BC Markets Briefing | Oil prices extend losses on possible peace deal

Oil prices fell on Thursday on expectations a potential peace deal between Ukraine and Russia would mean the end of sanctions that have disrupted supply flows. Trump’s latest tariff plan also hurt the sentiment.

Both benchmark contracts fell more than 2% in the last session after Trump said Putin and Zelenskiy expressed a desire for peace in separate phone calls with him. But the process may flounder given Russia’s terms.

Russia may be forced to throttle back its oil output in the coming months as US sanctions hamper its access to tankers to sail to Asia and Ukrainian drone attacks hobble its refineries.

Trump said he would impose reciprocal tariffs as soon as Wednesday evening on every country that charges duties on US imports, in a move that ratchets up fears of global economic outlook.

US crude oil inventories rose sharply last week, the EIA said on Wednesday, as refiners facing soft gasoline demand did maintenance work. The OPEC maintained its demand forecasts in the latest report.

Government data released showed surprisingly strong US inflation in January, bolstering the case that a heating economy and looming tariffs could undercut hopes for rate cuts this year.

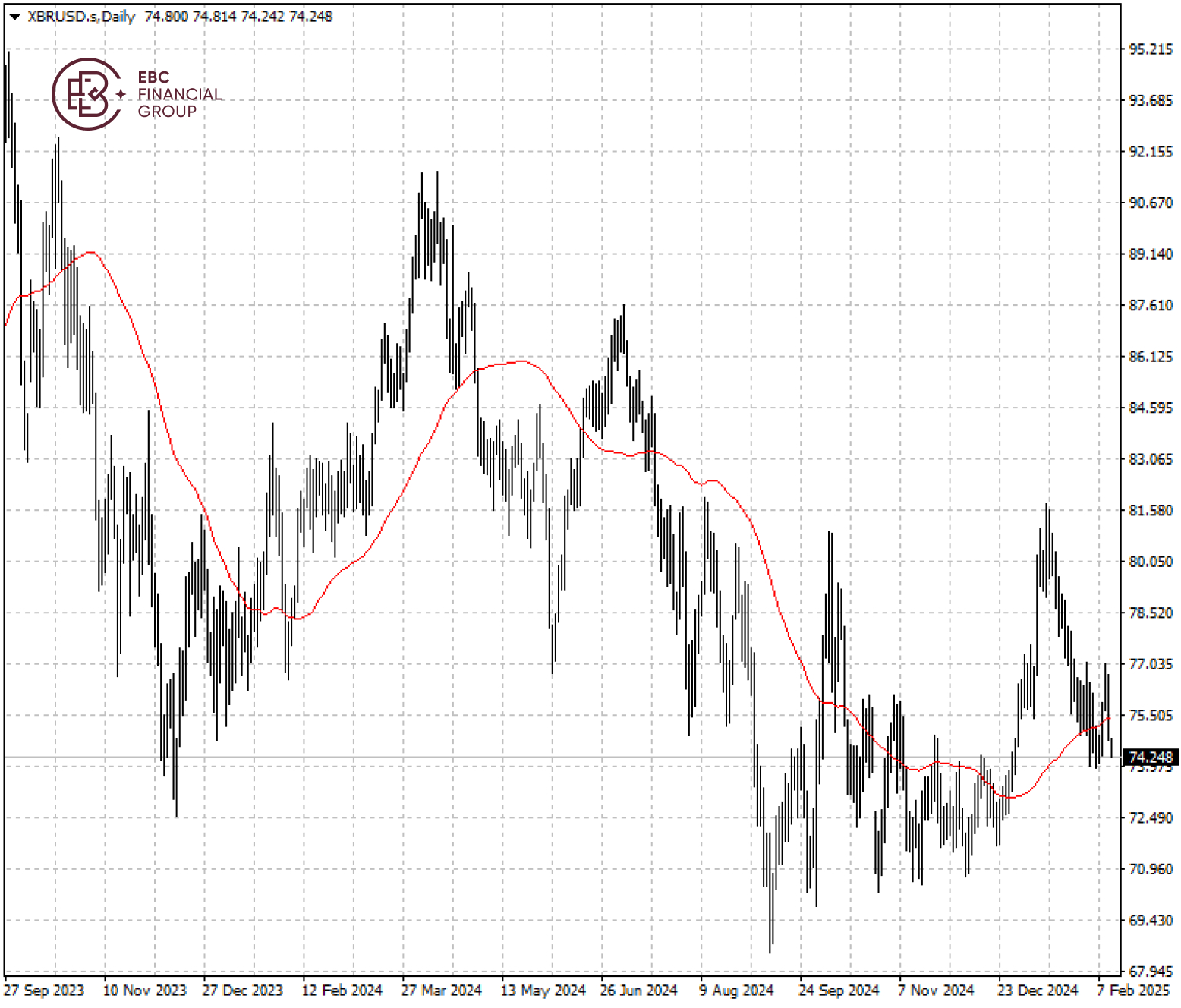

Brent crude has tumbled below 50 SMA, but the area around $74 may provide some support. A leg lower is likely if that does not occur.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.