Bitcoin will have to settle here

Market picture

The cryptocurrency market hit new highs on Monday, reaching a capitalisation of $2.5 trillion. Profit-taking was evident at the start of the active trading session in Asia on Tuesday. But before this, the market lacked enthusiasm.

Bitcoin peaked at $68,789, just $122 below its historical high. This is before the halving and before the final capitulation of buyers, typical of the weeks leading up to the halving, when some miners leave the market and sell coins.

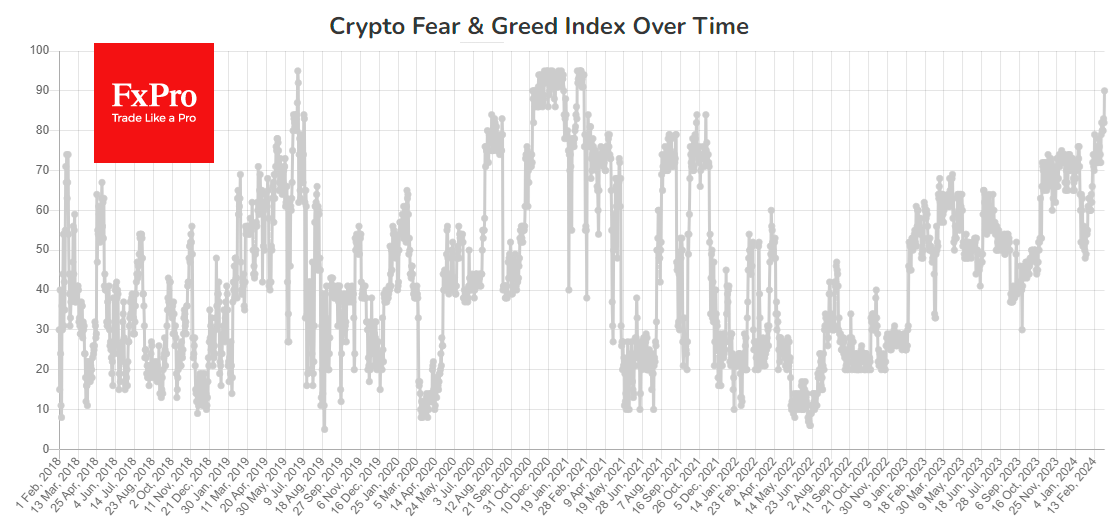

The Fear and Greed Index hit 90, the level last seen at the end of 2020. That's when we saw a similar test of all-time highs after almost two years. Back then, bitcoin needed about four weeks of fluctuations within 15% to form a base before the next leg up.

News background

According to CoinShares, crypto funds saw their second-largest inflows last week with $1.837 billion, up from $598 million the week before. Bitcoin investments increased by $1.728 billion, Ethereum by $85 million, Polygon by $7.6 million, and Solana decreased by $12 million. Investments in funds that allow shorting bitcoin increased by $22 million.

Trading volumes in investment products reached a record high of over $30bn during the week, with total assets under management (AuM) reaching $82.6bn, very close to the record high of $86bn set in early November 2021.

As a result of the market's growth, USDT stablecoin capitalisation reached $100 billion (+9% YTD), according to CoinGecko.

Double to triple-digit growth in a week for meme coins such as DOGE, SHIB, BONK, PEPE, and WIF is an early sign of the altcoin season, according to K33 Research. However, demand for ETFs is ten times greater than the number of coins being mined. Inventories on OTC platforms have shrunk many times over, and issuers of ETFs will soon have to buy directly from exchanges, leading to a surge in BTC.

Over the next 15 years, the price of bitcoin could increase 64-fold to $10.63 million. Former physics professor Giovanni Santostasi made such a prediction based on his ‘Power Law’ model. According to the professor's calculations, BTC will peak at $210K in January 2026 and then fall to $60K.

A US court has recognised the trading of some cryptocurrencies as securities transactions. This is not the first time that a court has approved the classification of virtual assets promoted by SEC Chairman Gary Gensler. The head of the agency has repeatedly stated that virtually all cryptocurrencies are securities.

Tether, the issuer of the USDT stablecoin, has unveiled an asset recovery tool. The tool will allow USDT to be transferred between blockchains if one of the supported networks fails.

Chinese investors meanwhile were reminded of the bitcoin ban. China's state-run newspaper Jingji Ribao warned locals about the risks of investing in the first cryptocurrency.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)