Bitcoin fell back to key technical levels

Market picture

The crypto market is suffering impressive losses, mirroring traditional markets flee from risk, which has mainly hit the financial and tech sectors—total crypto capitalisation is down 6.5% in the last 24 hours to 930 billion.

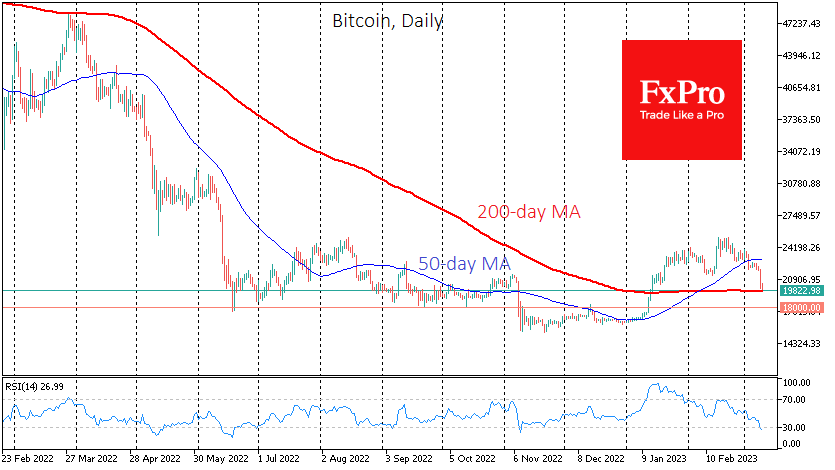

Bitcoin fell below $20K (-7.9% in the last 24 hours), an emotionally significant level for the first cryptocurrency. As expected, the drop below $21.5K accelerated the sell-off. Bitcoin is currently testing its 200-day moving average, which appears to be the last line of defence on the way to $18K. Further decline in risk-sensitive assets can punish early crypto optimists and raise questions about whether we are in the ‘crypto spring’.

The bulls have technically oversold, and the fact that markets rarely quickly abandon 200-day MA.

News Background

US authorities have moved to the Coinbase around 10,000 BTCs seized from the Silk Road darknet marketplace. Market participants fear that the US authorities will start selling off the bitcoins seized from cybercriminals.

Another reason for the decline in the crypto market was the closure of Silvergate Bank. Previously, there had been rumours that Silvergate Bank might reopen, but management decided to close the bank and return deposits to customers.

The head of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, said that the agency, not the SEC, should regulate Ethereum and stablecoins because they are commodities. According to Behnam, he would only have allowed the launch of ETH futures if he was firmly convinced that it was a commodity. Previously, SEC chief Gary Gensler argued that all crypto assets except bitcoin are securities.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)