AUDUSD looks for bullish expansion

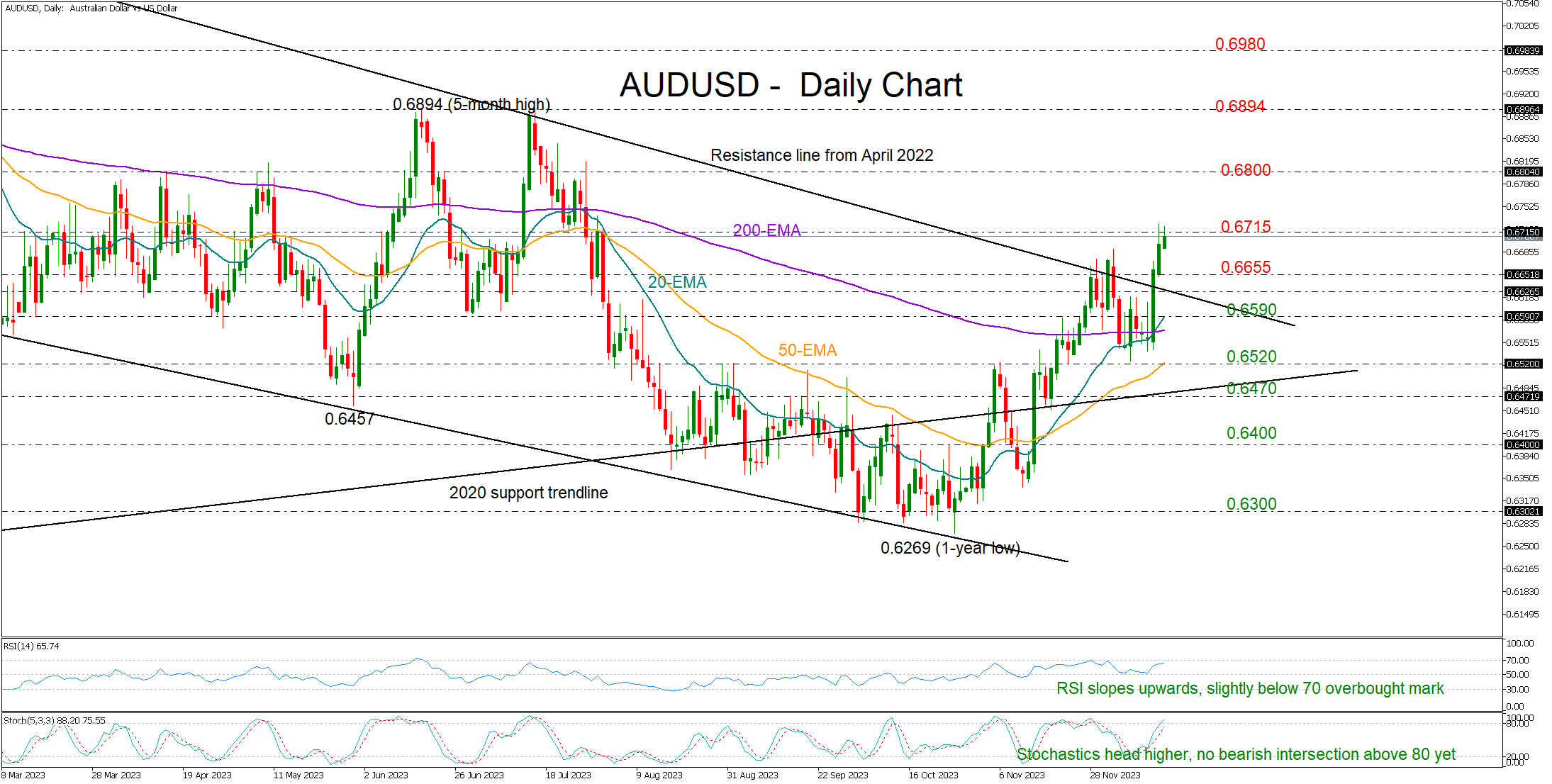

AUDUSD experienced a spectacular rally after a dovish FOMC policy meeting earlier this week, crawling as high as 0.6727 on Thursday – the highest level since the end of July.

The bulls have finally breached the resistance trendline from April 2022 with a strong attitude after a failed attempt at the start of the month, increasing optimism that the upside reversal from October’s one-year low could continue. The RSI and the stochastics are in line with this view since they haven’t confirmed overbought conditions yet despite fluctuating near their 70 and 80 levels, respectively.

The 0.6715 constraining zone, which had been limiting both upside and downside movements for more than a year, is currently under examination. If it gives way, the ascent could pick up pace towards the 0.6800 round level and then up to the June-July 2023 double top formation at 0.6894. Should the bulls gain more ground, the next obstacle could occur near the 0.6980 area.

Alternatively, a downward correction could initially pause somewhere between the nearby support of 0.6655 and the broken resistance trendline. If that floor collapses, the pair could seek shelter near its exponential moving averages (EMAs) currently seen between 0.6520 and 0.6600. Additional declines from there could stabilize near the 2020 ascending line at 0.6470 or lower at 0.6400. Then, the spotlight could turn to the important 0.6269-0.6300 region.

In short, AUDUSD is holding a bullish bias. While a slowdown could be possible after the latest aggressive rebound, the bulls might keep their focus on the 0.6800 mark in the coming sessions.

.jpg)