Bitcoin’s continued slide down

Bitcoin’s continued slide down

Market picture

The crypto market cap fell 1.6% in 24 hours to $1.166 trillion. Risk assets in traditional markets came under pressure as the accumulated overheating in equities (especially in techs) accompanied a trigger – Fitch’s cut of the US rating.

The initial flight of speculators into Bitcoin proved to be short-lived. Bitcoin closed Wednesday down 0.5%, losing over 3.1% from its peak at the start of the day, and failed to get back above the 50-day average. This is another bearish signal in addition to the sequence of downward daily candles. So far, Bitcoin has managed to avoid accelerating the sell-off, but it looks like it's only a matter of time before it does.

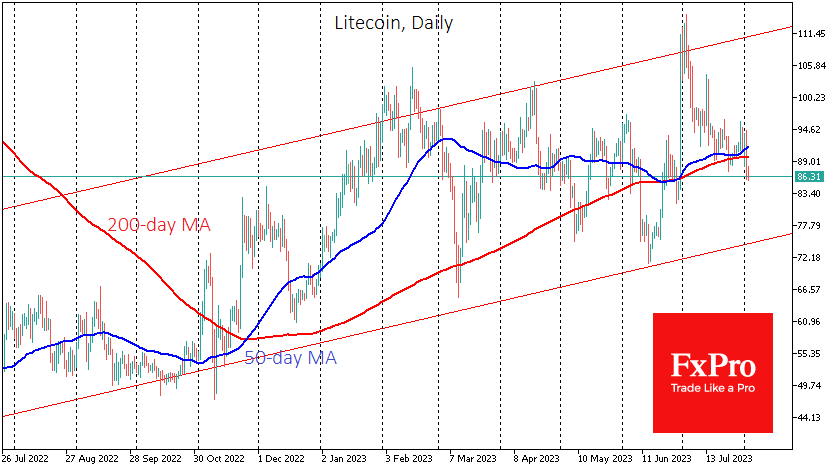

On Wednesday, the Litecoin (LTC) network saw its third halving. The reward per block was reduced to 6.25 LTC. So far, 87.5% of the total LTC supply has been mined. The altcoin reacted with a decline and hit new month lows at around $86. This drop sent the coin below the 50 and 200-day averages, raising the question of a long-term trend change and opening the way down to $77-80.

News Background

Trading activity in the Bitcoin spot market has weakened to its lowest since November 2020, Santiment noted. Major players have so far refrained from entering exchanges, and this trend may continue in August.

MicroStrategy founder Michael Saylor said the company had bought an additional 467 BTC worth $14.4 million in July. As of 31 July, MicroStrategy owns 152,800 BTC worth approximately $4.53 billion at $29,672.

BlackRock's filing to launch a bitcoin ETF is part of an "adoption cycle" that will allow the first cryptocurrency to hit record highs, Galaxy Digital CEO Mike Novogratz said. The head of BlackRock believed in Bitcoin, he said, and that's the most important thing that has happened in the crypto market this year.

The chances of the US Securities and Exchange Commission (SEC) approving a bitcoin-ETF application have risen to 65 per cent, Bloomberg analyst James Seyffarth said. Two weeks earlier, he estimated this probability at 50%; a few months ago – at 1%.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)