Crypto market blows off steam

Crypto market blows off steam

Market picture

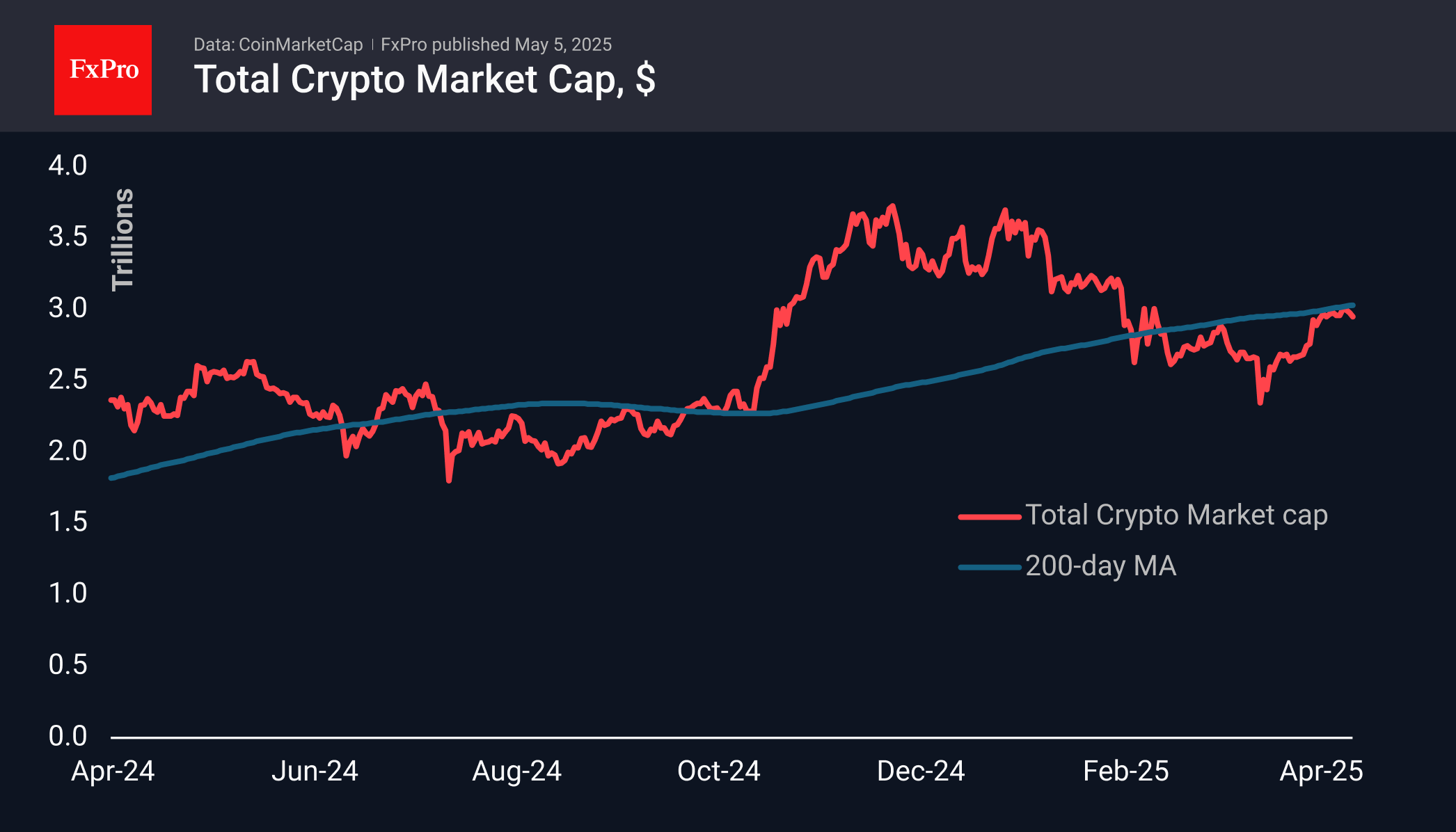

Crypto market capitalisation has returned below $3 trillion to $2.95 trillion, losing around 0.8% in the last 24 hours and down 1% in seven days. The selling looks like short-term profit taking after the rally of the past two weeks. Market sentiment is neutral with a slight positive bias, with the fear and greed index at 52.

Bitcoin has pulled back below $95000, correcting after briefly breaking above $98000 last Friday. The price has returned to the area of former strong support that worked from December to February. Expectedly, it is now equally strong resistance. Technical correction targets look like the $92500 and $89000 levels. However, a drop below $90,000 could shake investor confidence, pushing the price beneath both the psychologically important round number and the 200-day moving average.

News background

Significant inflows into spot bitcoin ETFS in the US continue for the second week in a row. According to SoSoValue data, weekly net inflows into spot BTC-ETFS totalled $1.81bn after $3.06bn the week before, bringing the all-time total to $40.24bn. Net inflows into ETH-ETFS totalled $106.8m last week, bringing the total to $2.51bn.

Fidelity believes Bitcoin has moved from the ‘belief and denial’ zone to the ‘optimism and anxiety’ phase. The first cryptocurrency's fundamental metrics remain strong despite the asset's decline from the year's highs.

Glassnode warns of sell-off risks as bitcoin rises towards $100,000. The cumulative unrealised gains of long-term investors in the first cryptocurrency approached 350%, which has historically coincided with stronger selling.

At the end of Q1, Tether generated an operating profit of $1bn from traditional investments. Investments in US government bonds provided the result, while the positive revaluation of gold almost offset bitcoin's volatility.

Santiment notes that the number of meme-coin mentions on social media peaked in 2025 due to a shift in traders' interest in high-risk assets in the last couple of weeks.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)