Bitcoin soars past $30K

Market picture

The total capitalisation of the crypto market rose 4.5% to $1.24 trillion, the highest since June last year and a colourful end to several days of consolidation. Bitcoin was the main driver, although BNB, Cardano, Solana and Litecoin also outperformed the market, rising between 5.5% and 11%.

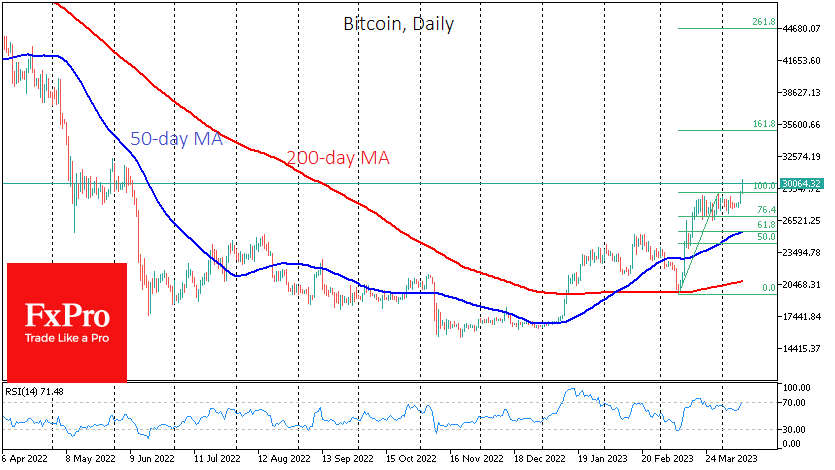

Bitcoin continued its storm of highs early on Tuesday, peaking at $30.4K and holding above $30K after a minor correction. This jump in a thin market marked the end of a consolidation triangle and a corrective pullback after a March rally. The target for the first pattern is the $40K area, while the second pattern sets up a rapid rise towards $35K, which is more realistic in the current market, as it already looks slightly speculatively overbought.

According to Glassnode, 53% of Bitcoins have not been involved in transactions for two years. Around 9.45 million BTC are held in wallets. Approximately 29% of BTC have been idle for five years, while just under 15% have not moved in over a decade.

Open interest in bitcoin options exceeded open interest in bitcoin futures for the first time, indicating expectations for BTC growth, Glassnode noted.

News background

Forbes estimates that crypto billionaires worldwide will lose around $110bn in 2022, with some losing up to 75% of their wealth. Binance CEO Changpeng Zhao is still the richest man in the industry with a fortune of $10.5bn, down from $65bn a year earlier.

Ethereum’s inflow into the stack declined on the eve of Shapella, Glassnode noted. Developers have scheduled an upgrade for 12 April.

The Chivo, a cryptocurrency wallet operated by the Salvadoran government, began freezing user accounts and requiring verification of the source of funds.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)