Crypto market surpasses milestone

Market picture

US financial markets closed higher on Wednesday despite a rough start to the day. A strong performance from the technology sector helped the crypto market cross the $2 trillion mark, up 3% in 24 hours. The positive sentiment in the market continued into Thursday morning, setting the market up for further gains, potentially through to Wednesday evening next week, when the Federal Reserve announces its interest rate decision.

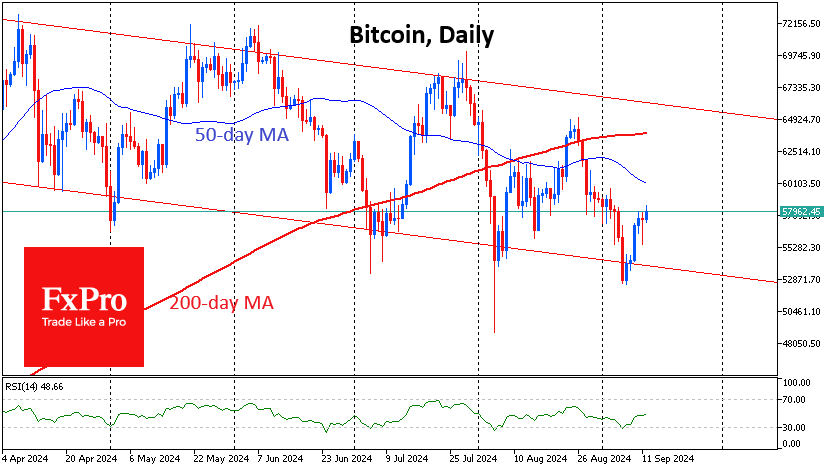

Bitcoin gained 2.5% in 24 hours, underperforming the broader market, but the price briefly broke above $58K on Thursday morning, something it had failed to do in previous days. A rebound from the lower boundary of the descending corridor could see Bitcoin top out at around $65.5K by the end of the month, with interim stops at $60K and $64K, the 50 and 200-day moving averages, respectively.

Ethereum is trading near $2350 but remains heavy, struggling to add 1% for the day and has yet to break above Wednesday's highs, which were closed. The second most widely traded cryptocurrency has found support below $2150 but has yet to see a confident rebound.

News background

Another recalculation saw the first cryptocurrency's mining difficulty rise by 3.58% to an all-time high of 92.67 T. The average hash rate for the period since the previous change was 662.34 EH/s, indicating bitcoin miners' confidence in the prospects of digital gold. At the same time, fresh price corrections could intensify selling due to a global decline in risk appetite, Glassnode noted.

Bitwise expects the crypto market to shift to growth in October-November after the end of US macroeconomic and political uncertainty. September is historically the worst month for Bitcoin.

Bitcoin will continue to grow regardless of the outcome of the US presidential election in November, Matrixport believes, citing BTC's growth under both the Trump and Biden administrations. The next US president will have a greater impact on the country's regulation of the crypto market.

BTC is moving from weak hands to strong hands, CryptoQuant noted. The number of bitcoins held by short-term holders is declining, while long-term holders are accumulating the asset.

The PayPal and Venmo teams have integrated the Ethereum Name Service (ENS). PayPal and Venmo app users can enter the recipient's ENS domain directly into the search field when sending digital assets to automatically identify wallets connected to the service.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)