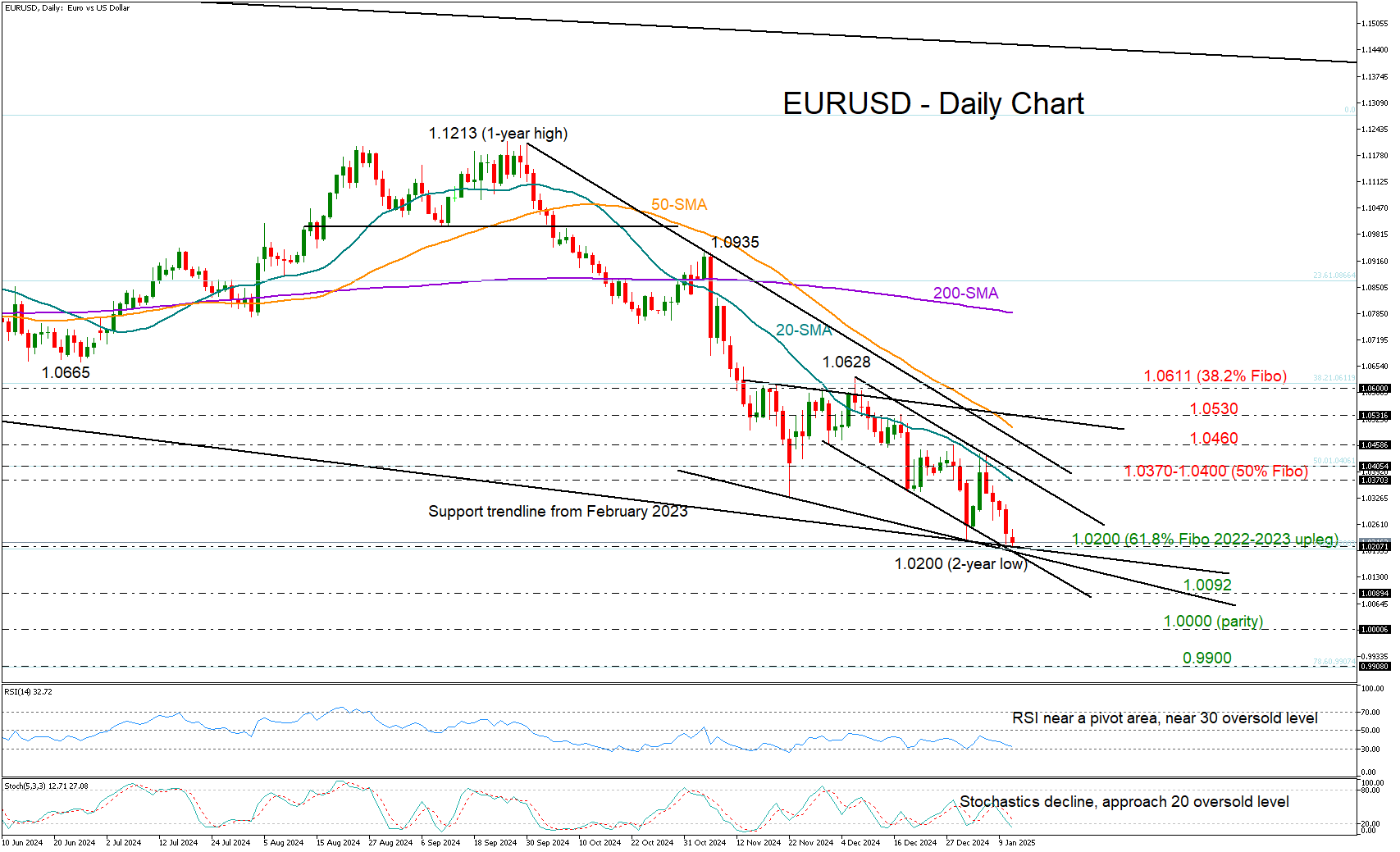

Could EURUSD pivot before parity?

EURUSD hit a new two-year low of 1.0200 in the aftermath of a stronger-than-expected nonfarm payrolls report, stirring up concerns that the pair could hit parity soon.

But the bulls may have one more chance to turn things around. The price is currently sitting at the 61.8% Fibonacci retracement of the 2022-2023 uptrend at 1.0200, and the support line from February 2024 is adding extra credence to the area. Note that the RSI and the stochastic oscillator are approaching their oversold levels, indicating that the recent decline may fade out soon.

Should selling interest strengthen, the price may initially test the 161.8% Fibonacci extension of the latest upturn at 1.0092 before it slumps to 1.0000 (parity). The 0.9900 mark could be the next major level of interest.

In the event of an upside reversal, traders will be keeping an eye on the 20-day simple moving average (SMA) at 1.0370 and the 50% Fibonacci number at 1.0400. Running higher, the pair may instantly lose steam near the tentative resistance trendline at 1.0460, while a continuation above 1.0530 could challenge the area around the 38.2% Fibonacci of 1.0611. A sustainable move above the latter is required to officially violate the negative trend from September.

Summing up, EURUSD is still in a bearish trend with a potential for a pivot near the 1.0200 level. For a shift to a bullish short-term outlook, the pair must run sustainably beyond 1.0600.