Crypto finished its pullback thanks to the Fed

Market picture

The Fed's comments returned risk appetite to global markets, immediately bringing buyers back to cryptocurrencies. In 24 hours, total market capitalisation rose 7.7% to $2.55 trillion. Bitcoin is showing roughly the same amplitude of growth, but Ethereum and Solana are adding around 10%.

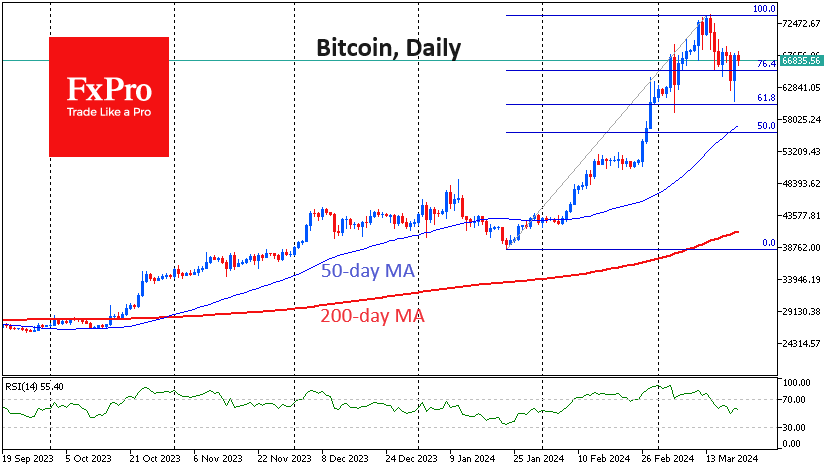

Bitcoin has held within a classic correction, never falling below 61.8% of the rally around $60.3K. If the positivity doesn't dissipate quickly, the next major milestone will be a return to highs above $73K.

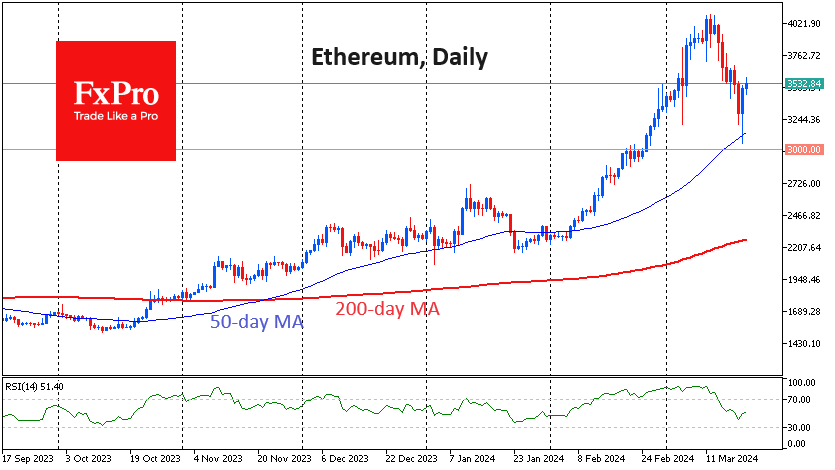

Ethereum reversed to the upside shortly after touching the 50-day moving average, confirming that this was a correction to the upside rather than a reversal to the downside. Solana lost over 22% between March 18th and 20th, from $210 to $162, and is back at $190 at the time of writing.

In all three cases, we have seen technical confirmation of the bullish trend and a sharp recovery from the correction. The pullback from the highs earlier in the week attracted active buyers on the back of Fed and other central bank weakness.

News Background

S&P Global Ratings released its ninth "stability assessment" of the major stablecoins. USDC, USDP and GUSD received a "strong" rating, while only Mountain Protocol's USDM received an "adequate" rating. The USDT, DAI and FDUSD stablecoins were rated "limited". The ratings of 4 out of 9 stablecoins were downgraded due to a lack of transparency or understanding of the risks associated with various stablecoins.

BlackRock, the largest asset management company, has filed to launch a USD Institutional Digital Liquidity Fund. This will be the company's first fund with tokenised assets.

The SEC is seeking to designate the Ethereum cryptocurrency as a security, Fortune reported, citing unnamed US companies that have been subpoenaed by the court to provide documents needed for the investigation.

According to Bloomberg, the chances of spot Ethereum ETFs being approved in the US in May are getting slimmer. Regulators have shown little enthusiasm.

Since 12 March, the Solana ecosystem has hosted 33 pre-sale fundraising campaigns for token launches, raising a total of 796,000 SOL (~$139 million). The largest was the pre-sale of the Book of Meme (BOME) meme token, which has increased in value by around 40,000% since its launch.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)