Better-than-expected European data failed to stop the euro’s decline

Weak Chinese manufacturing data put pressure on the single currency as Europe, particularly Germany, is highly correlated with China.

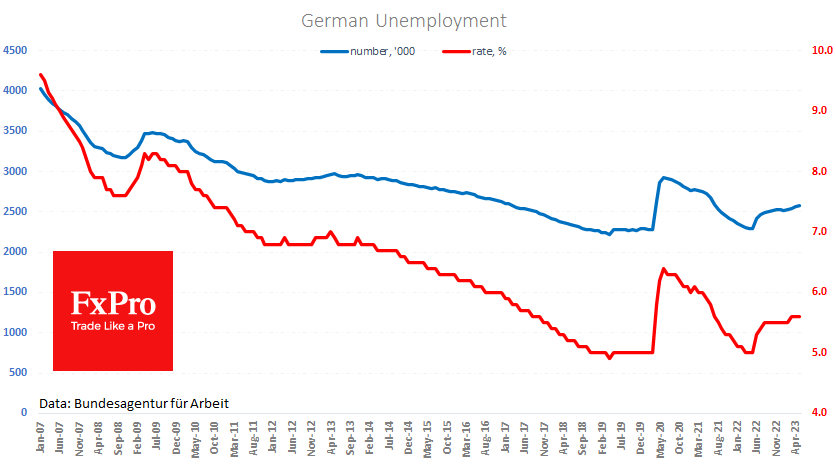

However, the Eurozone's data is not so bad today. The number of unemployed in Germany rose by 9K, down from 23K and 19K in the previous two months. Unemployment is rising much more slowly than in the recessions of 2009 and 2020, and the unemployment rate (5.6%) is low by historical standards.

Second estimates confirmed a 0.2% q/q and 0.9% y/y rise in French GDP in the first quarter, although private consumption fell by a further 1% in April after a 0.8% decline in the previous two months.

For Italy, the final data pointed to economic growth of 0.6% q/q and 1.9% y/y, 0.1 percentage points higher than previously estimated.

Despite the upbeat economic data, the EURUSD fell to 1.0660 in early European trading, its lowest level since 17 March.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)