Gold eases from record on Gaza deal, dollar firm after Fed minutes

Gold rally cools on Gaza peace deal

US President Donald Trump announced on Wednesday that Israel and Hamas have agreed on the initial phase of a peace plan aimed at ending the two-year war in Gaza, bringing about a much-needed ceasefire. The deal could see all Israeli hostages held by Hamas since the October 7 attacks two years ago released as early as Monday in exchange for Palestinian prisoners.

Whilst the agreement is just for the first part of a 20-point proposal, the fact that President Trump is due to travel to the region over the weekend suggests that the two sides are serious about the negotiations. This is pressuring gold slightly today, taking the steam out of the rally.

Gold notched up its fourth consecutive record close on Wednesday, closing above the $4,000 mark for the first time. The price is heading lower today, though it’s managing to hold above the $4,000 handle for the time being. In addition to the easing of geopolitical risks, the stronger US dollar could also be slowing gold’s bull charge, raising the possibility of a deeper correction in the near term.

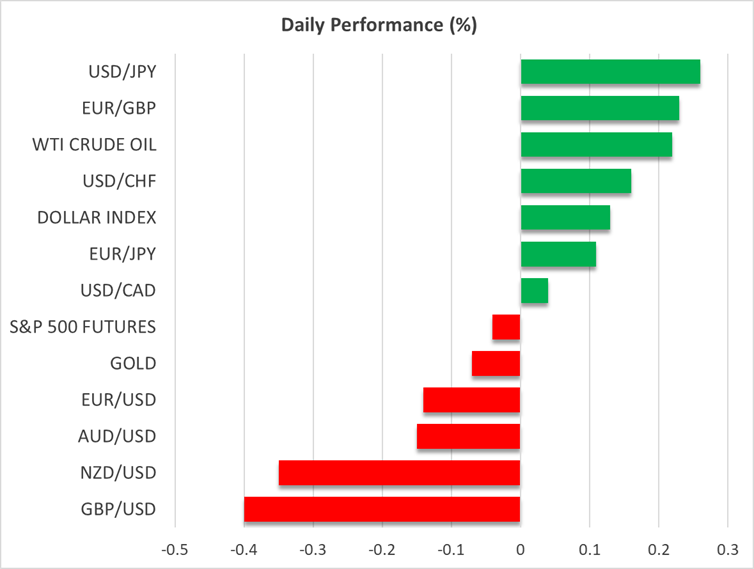

Dollar stands tall as yen slumps

The dollar has staged a decent bounce back this week, even as the US federal government remains shut amid the ongoing impasse over a funding bill on Capitol Hill. Against a basket of currencies, the greenback is trading at its highest in almost two months, largely due to weakness in the yen.

The Japanese currency has been under selling pressure since Monday following the election of a fiscal and monetary dove as the leader of the country’s ruling LDP party. Sanae Takaichi is likely to become Japan’s first woman prime minister when the Diet is expected to approve her appointment on October 20. The vote was scheduled for October 15 but negotiations between the LDP and its minority coalition partners are thought to be taking longer than expected.

Investors are not anticipating any surprises, however, and have been pummeling the yen on expectations that any new government will push back on the Bank of Japan’s plan to normalize policy by hiking interest rates. But it’s hard to see the BoJ holding off raising rates for too long if Takaichi presses ahead with substantial fiscal stimulus, and so the bearish bets against the yen may be overdone.

Nevertheless, traders are proceeding a little more cautiously now that the dollar has crossed above 153 yen, as the closer it gets to the 155 area, the greater the risk of an intervention by the finance ministry in FX markets.

Euro and pound unable to capitalize on dollar’s shutdown woes

Further supporting the dollar today is the slight scaling back of Fed rate cut expectations following yesterday’s publication of the minutes of the September FOMC meeting. There were no surprises in the minutes, which confirmed the widening split on the future rate path. Still, most officials backed further rate cuts this year and this is supportive of the broader positive sentiment in the markets.

The focus later in the day will be on Fed Chair Jerome Powell, who is due to speak at 12:30, although he may not comment on monetary policy.

In the meantime, there doesn’t seem to be much progress between Republicans and Democrats on reaching a deal on a stopgap funding bill to end the government shutdown that’s now in its ninth day. The key sticking point is whether to extend the subsidies for health insurance. It’s possible that behind the scenes there are some talks taking place, but even in the absence of official briefings and the data blackout, there’s little panic in the markets.

The dollar has also been reclaiming lost ground against the euro and pound. France will probably get a new prime minister on Friday, which may or may not end the country’s political paralysis, with President Macron again avoiding calling a snap election.

This is helping the euro to steady somewhat around $1.1610, but the pound is one of the worst performers on Thursday, declining for a third straight day towards $1.3350.

AI frenzy spurs new record highs amid valuation warnings

On Wall Street, the S&P 500 more than erased Tuesday’s losses to hit another new all-time high yesterday, closing at 6,753.72. The Dow Jones closed flat but the Nasdaq 100 outperformed, gaining 1.2% to reach a new record.

Despite the uncertainties surrounding the shutdown and Fed policy, the recent buzz around AI deals is boosting tech and AI-related stocks. Among the highlights, AMD surged another 11% yesterday following its deal with OpenAI, Nvidia shares gained as the company got US approval to export its chips to the United Arab Emirates, and Dell also rallied after it raised its long-term earnings guidance.

But futures are trading marginally in the red today amid growing warnings of bloated AI valuations. A day after the Bank of England warned about an AI bubble, JP Morgan boss Jamie Dimon became the next to talk of a “sharp correction”.

.jpg)