Crypto is awaiting a signal to choose its direction

Crypto is awaiting a signal to choose its direction

Market picture

The crypto market capitalisation has seen little change over the past 24 hours, stabilising around $1.165 trillion. The Fear and Greed Index is also little changed at 54 since the middle of last week. The market has been waiting for new signals, equally ready to return to growth or continue to fall.

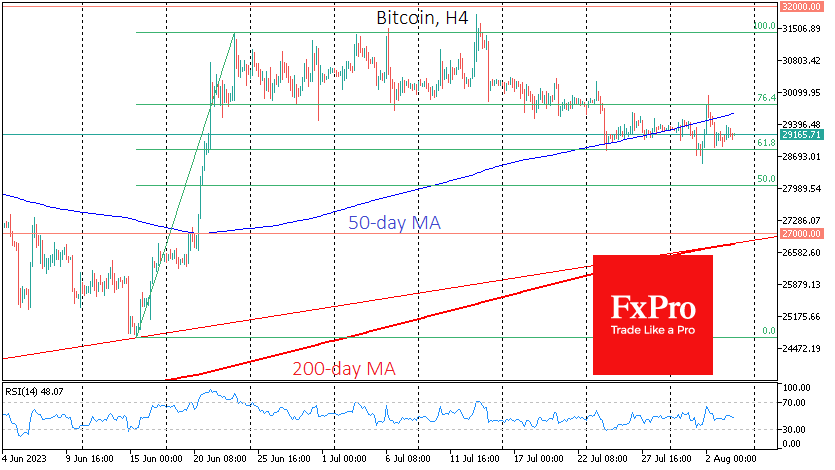

The most fluctuation in Bitcoin over the last week and a half has been around $29.2K. And this is interesting because during this time, the dollar has gone into a growth mode, and there has been significant profit-taking in the equity market. It's unlikely that investors' caution in Bitcoin is due to expectations of the US jobs report.

A drop below $28.8K could quickly take the market to $28K or even $27K. A rise above $29.5K would open a quick path to $30K and on to $31K.

News background

Most investors prefer to buy Bitcoin while trading below $30K, Glassnode noted. The number of addresses with a balance of at least 0.01 BTC has reached an all-time high of more than 12.22 million, while the number of wallets in deficit is 14.04 million, the highest since late June.

MicroStrategy bought 12,333 bitcoins worth $347 million in the second quarter of this year, the largest quarterly purchase since 2021.

Former CFTC lawyer Mike Selig suggested that if spot bitcoin ETFs are allowed to launch in the US, ETFs linked to Ethereum and XRP are next in line.

Hong Kong issues its first cryptocurrency retail trading licence. HashKey crypto exchange has been authorised to provide services to local retail investors.

The Australian Securities and Investments Commission (ASIC) sued the eToro platform over its line of CFDs that allow speculation on cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)