The rising dollar is a threat to the crypto

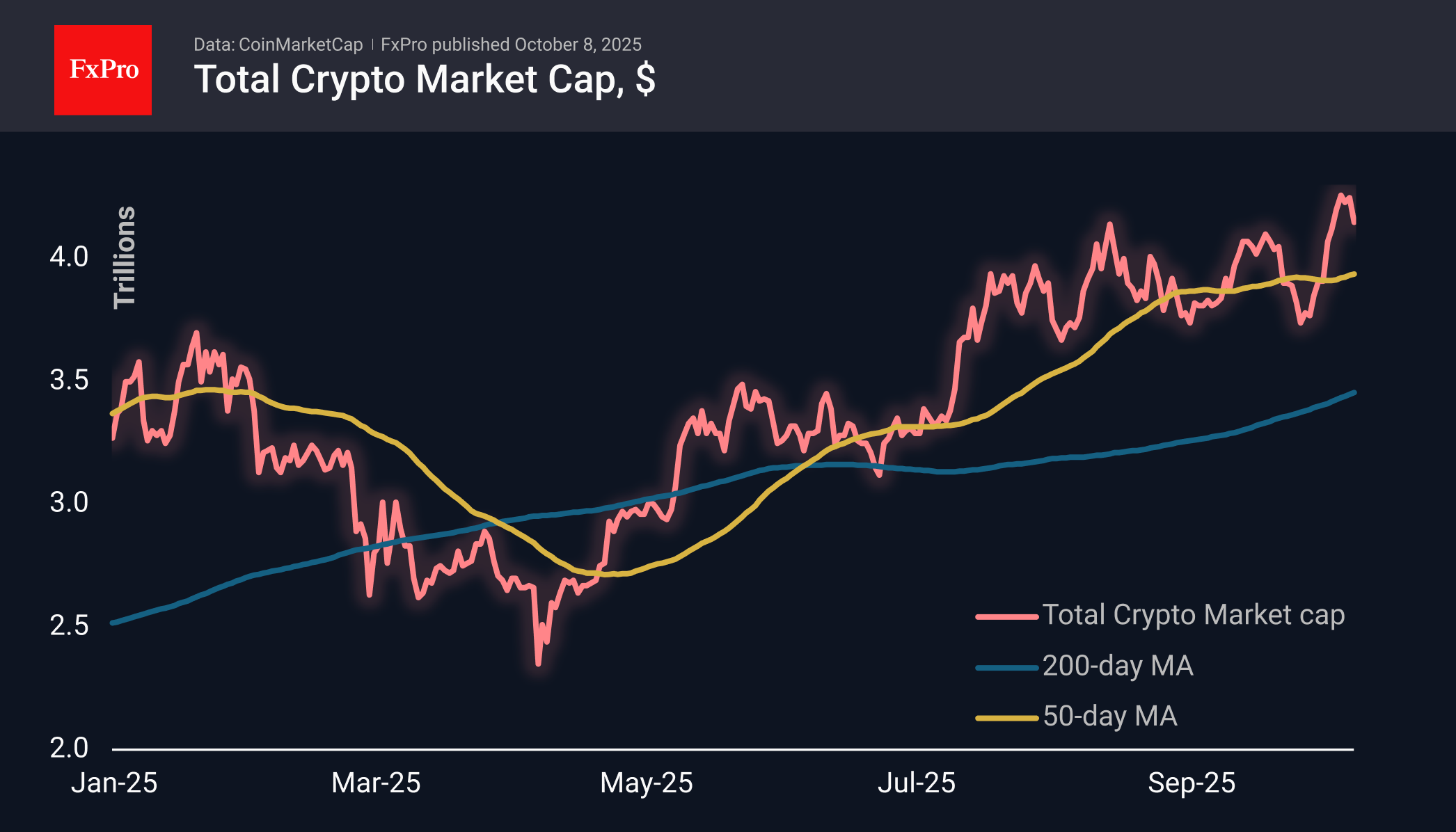

The crypto market capitalisation lost almost 3% in 24 hours, hitting a sell-off after a surge to historic highs at the start of the week. Such pullbacks have become a frequent occurrence in the crypto market – an important consequence of the growing number of professional cryptocurrency traders who take profits on the way up.

Bitcoin lost more than 4% during Tuesday's active US session, barely holding above $120k. It stabilised on Wednesday at the start of the day in the $121-122K range, turning July's resistance area into support. On the buyers' side, gold and stock indices are at historic highs. However, we also note the strengthening of the dollar index to its highest levels since early August. If this becomes a trend, a deeper decline is inevitable.

Retail investors have returned to the market amid new BTC highs. The inflow of bitcoins to the exchange from small players has jumped sharply, according to CryptoQuant. In contrast, large market participants continue to build up their positions.

On-chain metrics and derivatives data point to structural changes in the BTC market. According to Novaque Research, the current Bitcoin rally has a more solid foundation than previous ones.Vaneck predicts that the rally in the gold market will lead to Bitcoin rising to $644,000. After the next halving, BTC's capitalisation could grow to half the total value of the gold market.

According to the Strategic ETH Reserve, institutional and corporate investors' Ethereum reserves have reached 12.4 million ETH and exceeded 10% of the total supply of the asset. The bulk of this is accounted for by spot Ethereum ETFs — 6.83 million ETH (5.64%). Corporate reserves amount to 5.66 million ETH (4.68%).

The Coinbase premium for Ethereum has turned positive again, indicating renewed interest from institutional investors in the US.BNB set a new record high above $1,350 and moved into third place in terms of capitalisation, overtaking Tether. Traders expect the upward trend to continue, with a possible rise to $2,000.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)