Crypto market quiet

Market picture

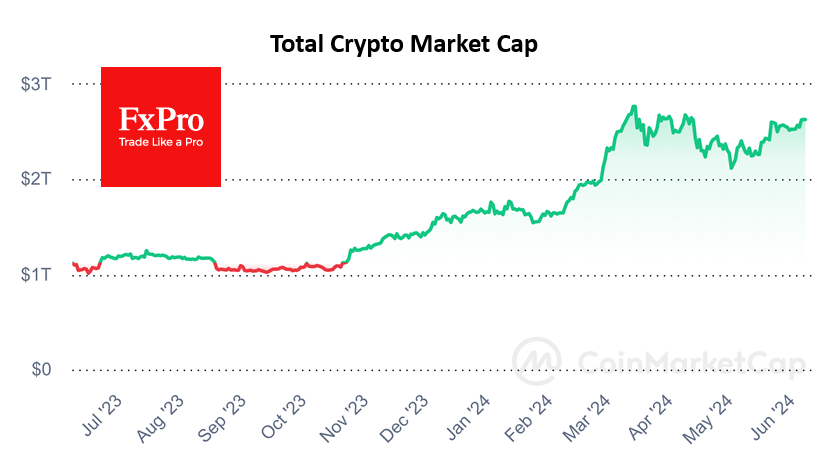

The crypto market capitalisation remained almost unchanged overnight at $2.63 trillion, showing a sharp decline in volatility. Bitcoin settled near the $71K level (+0.2%), while Ethereum settled near $3800 (-0.9 %). Prices of top altcoins changed between -1.2 % (Avalanche) and +2.7% (Toncoin).

The lull in the crypto market is probably due to expectations of important macroeconomic data from the US and the Fed's reaction to them. An important test is Friday's labour market statistics, with the FOMC rate decision and inflation to follow next week.

Technically, Bitcoin remains at an important resistance area, a break of which could trigger a FOMO rally with a quick update of historical highs. A reversal down from this area would send BTCUSD towards $60K.

News background

The options market has bet on Bitcoin rising above $74,000 by the end of June, suggesting increased expectations of a "decisive breakout" of the all-time high, QCP Capital believes.

MN Trading founder Michael van de Poppe notes that Bitcoin's chart is showing upward momentum. He believes altcoins are also poised for growth, and the big momentum will be seen from late June to September-October.

Bitcoin will rise to $100,000 by November, ahead of the US election, with a new all-time high it could hit as early as this weekend, Standard Chartered expects. The bank confirmed a target for BTC to rise to $150,000 by the end of the year and to $200,000 by the end of 2025.

Processing applications to launch spot Ethereum-ETFs will take "some time," SEC head Gary Gensler said. He emphasised that crypto firms are engaging in activities that laws do not allow traditional exchanges to conduct.

VanEck raised its forecast for Ethereum to $22,000 by 2030. The company called Ethereum a "successful digital economy" that attracts around 20 million active users per month while generating $5.5 trillion worth of stablecoin transfers in the last twelve months.

Paxos introduced the Lift Dollar (USDL) stablecoin, which entitles holders to a ~5% annualised 'risk-free' yield. The first market for USDL will be Argentina, known for its permanently weakened currency and high inflation.

Crypto exchange Bybit appears to have started services in mainland China, which is on the list of excluded jurisdictions for the platform, suggested crypto journalist Colin Wu.

Payment system Mastercard has reinstated agreements with Binance regarding payments and deposits after resolving issues with US regulators. The partnership broke down in September 2023 under the onslaught of US regulators.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)