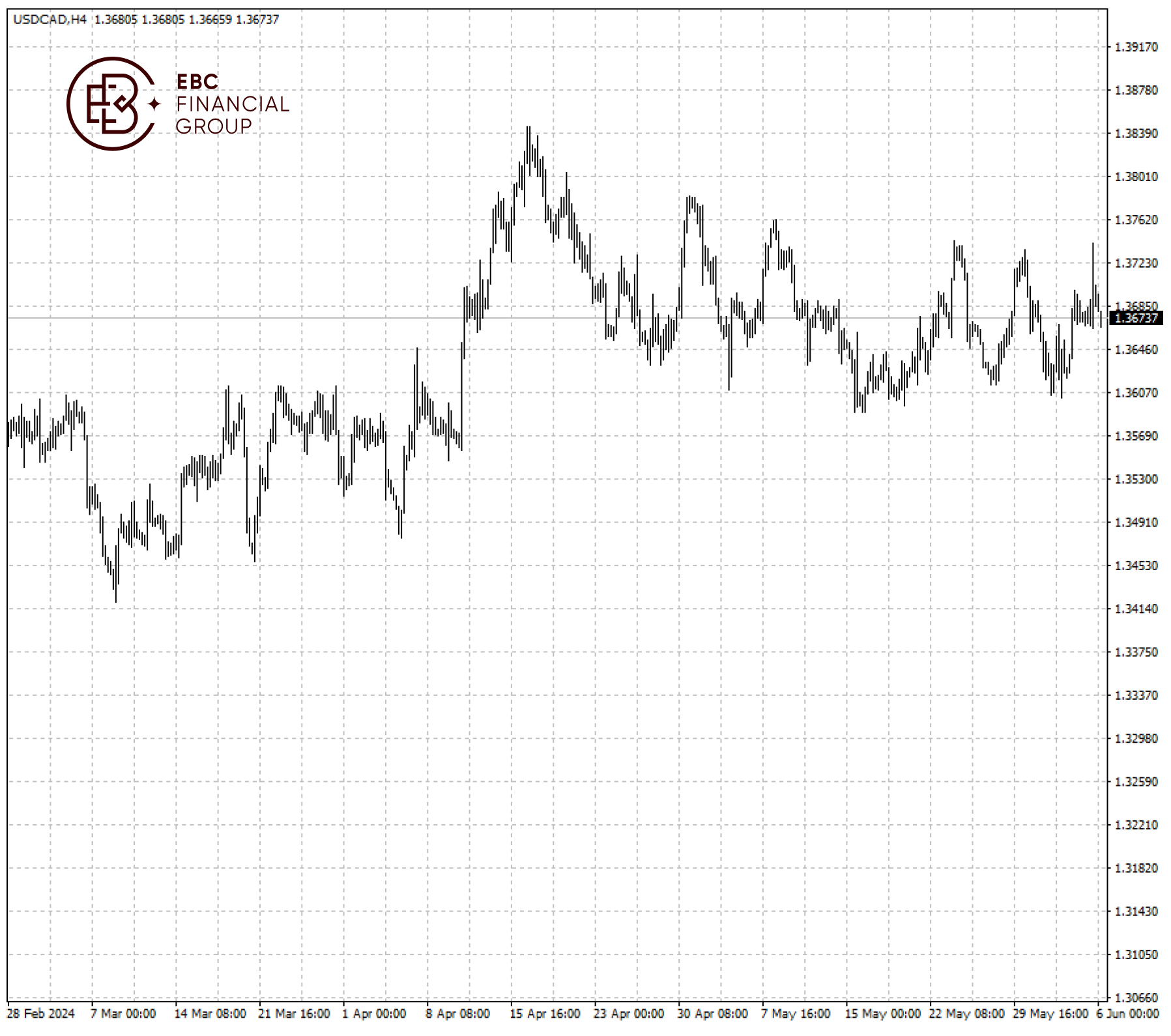

The pair failed to see a breakout as the support of 1.3600 remained intact. A push above 1.3750 could pave the way for more upside room.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Forex Trading Platform or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.