Crypto market: a breather after the climb

Market picture

The capitalisation has stabilised around the $2.63 trillion level, losing 1.7% in 24 hours, but very close to where it was at the end of the day on Monday. Bitcoin is down 1.2%, Ethereum lost 2.3%, BNB sank 3%, and Solana is minus 4%. On the surface, the trend is for a deeper pullback in the coins that have rallied the most in recent days.

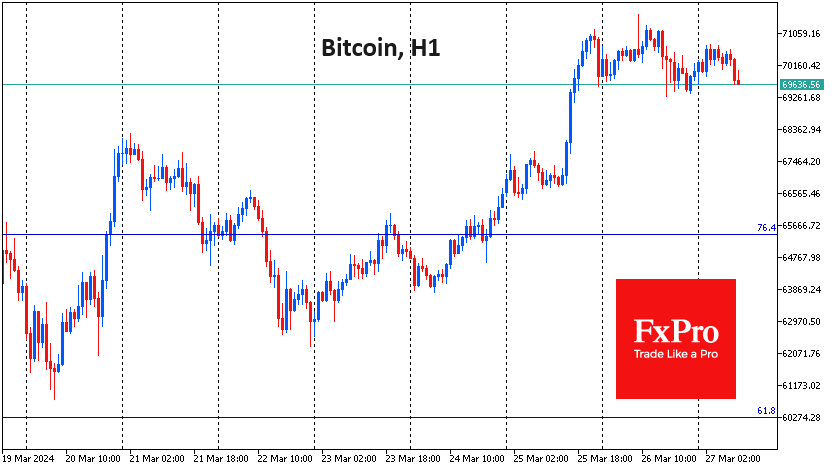

Bitcoin has fallen back below $70K, which can be attributed to the bulls' need to let off steam and the general decline in risk appetite in global markets. The short-term focus for traders will be to see if Bitcoin can retest Tuesday's intra-day lows near $69.5K. A break below this level could signal a more protracted correction.

New background

The US Department of Justice has filed charges against one of the world's largest crypto exchanges, KuCoin, and two of its founders. The exchange is accused of ignoring US anti-money laundering laws and failing to monitor suspicious transactions as US law requires.

Bitcoin is more like a precious metal than a risky asset, according to BlackRock. However, it is unsuitable for high concentration in portfolios because of volatility, which becomes a huge risk factor.

The recent correction in BTC has almost completely repeated the pattern seen before the 2020 halving. Bitcoin has pulled back 18% in this cycle, while the asset is down just over 19% in 2020, the Rekt Capital analyst noted.

Spot Ethereum ETFs will be approved in May despite claims of the SEC's "lack of engagement" with applicants, Grayscale believes. Many of the details had already been worked out before the spot bitcoin ETFs were approved. Bloomberg puts the chances of the ETH ETF being approved at "a very pessimistic 25%".

The US SEC has asked a New York court to order Ripple to pay a $2 billion fine for violating securities laws. The case regarding the company's institutional sales of XRP is ongoing.

According to Arkham Intelligence, the anonymous whale, who had been sleeping since 2019 with a balance of 94,500 bitcoins (the fifth largest accumulated coin), became active on the eve of the halving. He split his assets between three newly created cryptocurrency wallets. Santiment believes that such transactions could be a sign of preparation for a sale.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)