Crypto market takes profits

Market picture

Bitcoin hit a 10-month high above $30,500 on Tuesday. However, two attempts by the bulls to build a sustained rally were not supported by the market. On Wednesday morning, the price pulled back below $30K, losing 0.4% over the past 24 hours.

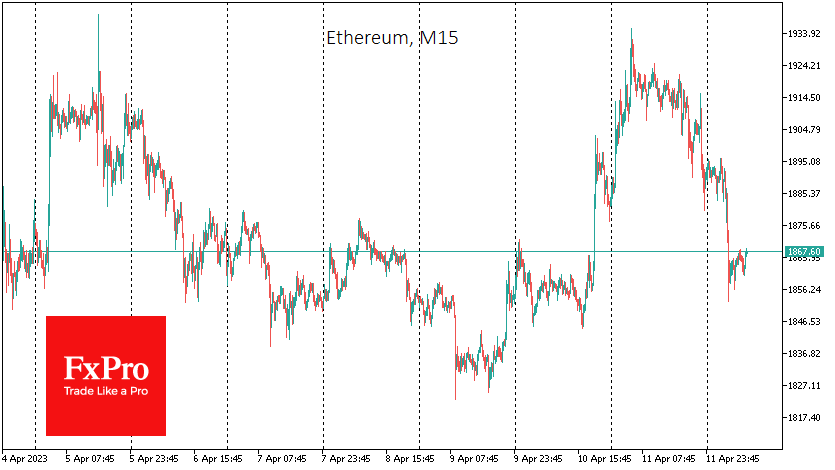

The crypto market has lost more than 1.2% over the same period to $1.22 trillion. Traders are rushing to lock in profits from the recent rally amid concerns about volatility ahead of today's US inflation figures.

According to CoinShares, investments in cryptocurrencies rose by $57M last week, the third consecutive week of inflows. Bitcoin investments increased by $56M, Ethereum by $0.6M, Uniswap by $0.5M and Polkadot by $0.4M.

Despite the positive investor sentiment, trading volumes for the week were low at $970M. The same trend was seen in the global BTC exchange market, where trading volumes for the week were only 25% of the average since the beginning of the year, Coinshares noted.

News background

The US dollar is heading for an "absolute collapse" that will give a strong boost to bitcoin's growth, said Larry Lepard, founder of Equity Management Associates. In his view, a tight supply of 21 million coins would give BTC a key advantage over gold and play an important role in its "long-term parabolic growth".

US business magazine Fortune has compiled its first ranking of the top 40 cryptocurrency companies in eight categories - the Crypto 40. In the protocol category, bitcoin gave way to Ethereum.

According to Messari, Cardano outperformed Bitcoin and Ethereum in terms of blockchain transaction volume. However, Cardano lags far behind BTC and ETH in the number of active addresses.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)